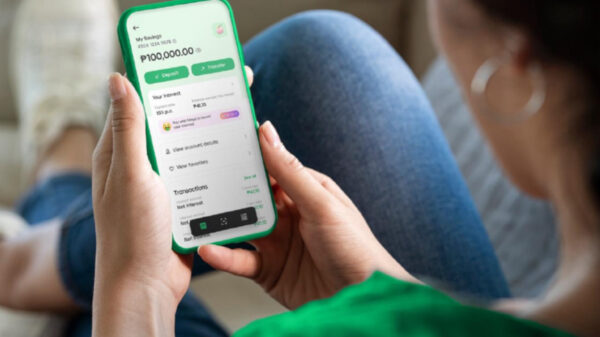

If you’re all about romanticizing self-care this season, don’t stop at skincare and spa days, your wallet deserves some love too. With Maya, the #1 Digital Banking App in the Philippines, pampering your finances has never been easier.

Think high-yield savings that grow your money or extra funds to support you along the way as you live your life—because real self-care means securing the bag, not just the glow.

Give Your Money the Main Character Treatment

Think of your savings as a VIP guest at a five-star retreat—it deserves the best. While traditional savings accounts barely keep up, Maya Savings offers up to 15% p.a., ensuring every peso you set aside is working overtime. Whether you’re tucking away extra cash from a side hustle or setting aside a chunk of your paycheck, your balance keeps growing daily without you lifting a finger.

What makes it even better? Maya is fully regulated by the Bangko Sentral ng Pilipinas and deposits are insured by the PDIC, so your money stays as secure as it is rewarding.

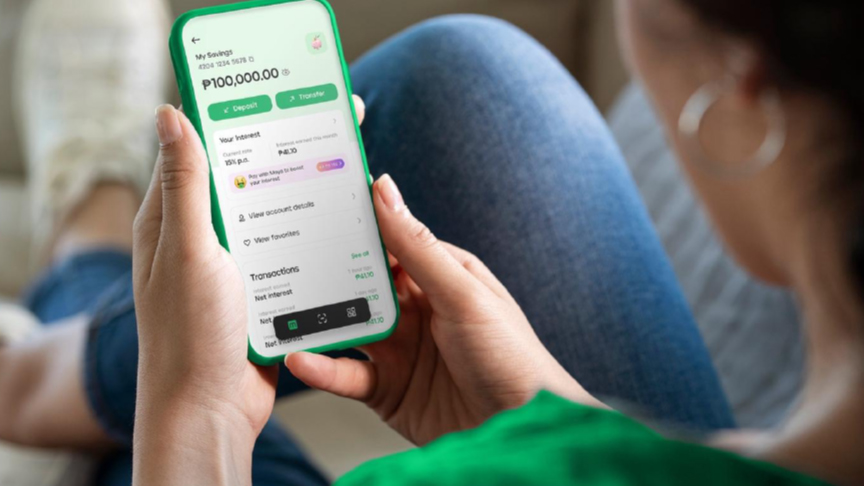

Make Saving Feel Like a Treat, Not a Chore

Saving doesn’t have to feel like a sacrifice. Try rounding up your daily expenses—if your coffee costs ₱180, transfer an extra ₱20 into your Maya Savings. These little habits build up over time, and before you know it, your savings will have leveled up without any extra effort.

Set Financial Goals That Love You Back

Create financial goals that match your lifestyle. Whether it’s for a dream vacation, a splurge fund, or a major life investment, Maya Personal Goals lets you set up to five separate savings accounts, each earning 6% p.a. It’s like vision boarding, but for your bank account.

If you’re ready to take your savings to the next level, Maya’s Time Deposit Plus lets you lock in your money for 3, 6, or 12 months with interest rates as high as 5.75% p.a. Perfect for when you have extra funds you don’t want to touch but still want to grow significantly over time.

Unlock Money Wins for your Wallet

Set yourself free from money worries and focus on what truly matters. With Maya Easy Credit, get instant funds of up to ₱30,000, or borrow up to ₱250,000 with Maya Personal Loan—no lines, no paperwork, just fast and easy funds to treat yourself or make big moves toward your goals.