Small and medium businesses (SMBs) can now avail of collateral-free financing scheme with the launch of the Philippines-based First Circle, an Irish-led financial technology startup that offers access to capital through its online platform.

Over 90% of the registered business in the Philippines are considered as SMBs, and yet access to finance remains a hindrance to their operations. This is why First Circle came into being as the first digital SMB financing company in Southeast Asia, as it aims to provide access to short-term financing for local SMBs. Better yet, First Circle designed its business platform to be agile.

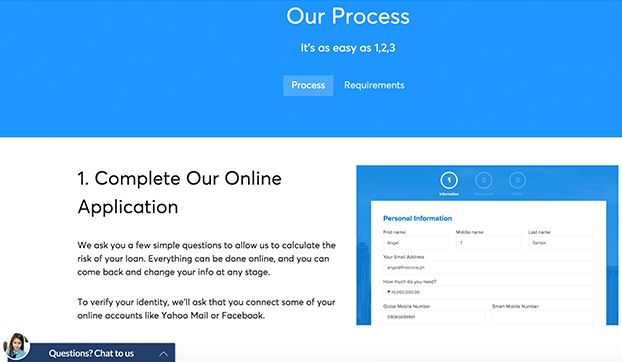

According to Patrick Lynch, president and CEO of First Circle, the processing time for accessing loans was shortened, taking only two to three minutes with First Circle’s proprietary-built secured system. “The full end-to-end solution from the moment a consumer engages with us is done online. There is no paper exchanged. This also allows us to have great control in the customer journey,” said Lynch. “It takes 24 hours to open an account and receive a decision from First Circle. It also takes 24 hours to actually get the finance. We can give the loans within one to two days as we have the technology and the logarithms to process the applications.”

The maximum amount of loan a first-time applicant can avail is Php1-million, while the minimum is P100,000.

Lynch said they review and compute risk or credit standings for the borrowers. “If their risk standing improves, then that means they can borrow more. Since all businesses need capital in order to grow, we will give them the chance to grow,” he said.

First Circle is operating in beta mode at the moment.

SMBs already existing for two years can apply for financing. To avail of the loan, an applicant is required to submit the audited financial statements (AFS), including income statement and Balance Sheet, for the last two years. If it has no AFS, its Income Tax Return for the last two years is needed. Proof of sales for three to six months is also required. For e-commerce trader, its Statement of Accounts from the eCommerce platform is needed. Apart from these, business bank account statement for the last three to six months, business permit, and government ID are also required.

First Circle already collaborated with Lazada and Zalora to help online merchants sell products. The company also established partnerships with PhilExport and the Go Negosyo of the Department of Trade and Industry.