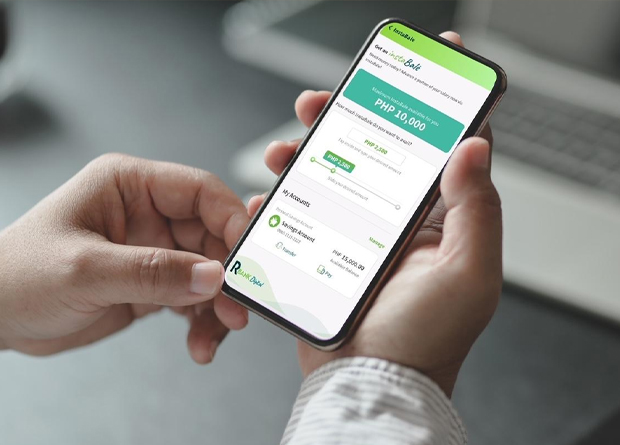

Robinsons Bank launched its new product, InstaBale, which allows eligible employees to make a cash advance on their upcoming salary credits.

Employees can skip filling up forms or long waiting time since they can easily apply for an InstaBale through the RBank Digital App. There’s no enrollment needed; and funds can be received in just a few minutes. What’s more, InstaBale also offers unlimited and multiple availments within the cash advance limit.

Instabale offers a maximum cash advance limit of up to Php 200,000, depending on the approved limit per qualified employee.

The cash availed is automatically charged on the upcoming payroll, thus no need to worry anymore about missing the due date. Easy and convenient!

InstaBale is the perfect solution that will allow employees to have the financial flexibility they need as it provides a quick, safe, and reliable access to funds whenever they need.

InstaBale is only available to qualified employees with payroll account with Robinsons Bank Corporation. Download the RBank Digital app now.

Robinsons Bank is the financial services arm of the JG Summit Group of Companies, one of the largest conglomerates in the Philippines. It currently ranks 18th among universal and commercial banks in the country, with assets amounting to Php 151.215 Bn Bn as of December 2020. The Bank is recognized as the Fastest Growing Retail Bank in the Philippines for 2019-2010 by The Global Banking and Finance Review; Fastest Growing Commercial Bank in the Philippines for 2019 and 2020 by the Global Business Outlook; and the Best Commercial Bank in the Philippines for 2020 by the International Business Magazine.