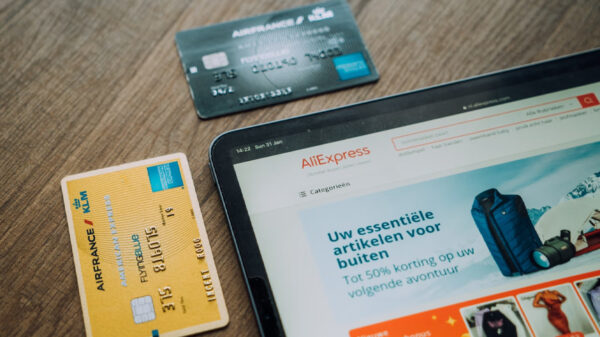

The world is gradually going cashless. The volume of online transactions has increased exponentially with the advent of the internet and the apparent demographic shift. Whether you’re purchasing something online or making a gambling deposit or you’re sending money to a loved one, nothing beats a seamless transaction. Digital wallets and other e-payment platforms digitize your financial details and enable the swift completion of these transactions. With eWallets and other electronic payment options, transactions can be completed under five seconds depending on the blockchain technology used by the wallet or the digital currency.

Electronic wallets or e-wallets are prepaid electronic cards that safely store customers’ financial details to ease the online transaction process. Your phone is technically a ‘wallet’ when this method is used. Neteller and Skrill are some of the popular e-wallets. Crypto digital wallets store the unique key needed for cryptocurrency transactions.

Some eWallets can also process bitcoin transactions. For instance, Skrill is targeted towards digital currencies such as Litecoin, Ethereum, and Ether. eWallets are a top choice for users who enjoy online gaming. Payment Gateways are simply third-party systems that act as a bridge between cardholders, financial institutions, and service providers. Some of the popular payment gateways include PayPal, Stripe, Square, Payoneer, and Zelle.

Advantages of Modern Digital Payment Systems

Conventional payment methods such as credit and debit cards are gradually being replaced by more sophisticated alternatives such as eWallets and payment gateways. With digital wallets, online transactions are more convenient, secure, and flexible – three practical features that are valued by most people nowadays. It is very important to compare payment methods and the features unique to each one before deciding on which one to use. Some of the advantages of alternative payment methods include:

Flexibility

It is almost impossible to use credit cards, debits cards, and other traditional payment methods for other purposes asides financial transactions. Electronic wallets, however, are highly flexible. eWallets can also be used to store loyalty points and other items such as driver’s licenses, transport passes, and even event tickets. Not only this, but gift cards can also be processed directly using eWallets. With eWallets, you can conduct transactions worth as low as $0.1.

Convenience

E-payment platforms have undoubtedly revolutionized the business industry. Setting up an account with most of these platforms is relatively easy. Payment gateways require less time and effort – using them eliminates the need to manually enter financial details on the payment form. With payment gateways and eWallets, customer’s financial details such as the credit card number, the date of expiry, and security code are entered automatically. Users only have to complete the authentication process and transactions are approved swiftly.

Security

No matter where your transactions are conducted, security is the first factor considered by many consumers. Digital wallets and other e-payment platforms mitigate the security risk associated with offline transactions. Bitcoin transactions are conducted using digital wallets that can be secured on your mobile device, computer, or in the cloud. Credit cards on the other hand are stored in a physical wallet.

Physical wallets can be stolen. Also, it is very possible for hackers to access your credit card details. However, most digital wallets require intricate verification and authentication processes including fingerprints, facial recognition, and iris scanning. The majority of the payment gateways encrypt confidential information such as credit card numbers to ensure the safety of transactions.

Paradoxically, the major reason why many people are wary of using e-payment platforms is that they are concerned about the safety of such transactions. In reality, your financial details are more secure when you use e-payment platforms such as eWallets, crypto wallets, and payment gateways when compared to credit cards. In addition to the security provided, these payment systems guarantee flexibility and convenience.