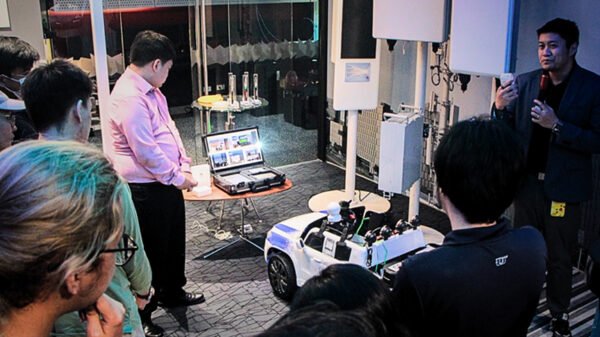

Startup businesses take on a slightly different path, than businesses in the Silicon Valley, where Katalyst.ph founder, Joe Maristela, got his start as an independent investor and portfolio manager for his family

office

In 2009, Maristela launched a healthcare BPO that’s now headquartered in Makati City. In 2015, this BPO had matured enough for him to step away from day-to-day operations, and so, Maristela decided to launch an independent one million dollar investment program—his own money, his own investment theses.

His first position was Satoshi Citadel Industries (SCI), a universal Bitcoin business that had as its flagship a Bitcoin and Blockchain-based remittance business. In total, Maristela invested $350,000 (USD) into the so called fintech space, which also included a seed investment in Qwikwire (QW).

“In late 2015, like many of the startups that I’d invested in, I’d gone through growing pains in the short time that I’d been operating. I had to let some of my team members go, and had to pivot in terms of marketing and focus in key areas, in order to achieve the mission, which is to create an office that is in and of itself a catalyst for other catalysts of progress in the Philippines.”

“What use would a follow-on investment be, if the corporate VC only had as its exit in mind, an acquisition—worst yet, by one of only two telcos in this country?” Maristela spent the greater part of a year, trying to find a follow-on investor that wouldn’t kill the prospects and potential of his initial investment. He’d found a strategic partner in Kakao Venture Group (KVG), the venture arm of Kakao Corp. in Korea. “Their investment is significant, and it helped to close our seed round,” Maristela said.

Maristela’s second investment in 2015, seeding QW, secured a slot in 500 Startup’s current cohort in San Francisco, California as well as Ideaspace, a non-profit business support organization affiliated with Smart Telecom.