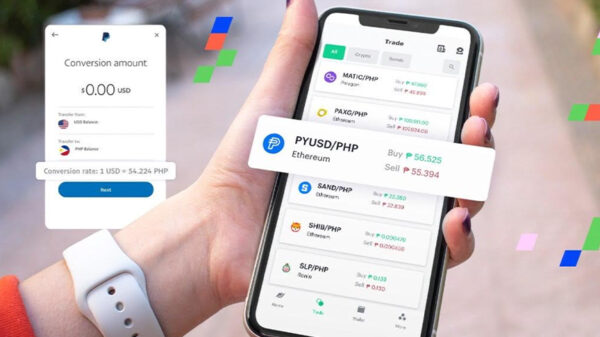

Sending remittances to the Philippines can now be made faster at less cost through a digital money transfer platform which eliminates the traditional way of sending money which uses forms, codes, agents, extra time and fees.

US-based digital money transfer service provider Remitly allows users – immigrants and overseas Filipino workers in the US, Canada, Australia and the recently added 11 countries across Europe – to send money or remittances online to their loved ones back in the Philippines from the Unites States by downloading the Remitly app to a desktop, tablet or smartphone.

The platform provides disbursement network in the Philippines which currently includes banks and over 10,000 cash pickup locations across the country. Some of Remitly’s partners include Banco de Oro, BPI, Metrobank, PNB, M Lhuillier, Cebuana Lhuillier, and LBC, SM Department Store, Globe, Villarica Pawnshop, Palawan Pawnshop, and Bayad Centers.

According to Gene Nigro, vice president for business development at Remitly, sixteen years ago, the whole business in the Philippines was home delivery which was paid in cash. No Internet, no smartphone, and no application. Sixteen years later, he said, the data is completely different. Today, 10% of the audio volume coming to the Philippines is online, and expected that three to four years from now, about half of the total volume is going to be online.

The application allows customers to send the currency they need to their loved ones in the Philippines. Dual currency is allowed, regardless of the location they send from, to send money in USD, CAD or AUD and receive the funds in USD or PHP in the Philippines. This feature is available at cash pickup locations or through home delivery.

To date, Remitly has sent over US$2-billion to the Philippines with its customers saving over US$9-million in transfer fees on average compared to its competitors. This is for transactions of cash pickup to the Philippines using a debit card for the average amount of US$300.

On remittance charges, Nigro shared Remitly’s average fee depends on the type of services, whether it is instant or delayed, but the average fee is US$3.99 per transaction of up to US$2,999. Customers have the option of paying it in pesos or dollars, taking into account the exchange rate. There are also no add-on rates.

The areas that receive money through Remitly’s platform include Cavite, Cebu, Bulacan, Davao del Sur, Negros Occidental, Laguna, Rizal, Metro Manila, Pampanga, and Pangasinan.

Sending money through Remitly is fast and safe, according to Nigro. “The transaction is 100% safe, ISO safe that would guarantee your principal at your feet. We aim our transaction to be immediate.”

Nigro claims a big portion of Filipino remittances come from the US because a lot of Filipino seafarers disembark there to send remittances to the Philippines. “Majority of remittances comes from West Coast, and a lot also come from Miami. You have lots of seafarers which disembark when they had their day offs, and send remittances from Miami. There are also cities PAL flies in the US where there are lots of Filipinos such as LA (Los Angeles), San Francisco, New York and so forth,”

Remitly conducted a survey to thousands of their customers on why Filipinos send money to the Philippines. The results showed that 72% of respondents send money for basic necessities like food and shelter, while 28% said it is for education and emergency purposes.

Last year, Remitly created the Seafarers service for Filipino cruise ship workers which make up about a third of the cruise ship workforce that contribute over US$5-billion in remittances annually to the Philippines. The solution helps cruise ship workers send their money to the Philippines while they’re away at sea straight from the cruise ship using their phone or computer.

Apart from this, Remitly recently partnered with Stripe, a fintech company, to help more Filipinos as it expand its services to 11 new send countries across Europe including Austria, Belgium, Denmark, Finland, Germany, Ireland, Italy, the Netherlands, Norway, Spain, Sweden, and the United Kingdom.