The unceasing depreciation of the Philippine peso from April-June 2013 has led to a number of PC distributors delaying their loading activities, resulting in lower-than-expected PC shipments to the Philippines for Q2 2013, according to IDC’s Asia/Pacific Quarterly PC Tracker.

The Philippines PC market shipped a total of 460,000 units in Q2 2013, 12% lower than IDC’s initial forecast, this corresponds to a year-on-year decline of 16.5%.

“The common reaction of distributors (those who buy PCs in US dollars) to the depreciating peso is to hold back on loading when vendors do not grant them price protection to cover the impact on their profit margins,” says Daniel Pang, ASEAN Research Manager for Client Devices at IDC ASEAN.

While some vendors offered price protection schemes to their distributors, the subsidies were usually capped at a currency ceiling.

“Most distributors play in the value segment, and wanted to avoid the risk of bringing in new stocks when prices of PCs are still high,” Pang adds.

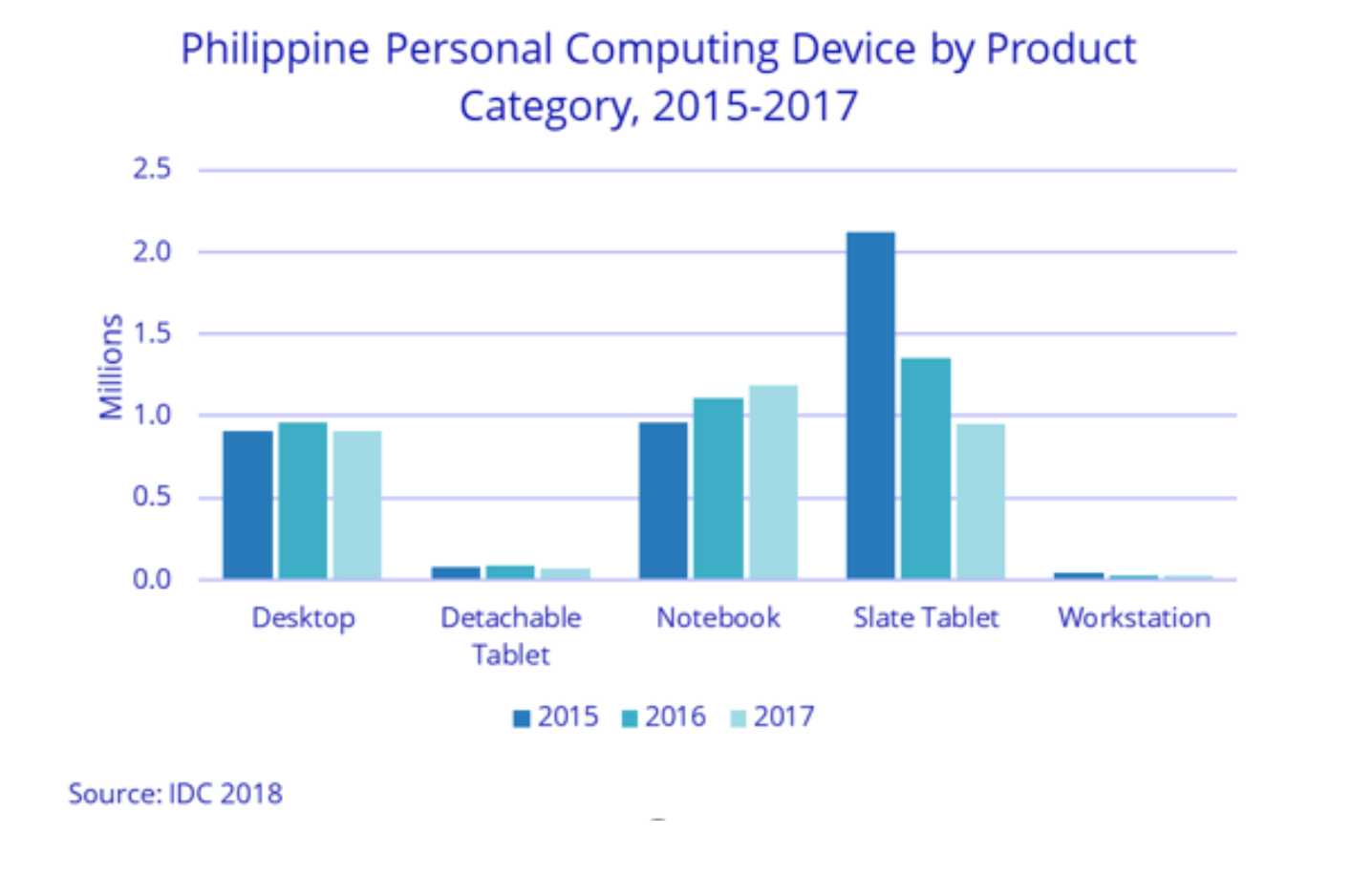

The consumer market for PCs was the segment most affected by the peso depreciation. While it was a flat quarter for consumer desktops, consumer notebooks suffered a 16.9% slide quarter-on-quarter for Q2.

Distraction from tablets

Another possible factor that could have had an impact to the declining consumer PC market is the tightening competition the market is facing against tablets. According to IDC’s Worldwide Quarterly Tablet Tracker, tablet shipments to the Philippines grew 54.4% in Q2 2013.

Jerome Dominguez, Associate Market Analyst for Client Devices at IDC Philippines says, “The consumer notebook market has been on a downward trend for over a year now, while the tablet market has been making waves in the consumer segment since 2012. With the increasing proliferation of low-cost tablets in the Philippine market, consumers are becoming more aware of them and driven to them due to their attractive price points and increased portability relative to notebooks.”