Sales of non-fungible tokens (NFTs) erupted in 2021, with NFTs from the collections of Cryptopunks and Bored Ape Yacht Club selling for well over a million US dollars. One of the most notable high-profile sales was Beeple’s – The First 5000 Days which sold for $69.3 million.

What was previously just a means of buying digital art has now become the new buzzword in town and potentially a form of investment and security.

The burgeoning popularity of NFTs has also led to a rise in the number of NFT-related cyber scams from phishing, fake mints, fake airdrops, rug pulls, and also trade washing. Investors and traders alike need to take top precautions to ensure their most valuable digital assets are kept in high-security cryptocurrency wallets.

What are NFTs (non-fungible tokens)?

Most people think that NFTs are simply digital art, however, there is more to it than that. NFTs are firstly a piece of immutable code that is stored on a decentralized blockchain (which is an encrypted immutable distributed ledger across computer nodes) and provides proof of ownership to a person’s crypto wallet. Subsequently, this piece of code can have links to images, animations, audio files, etc.

In other words, people who own NFTs essentially own a piece of code with an image attached to it, they do not own the rights to the image or its intellectual property. In fact, an NFT does not prevent the creation of another NFT with the same digital file, meaning, it is possible to have 2 different NFTs with exactly the same image.

NFTs also have various real-world applications such as facilitating real estate transactions, recording personal health data, and even ensuring product traceability and provenance in supply chain logistics, etc.

What is NFT wash trading?

NFT wash trading is a type of scam where a buyer and seller, often the same bad actor, artificially drives up the price of an NFT by selling that NFT back to forth at high prices. This generates artificial high sales volume for the individual NFT as well as the entire collection, pushing the NFT collection up in the marketplace rankings and causing unsuspecting buyers to believe this is a trending collection.

When traders and collectors are unable to establish an accurate opinion, they tend to respond hastily when misinformed facts and history an NFT collection lead them to believe that it is a trending collection.

The practice of wash trading was a common scam in the 1930s where stock manipulators would pump up the price of a stock and cause a rush of buyers, only to short the stock later. This was first made illegal by the US federal government after passing the Commodity Exchange Act in 1936.

Wash trading can be done a lot more easily for NFTs compared to a cryptocurrency exchange because bad actors can easily set up multiple wallets to transact the NFT between these wallets.

While transactions of the NFT can be viewed on a blockchain explorer, the wallet owner cannot be so easily identified as wallet addresses are represented by a string of hash rather than an actual ID. This is unlike most traditional centralized stock exchanges which has strict Know Your Customer requirements.

Examples of NFT wash trading

CryptoPunks 9998

One of the most well-known cases was the sale of CryptoPunk 9998 on 28th Oct, 2021. On that particular day, CryptoPunk 9998 was transacted from a buyer to a seller for 124,457 ETH, or $532 million at that time. The sale of that NFT was detected and broadcasted to Twitter by the CryptoPunks Bot which gained a lot of attention from the public.

This was made even more suspicious when the seller sent back all the ETH to the buyer.

However, the CryptoPunks team later announced that the transaction was non-malicious, and that buyer was borrowing flash loans to purchase this CryptoPunk NFT and repaid the loans in the same transaction.

The buyer then listed the NFT back onto the marketplace for 250,000ETH or about $1 billion.

LooksRare $8 billion NFT wash trading

Another example of high volume wash trading was on the LooksRare marketplace that appeared from to rival the biggest NFT marketplace Opensea in early 2022.

CrytoSlam, an analytics firm for NFTs, reported that LooksRare comprised of over $8 billion in wash sales coming from NFT sales of Meebits, Terraforms, Loot, Crpytophunksv2, and others.

The reason for the high volume of wash sales comes down to LooksRare’s reward system of giving a percentage of the day’s sales through $LOOKS tokens to participants who purchase on their website.

How to Spot an NFT Wash Trade

NFT wash trades can be easily spotted if you spend some time to do some checks before purchasing the NFT.

