Since its launch as the first all-digital bank in the Philippines in November 2018, ING seeks to redefine banking and savings in the Philippines. With a fully digital account opening process, high interest rate offer with no minimum amount and no lock-in period, ING wants to promote a healthy savings mindset and higher adoption of cashless transactions in the Philippines.

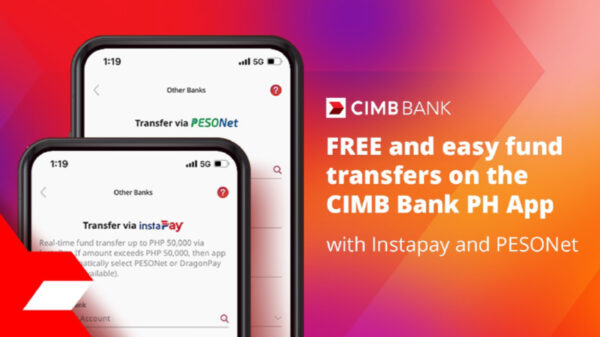

True to its promise, ING is giving its customers another reason to save more now at the peak of the holiday season. From now until January 31, 2020, ING will take care of your other bank’s transfer fees when you transfer to your ING Savings Account. You will receive a fixed rebate of PHP 100 for every successful electronic bank transfer, for up to two transactions per month.

Mohamed Keraine, Head of Retail at ING Philippines shared, “We believe in giving our customers control of their money and freedom to move their funds as they need and wish, especially when most people have money in different bank accounts. While ING does not charge any transfer fees, other banks charge fees as high as PHP 100 for interbank fund transfers.”

“By offering our clients a rebate on transfer fees, we are removing one of the barriers that hinder them from fully maximizing the benefits of their ING Savings Account. The PHP 100 rebate fee offer works alongside the high savings interest rate of 4% per annum, which both new and existing ING clients can enjoy.”

This initiative further reinforces ING’s promise to deliver a differentiating banking experience that truly meets customers’ needs and address a major banking pain point.

Mohamed added: “During this holiday season, we are giving that little nudge for people to truly save and be more mindful of their finances. We also hope that through this initiative, along with many others already in place, more and more Filipinos will be empowered to start saving.”