E-commerce has profoundly transformed the way consumers shop and businesses reach their markets. While the brick-and-mortar shop is still the primary venue for retail transactions, an increasing number of consumers are making purchases online, a huge opportunity for businesses of all sizes and across all industries.

According to the Visa eCommerce Consumer Monitor 2014, as much as nine out of 10 Filipino consumers go online to shop at least once a month. Benefits such as convenience (58%), price (47%), and deals (46%) are being cited as top reasons for online shopping.

While it is clear the e-commerce industry in the Philippines has grown over the years, it is still in its early days. However, the accelerating use of Internet and mobile devices have led to the expansion of the online consumer base which is very conducive to the further growth of the industry.

“It is early days of e-commerce in the Philippines. It has been growing quite fast in the last four years. There is a huge market to be penetrated while the entry of new e-commerce firms, as a result of the industry’s progress, helps further boost the growth of the market,” said Inanc Balci, CEO at Lazada Philippines, a leading e-commerce marketplace.

In 2015, the market performance of the local e-commerce industry was less than one percent of the e-commerce penetration of non-food, non-travel retail market which was $75-billion, according to Balci.

It is this progress and huge opportunity that Balci noted that have attracted more foreign online marketplaces to set up a local presence, such as Thailand’s itruemart.com and Singapore’s YiLinker.

In an interview with UpgradeMag.com at the AWS re:Invent 2015 held in Las Vegas last year, Chaiwat Ratanaprateepporn, chief technology officer of Thailand-based Ascend Group announced the scheduled opening of its online shopping site – itruemart.com – in the Philippines in November 2015. When operations started, the Philippines became the first country to have the e-commerce site outside of Thailand.

Ratanaprateepporn is cognizant of the presence – and even dominance – of other key players in online shopping in the Philippines, including Lazada.com.ph, ZALORA.com.ph, and CashCashPinoy.com. “Competition is there, obviously. It’s a very competitive market,” Ratanaprateepporn said. However, “we aim to just serve to encourage more and more people to go online when shopping. That way, we just focus on customer satisfaction.”

A month after itruemart.ph launched, YiLinker announced at a press conference its local online marketplace with an investment of US$6 million.

According to Nelson Liao, CEO of YiLinker Philippines, the growth of online transactions from 2013 to 2015 has grown almost 100% every year. “Based on this, the Philippines could become a better market for e-commerce like China and other developed countries.”

“We have knowledge about the lifestyle of Filipinos, what they want and what their habits are. We want to turn these habits into business opportunities,” said Liao.

With YiLinker’s entry into the Philippines, “we aim to revolutionize the local e-commerce industry with the YiLinker model where online is better than offline. We have an affiliate program where stakeholders can set up online stores and offer merchandise without spending a single centavo, no need to hire people, but have the chance to earn,” said Liao.

What’s driving the growth?

The swift increase in the country’s Internet penetration rates which currently reached over 44%, driven by the increasing adoption of smartphones particularly by the younger population as more of these have become affordable, strongly contributes to the growth of the industry. As mobile Internet penetration rises, Internet usage is expected to increase, helping e-commerce gain increased popularity.

With the rising number of Internet users, Barbie Dapul, Head at Globe myBusiness, expressed the need to have a broader Internet access for the growing online market as a result of the growth in smartphone and Internet penetration in the country. Internet access, she said, has also expanded to devices such as laptops and tablets for an accessible and easier connectivity.

The emergence of new payment methods is also a prime factor which boosted e-commerce. Lawrence Ferrer, Vice President at PayMaya Philippines, notes that without a means to pay online, people will not be able to participate in the digital economy. “While some e-commerce stores in the Philippines will accept cash on delivery (COD), the imperative really is to create more inclusive and more extensive financial technology.”

Logistics is also very important in e-commerce. Mitch Padua, Vice President for Digital Commerce at Voyager Innovations, stressed the need for an affordable delivery to the far corners of the Philippines, innovation on speed of delivery, and granularity in tracking and ability to deliver different types of items that will bring brands and products from the online store to the consumer’s door.

Dapul cited that the rise of big online players’ web sites and apps such as Lazada and Zalora provides the industry more opportunities for growth as these create a new online buying behavior due to their wide array of product lines and affordable value proposition. They also promote better value due to price markdowns and special offers and discounts, she said.

The country’s growing economy, which is reflected in the increased income, also helps fuel the demand for online transactions. “People continue spanning their disposable income but at the same time, people are getting used to the idea of shopping online,” said Balci. “More people try and keep buying online so the growth of e-commerce will continue.”

Who are shopping online?

In this age of e-commerce, a new set of customers has emerged. Majority of e-commerce customers are females in the 25 to 34 age range, followed by the younger, digital-savvy millennials, especially females, who belong to the 16 to 24 age segment. They are owners of smartphones who always want to be connected to the world via social media.

Citing a study PayMaya conducted, Ferrer said that millennials are scared of missing out on the benefits that e-commerce can bring to their life. “That’s why one of the unofficial rallying cries around PayMaya is #NoFomo, which means fear of missing out,” he said.

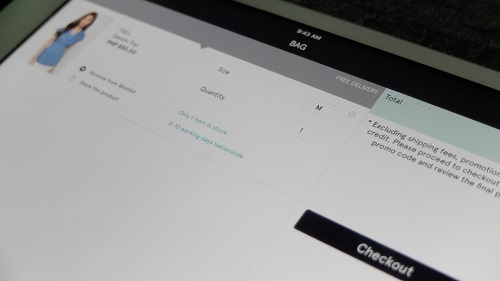

With females as most active consumers, the top products that are most in demand consist of electronics and computers, mobile devices, apparel and accessories, shoes, household products, beauty and wellness items, and baby products.

