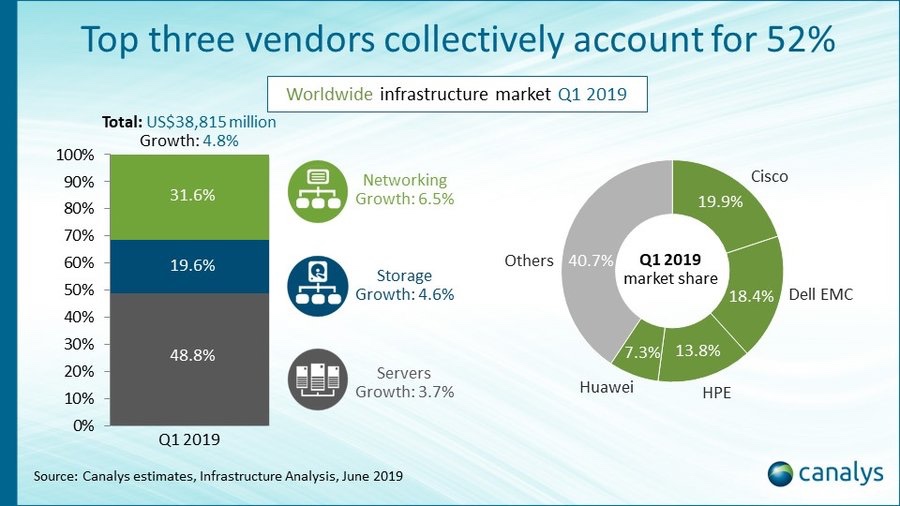

The latest research from leading global analyst firm Canalys shows that the worldwide growth rate for server, storage and networking infrastructure shipments slowed to 4.8% in Q1 2019, as the total market value reached US$38.8 billion. This comes after a stellar 2018, when the growth rate for the full year reached 16.3%. A marked slowdown in capital expenditure by the hyperscale cloud builders, combined with ongoing weakness in service provider spending, the end of the mainframe refresh cycle, and smaller expansion in enterprise server and storage sales were the main factors. Nevertheless, the total shipment value was still US$1.8 billion higher compared with a year ago. But the outlook for the rest of the year is uncertain, as the fallout from escalating trade dispu tes starts to affect global trade and economic performance.

All three technology segments were positive in Q1, with servers slowing the most. Shipments grew 3.7% during the quarter against 39.2% in the same period a year ago. “Vendors have become accustomed to high double-digit percentage growth rates over the last 18 months, fueled by rising ASPs, due to server refresh, component price rises and demand for higher configurations to support more compute-intensive workloads. But this is cooling, with ASPs starting to stabilize and unit shipments falling,” said Canalys Principal Analyst Matthew Ball. “Server refresh is still ongoing in businesses, but greater emphasis is being placed on integrating multi-cloud services with existing on-premises resources as part of hybrid-IT strategies and simplifying operations.” The fall in server unit shipments has been stronger among hyperscale cloud builders, which have switched to consuming capacity after making big investments last year. This is expected to continue for at least the next quarter.

Storage shipment growth also slowed in Q1 2019, to 4.6%, compared with 19.8% in Q1 2018. All-flash arrays and hyperconverged infrastructure remain key investment areas for customers. Data management will be a critical part of hybrid-IT strategies, as businesses look to optimize multiple storage resources to store, process and analyze the increasing volume and variety of data being produced. Networking was the only infrastructure segment to register stronger growth than last year, albeit at a relatively low level, increasing 6.5%. Refresh of campus networks continued and the transition to Wi-Fi 6 gained traction, while data center switching was flat. SD WAN has emerged as a key growth opportunity, as businesses optimize and secure branch access to cloud-based services.

For full-year 2019, Canalys forecasts worldwide infrastructure shipments will grow 6.4%. “IT infrastructure growth was always going to be slower this year, as maintaining the high rates recorded in the in the last six quarters was not sustainable. The longer the US-China trade war goes on, the more of an impact it will have on economies and business investment. Confidence is starting to decline around the world, with central banks prepared to inject stimulus measures if the situation worsens,” added Ball. Vendors have already faced multiple challenges this year linked to the trade war, in terms of managing supply chains to reduce exposure to US tariffs and shifting manufacturing from China. The short-lived threat of tariffs on imports from Mexico would have made the situation even more challenging for vendors.

The top three infrastructure market leaders in Q1 2019 were Cisco, Dell EMC and Hewlett Packard Enterprise (HPE), which collectively accounted for 52.1% of total shipments. This increased from 50.5% a year ago. Cisco continued to dominate each segment of the networking market, while Dell EMC made further gains in the channel in both servers and storage. HPE remained the leading challenger in all segments, with its Aruba wireless LAN business taking further share. Huawei was the fourth largest vendor, accounting for 7.3%. It is arguably facing the biggest supply chain challenges among any of the top four vendors, given the US Executive Order signed on 15 May.