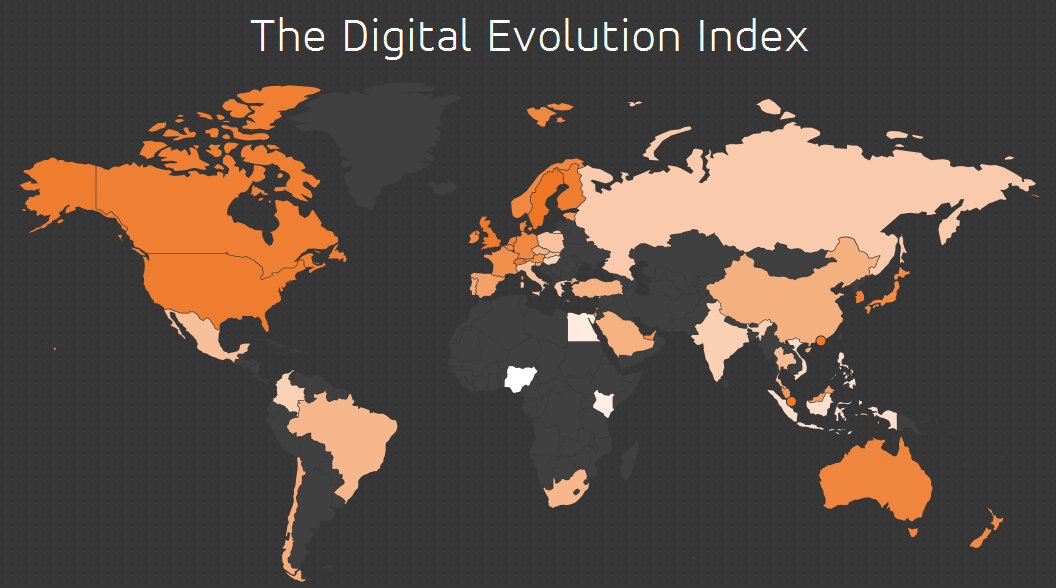

The Philippines scores low in a global e-commerce readiness index, ranking 47 out of 50 countries included in the Digital Evolution Index released by MasterCard and The Fletcher School at Tufts University.

Of the more than 98 million Filipinos, only 37% are Internet users and 38.7% are smartphone users. The country also has a low credit card penetration of 3%.

While the Philippines scores low, it’s digital economy is rapidly evolving. The Philippines demonstrated an overall improvement in Digital Evolution score of almost 20% from 2008-2013. The study says that if the country sustains its evolution rate, it will emerge as a strong digital economy, but the Index shows that the next phase of growth may be harder to achieve.

Globally, Singapore, Sweden and Hong Kong are the top three countries prime to welcome the next billion Internet users. Currently, there are 2.9 billion global Internet users. And counting.

The United Kingdom and Switzerland round out the top five, while the United States ranks sixth among the 50 countries measured. China, Malaysia and Thailand ranked as the top three fastest moving digital economies, a result of their rapidly increasing Internet and smartphone population.

While developed markets dominate the top spots, a different picture emerges when measuring the pace of digital adoption. The study analyzed each market’s evolution from 2008 to 2013 to understand country benchmarks, track progress and identify areas for improvement.

The study grouped the countries in four trajectory zones, namely Break Out, Stall Out, Stand Out, and Watch Out group.

Countries in the Break Out zone currently have low readiness scores, but are rapidly evolving. India, China, Brazil, Vietnam, and the Philippines are examples. If their evolution rates sustain, these countries will emerge as strong digital economies, but the Index shows that the next phase of growth may be harder to achieve.

While possessing a history of strong growth, countries in the Stall Out category (most of Western and Northern Europe, Australia and Japan) have matured. Innovation and seeking markets beyond domestic borders will be critical to continuing growth.

Countries that Stand Out, such as Singapore, Hong Kong, and the United States, have and continue to maintain high levels of digital transactions, supported by cutting edge infrastructure and sophisticated domestic consumers. To remain Stand Out markets, these countries must continue to fast-track innovation.

Countries facing challenges, are under the Watch Group, but with a combined population of 2.5 billion people, they represent significant opportunities for investment. Indonesia, Russia, Nigeria, Egypt, and Kenya are examples.

Opportunity to expand reach

The study says businesses and governments have an opportunity to expand their reach by bringing the remaining 60 percent of the population online.

In the Philippines, Smart Communications recently announced free but finite mobile Internet access to its subscribers, a move that would allow more Filipinos to go online, and shop.

“This special offer is specifically designed to assist our prepaid subscribers who make up the bulk of our population. Many of them already have the mobile devices capable of accessing the internet but have yet to use them to go online. In this way, Smart can effectively promote digital inclusion and spread the benefits of the Internet in the fastest and most effective way possible,” said Manuel V. Pangilinan, chairman of Smart and its parent company PLDT.

Smart’s parent company, Philippine Long Distance Telephone (PLDT), has invested 333-million euros (US$445-million) for a 10% stake in the Berlin-based Rocket Internet AG (Rocket).

With the investment, PLDT and Rocket will jointly develop mobile and online payment technologies and services for the “unbanked, uncarded and unconnected” population in emerging markets.

Rocket Internet’s most prominent brands include leading Southeast Asian e-commerce businesses Zalora and Lazada, as well as fast growing brands such as Dafiti, Linio, Jumia, Namshi, Lamoda, Jabong, Westwing, Home24 and HelloFresh, in Latin America, Africa, Middle East, Russia, India and Europe.

“This special offer is specifically designed to assist our prepaid subscribers who make up the bulk of our population. Many of them already have the mobile devices capable of accessing the internet but have yet to use them to go online. In this way, Smart can effectively promote digital inclusion and spread the benefits of the Internet in the fastest and most effective way possible,” said Manuel V. Pangilinan, chairman of Smart and its parent company PLDT.