Price and rarity: If you see an uncommonly high price that the NFT was bought for compared to the floor price (e.g. sold for 5 ETH when the floor price is only 0.1) and the NFT does not have many rare attributes, there is a high chance this might be a wash-traded NFT.

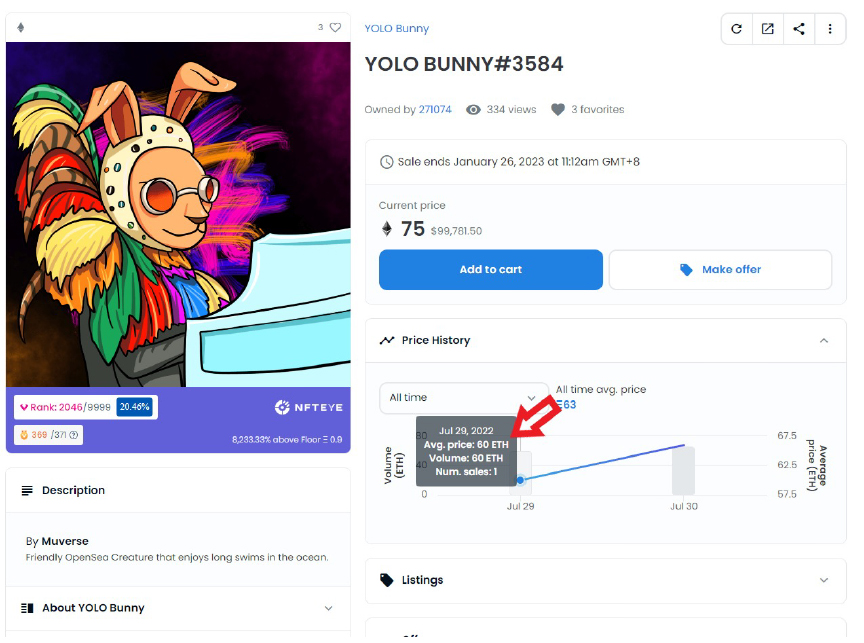

For example, the YOLO BUNNY #3584 below was sold for 60 ETH on July 29 2022 when the floor price before that date was less than 1 ETH, furthermore this particular NFT is considered a common rarity in the collection.

YOLO BUNNY #3584 bought for 60ETH on 29th July 2022. Image Source: Opensea.

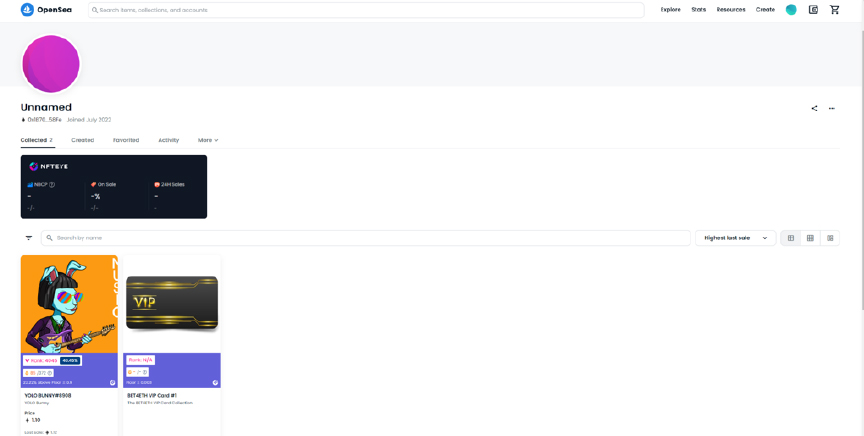

Ownership: When you look at the profile of users in Opensea who wash trade, they often only have 1-2 NFTs. In the case of the user who paid 60ETH for YOLO BUNNY #3584, he currently only has 2 NFTs in his profile at the time of writing.

User profile who paid 60ETH for YOLO BUNNY #3584 on 29th July 2022. Image Source: Opensea.

