Southeast Asian regulatory technology (regtech) firm Tookitaki recently announced its launch in the Philippines with partnerships with payment gateway company Paymongo and the country’s leading all-in-one money platform.

Headquartered in Singapore, Tookitaki provides end-to-end financial crime solutions to some of the world’s leading financial institutions. In the ASEAN region, some of the largest banks and fintech companies rely on Tookitaki to transform their anti-money laundering (AML) compliance needs.

The Bangko Sentral ng Pilipinas (BSP) reported that the Philippine financial system is at ‘medium risk’ of being used for money laundering last year. While preventive measures have been placed to curb risk of dirty money, the country remains in the gray list of international watchdog on money laundering and terror financing Financial Action Task Force (FATF) as of June 2022.

“We are deeply committed to empower the banking and financial services (BFS) sector in the Philippines to fight money laundering in the most effective and efficient manner,” shared Abhishek Chatterjee, Founder and CEO of Tookitaki. He adds, “The volume of digital banking and ecommerce transactions is rising exponentially, with global cashless payment volumes expected to increase by more than 80% from 2020 to 2025 and total cross-border payments reaching over $156 trillion. Unfortunately, this vast flow of money crisscrossing the globe provides cover for money laundering and the Philippines is no exception. As more Filipino consumers become part of the banking ecosystem and financial crime becomes more sophisticated, the financial institutions (FIs) in the region need to look beyond traditional and siloed AML systems to keep pace with growing business and compliance requirements.”

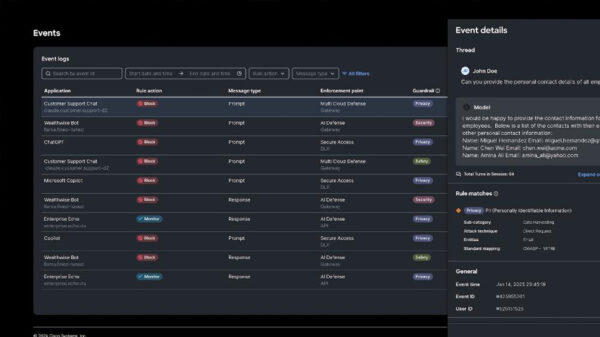

Designed on three C-principles – comprehensive, convenient and compliant – Tookitaki’s AML solution can empower FIs in the region to strengthen their risk coverage and mitigate risks seamlessly in the ever-evolving world of regulatory compliance. Named Anti-Money Laundering Suite or AMLS, it became an instant hit with the region’s digital banks and fintechs because of its unique Hub and Spoke model for powerful transaction monitoring. The ‘Hub’ is an extensive and evolving collection of latest intelligence on money laundering patterns sourced from AML expert network globally in a privacy-preserved manner. The ‘Spoke’ represents a simulation setup and allows local companies to download and test relevant patterns from the Hub, detect illicit money trails and stay protected. The Spoke is installed within the environment of a financial institution without letting the test data leave the network, therefore providing utmost security. Built on BigData, AMLS extensively uses machine learning for its transaction monitoring, smart screening and customer risk scoring solutions. The alerts from all solutions are unified in an interactive, modern-age Case Manager that offers companies with speedy alert disposition and easy regulatory report filing.

Ahead of its local launch, Tookitaki secured partnerships with the country’s leading all-in-one money platform and PayMongo to rapidly help the growing fintech industry of the country reduce risk and design a robust anti-money laundering program, aligning with the compliance norms set out by the local regulator. This will offer safer and more secure transactions for the money platform’s over 47 million users and the digital payment platform’s over 10,000 partner merchants. “We look forward to partnering with more fintechs and local banks in the region offering an end-to-end AML detection and prevention software solution,” mentions Mr Chatterjee.

Earlier this year, Thunes, a global leader in powering payments, took a majority stake in Tookitaki to accelerate global business expansion and a major focus was laid to deepen presence in core APAC markets, including Philippines. Setting up its Philippine office in Q3 2022, Tookitaki will be employing Filipino talents for its local operations to strengthen the country’s pool of regtech talents and contribute to the economic growth of the country.