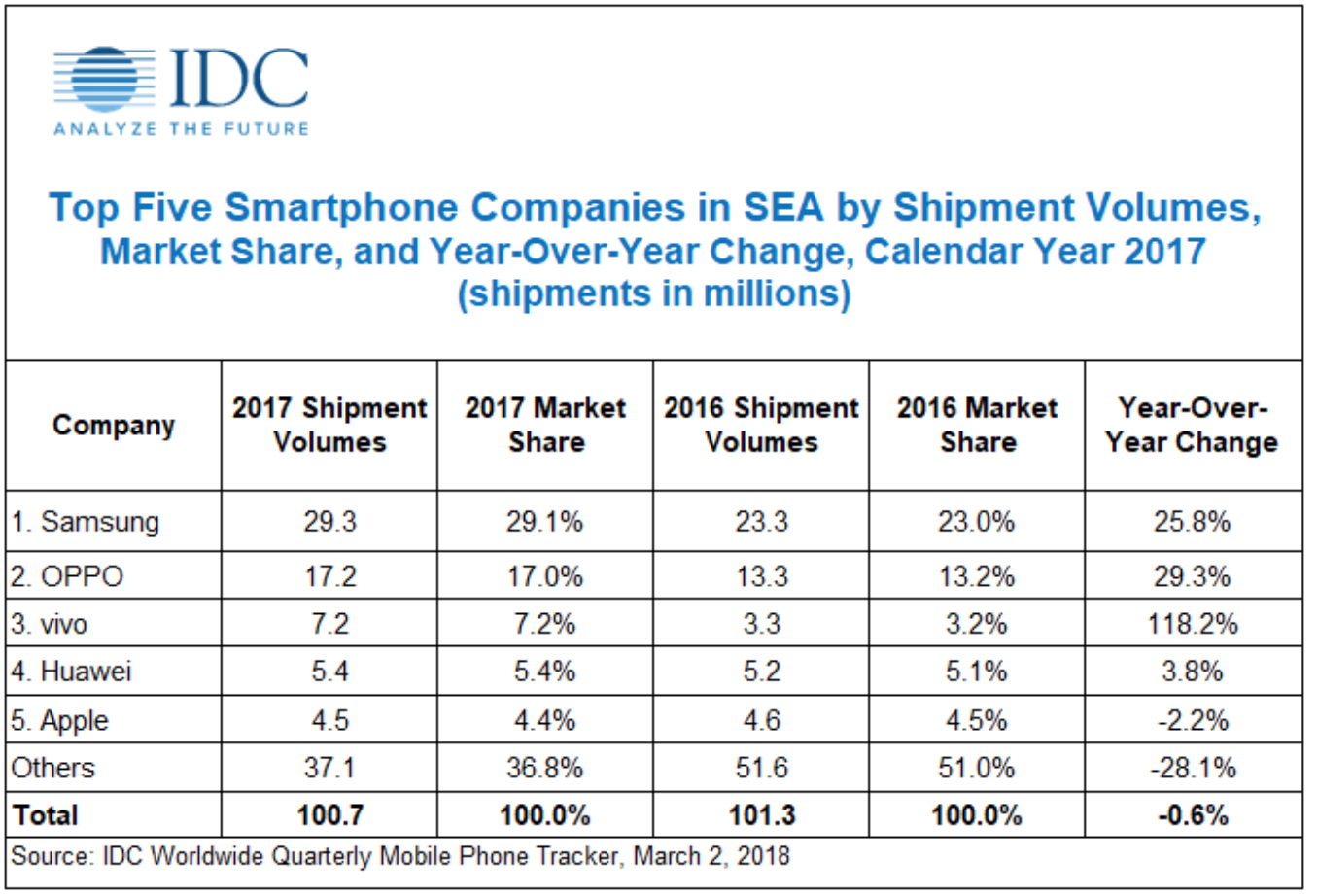

Total smartphone shipments in the South East Asia (SEA) region recorded nearly 28 million units in the second quarter of 2016, according to the latest International Data Corporation (IDC) Asia/Pacific Quarterly Mobile Phone Tracker. This reflects an 18.1% increase quarter-on quarter (QoQ) and continued positive growth year-on-year (YoY) of 6.5%.

Countries in the SEA region tracked by IDC’s local and regional analysts are Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.

“Competitive price points and heavy marketing activities in a now crowded market are the key driving factors for the budget conscious SEA market. Smartphones priced at <US$150 make up for 68% of total smartphone shipments in 2016Q2. Some of the best-selling models in that price range are Samsung’s Galaxy J1 Mini, OPPO’s Neo 5, and Asus’s Zenfone Go,” says Jensen Ooi, Market Analyst, Client Devices Research, IDC Asia/Pacific.

In terms of market share, the overall smartphone market remains dominated by Samsung, followed by OPPO, True (an operator in Thailand), Asus and Lava.

Samsung retained its top position by relying on its price and spec competitive Galaxy J series which was highly suited for the budget conscious SEA market. Meanwhile, the flagship Galaxy S7 series saw better YoY performance in terms of unit shipments compared to the Galaxy S6 series launched back in 2015.

OPPO moved to second position for the first time. Despite Oppo’s continued marketing investments to build a solid brand equity for its F1 family, it was the Neo model that drove up its volume.

Asus’ position is supported by its highly affordable Zenfone Go model. Meanwhile, the growth of its flagship, the Zenfone 2 Laser, slowed down in preparation for the new Zenfone 3 targeted for launch in the third quarter.

Unit shipments for True and Lava were propelled by heavy operator activities to increase 3G subscribers nationwide in Thailand.

Meanwhile, 3G handsets still make up majority of the market share as they carry significantly lower price points as opposed to 4G ones, a pivotal factor particularly for SEA consumers. Furthermore, the slow uptake of 4G is largely attributed to the temporary rise of 3G devices in Thailand, where operators were in a rush to migrate subscribers from 2G to 3G, handing out large amounts of free or heavily discounted handsets.

From the third quarter onwards, IDC expects an increase in demand for handsets with better specifications. While smartphones of <US$150 will continue to make up the larger share of unit shipments, demand for US$150<US$250 priced smartphones is expected to increase.

“With the rise of replacement users in SEA seeking to upgrade their handsets in order to cope with the latest usage and apps, vendors will need to increase the market availability of handsets with better specs that come at slightly higher prices, which the buyers are willing to invest in for a better usage experience,” adds Ooi.

Global, China-based and local vendors are expected to switch strategies as the demand for SEA market begins to change where solely relying on supplying highly affordable low-end handsets to the market will no longer suffice to keep their businesses afloat.