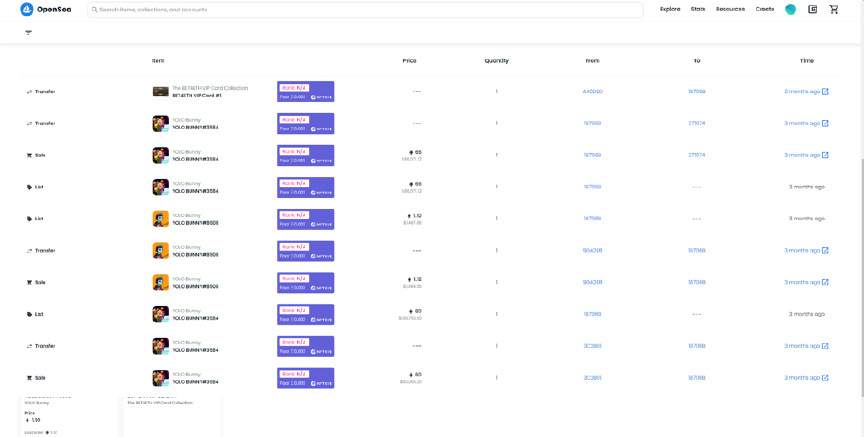

Transaction History: If a user was truly legitimate, he not only would have a decent collection size on Opensea but also a history of buying and selling other NFTs. We might empapthize if the person is new to NFTs and has a small collection, with only a few transactions, but if the small number of transactions are of an exorbitant value, it starts to become suspicious.

Going back to the same user who bought YOLO BUNNY #3584 bought for 60ETH, you can see that his transaction history only consists of buying and selling a few YOLO BUNNYs for extremely high price.

YOLO BUNNY #3584 bought for 60ETH and sold for 66ETH. Image Source: Opensea.

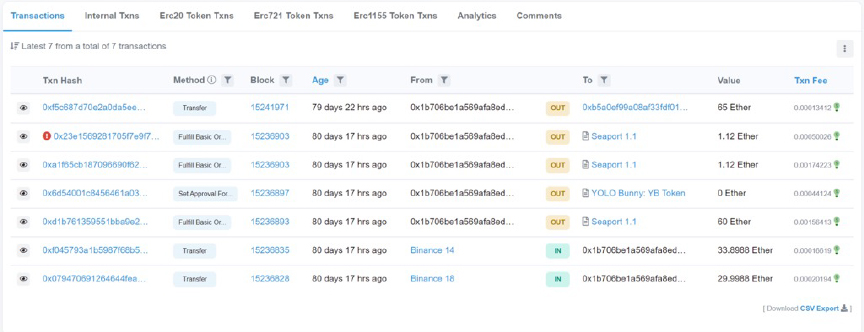

You can also check a blockchain explorer for the user’s transaction. In this case, we can see that he transferred 64 ETH to himself from Binance before making the purchase of the YOLO BUNNY #3584 bought for 60ETH.

Conclusion

There are many ways to make money through decentralized applications and trading NFTs is just one of them. For every kind of interaction in the Web3 space that promises profit, there is always the risk of loss.

Wash trading in the NFT space is currently difficult to enforce in NFT marketplaces due to its decentralized nature. This practice will continue to be carried out by traders and the teams behind art collections as well.

It is important for us to always keep a lookout for any signs of wash trading such as unusually high prices, suspiciously empty profiles and consistent back and forth transactions between the same wallets. Only then can we stay safe from such market manipulators.

AUTHOR BIO: Daniel Thomas

Daniel is a full-time blogger and founder of Basigue.com where he writes articles on Web3, cryptocurrency, NFTs, E-commerce, business, and reviews on products and services. Daniel has experience in dropshipping, creating Shopify online stores, affiliate marketing, SEO, and running digital advertisements like Facebook and Google Ads. In his free time, he loves playing games or watching anime with his wife.