Xendit, the leading payment infrastructure platform in the Philippines and Southeast Asia, partners with China Banking Corporation to launch the China Bank Direct Debit, a new feature that allows customers to safely and seamlessly fund their Maya account directly from their China Bank account.

Through Xendit’s digital payment infrastructure, China Bank account holders nationwide can now link their bank account to the Maya app. Once the accounts are linked, customers can instantly cash-in directly from their China Bank account.

“At Xendit, we recognize the importance of cashless transactions in today’s digital economy. That’s why we continue to cultivate partnerships that lead to more simple and secure cashless payment options for Filipinos. With the launch of this new channel in partnership with China Bank, , we provide an improved customer experience when topping up the Maya wallet,” said Yang Yang Zhang, Managing Director of Xendit Philippines.

“Making convenient cashless payments more accessible is one of our top priorities at Maya. This starts with providing a simple and seamless cash in experience to our users. That’s why we’re pleased to work with China Bank and Xendit as we offer more ways for Filipinos to master their money with Maya,” said Khurram Malik, Chief Operating Officer of Maya Philippines.

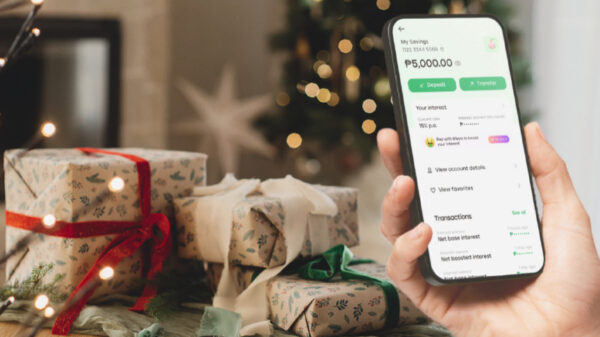

With this new cash in option, Maya users can conveniently fund their wallet with a few taps on their phones. Once their China Bank account is linked with Maya, they no longer need to exit the app or key in their bank account details for future cash in transactions. After cashing in, users can easily pay their bills, buy load, or shop for their daily essentials with their Maya account.

This newest cash in channel ensures better security when sending funds from China Bank and provides customers with a quick and easier way of making payments. With their China Bank accounts linked to Maya, they can instantly buy load, pay bills or pay for products and services from multiple merchants.

“Gone are the days when people had to physically go to our bank for every financial transaction. To meet the changing needs of our customers, we have to provide innovative financial services relevant in the digital world. Partnering with Xendit allowed us to offer convenience to our clients who use the Maya app for some of their financial needs,” said Manuel Tagaza, SVP and Chief Digital Officer of China Bank.

To make convenient cashless payments, download the Maya app for free today and top up your wallet using your China Bank account.