Social network platforms, such as Facebook and Instagram, are now gaining importance from e-commerce companies as they put their efforts in using them as marketing channels. These are used as a means to attract and influence online buying and selling. Besides, it is also a way by which e-commerce firms can be widely known to millions of social network followers.

“All these people are potential customers through social media,” said Balci. “We are maintaining our social network platforms and give a lot of importance to them as we target more people to engage in trade in social media. We are also using them as a better marketing strategy compared with the old method of marketing.”

What factors are stopping further growth?

Although the e-commerce industry is fast accelerating in the Philippines, it is, however, not spared from challenges such as logistics, payments and the cash mentality of Filipinos, and even market conditions that hinder the attainment of its growth.

Dapul said that the major stumbling block to the growth of the industry is the Filipino cash mentality which slows the adoption of mobile payment as alternative to cash.

“Majority of Filipinos still wants to hold on their money and this is why they are still transacting in cash. The Filipino concept of “Kaliwaan Transaction” is prevalent as the rule of thumb of Philippine trade practice. This is evident in the low penetration rate of credit cards and the increasing number of physical banks in every city nationwide,” said Dapul.

Balci also noted that the Philippine economy is still mainly cash-based with low credit card penetration. “Alternative payment methods are steadily growing from a small base, but the payment landscape is primarily based on COD transactions which is difficult for small-sized e-commerce companies to manage.”

With regards to payment, Padua said COD is both a boon and a bane to e-commerce and needs to be disrupted in order to reduce friction in the ecosystem.

Padua mentioned that many of the driving forces of e-commerce are still in their infancy but seeing exponential growth in innovation. He also stressed the need for a closer collaboration and dialogue between private and public stakeholders to address challenges.

Being complex and fragmented, the Philippine geography is also considered as a challenge to the e-commerce industry. There are low-density areas with low retail pressure that are hard to reach as these require expensive delivery infrastructure. Logistics and warehousing capabilities must be upgraded to have a reliable and affordable delivery.

“Logistical coverage, reliability and related costs are challenging even for largest players, making it difficult for new players to increase their market share,” said Balci.

Balci also mentioned customer awareness, lack of trust and market size as other bucket of main challenges. The industry should expand its coverage to include places outside Metro Manila or the under-penetrated market.

He claimed that in the local e-commerce industry, the market is underpenetrated so there is always a demand to buy stuff at a cheaper price. Besides, e-commerce firms have a lower cost pay which they can reflect to their customers to provide them goods at lower cost.

Payment landscape is evolving

Aside from transforming shopping practices, online retailing has also paved the way for the emergence of alternative payment methods or technologies which is very necessary to propel the growth of the industry. Although COD is still the most popular mode of payment in the country, the payment landscape has evolved considerably. In addition to credit and debit cards, new payment technologies such as e-wallet and mobile-based payment methods have also emerged.

Padua remarked that solutions for the unbanked, uncarded and unconnected like PayMaya will continue to evolve and a cashless economy will emerge. He also said that wallet digitization will continue as well as alternative payment methods with changes in form factor and usage habits from tapping a phone or a plastic card, to using mobile number, email address or bio identification to trigger a payment.

Even if COD or over-the-counter payments are still popular payment modes in the country and credit cards are still in use, payment options using mobile devices emerge and available to pay purchases transacted online.

“As mobile penetration in the country hits over 100%, customers will continue to use their mobile devices to pay for their purchases and this is where mobile money will be most useful,” said Dapul. “Globe has its flagship mobile money service GCash which is now accepted by a growing number of online merchants and sellers, offering users access to a convenient, secure, and hassle-free way of purchasing items from online stores and e-commerce sites using their mobile phones.”

Balci also insists that cash payment (via COD) will still capture a bigger share of the market in the country. However, he said that just as the mobile landscape is growing, so will alternative payment solutions like e-wallet that enable customers to pay directly from their phones.

Balci said Lazada accepts Hellopay, an e-wallet and online payment gateway which converts post-payment methods into pre-payment and serves as a best value proposition for merchants.

For e-commerce companies which transact business to a lot of customers, security and privacy are important issues that matter for them. Security needs to be addressed that’s why e-commerce firms put a lot of efforts to make sure the sites and information they have are secured.

Securing online transactions

Ferrer expressed that at PayMaya, they take several steps to make online transactions even safer.

He explained these steps as follows:

“We implement a two-factor authentication process – one for online and through mobile. For example, your PayMaya account is tied to your mobile number, which can be associated with either telco. That way, when you make a purchase online, say, you buy a Christmas gift on Takatack, you will immediately get a text message from PayMaya confirming the details of the transaction. This message happens even for recurring monthly charges, like if you were subscribe to iFlix, so you can rest assured that only you are able to transact online with your money.”

Ferrer said you get peace of mind because there is an SMS notification for every kind of transaction – whether a one-time purchase or a recurring charge – so you never have to worry about your card being misused. In the rare event you think the security of your card may be compromised, in the near future, you will be able to lock your account through the dashboard on the PayMaya app.

For Lazada’s part, Balci said that their online transactions are secured via enhanced protocols that protect customers’ data through encryption, merchant’s buyer protection and data privacy policies, and strict verification procedures of payment gateways.

Dapul stressed that while there are a number of merchants whose payment platforms are safe and secure, there are also those which may compromise a user’s personal information such as credit card details or other payment accounts.

She urges online buyers to be more vigilant when it comes to paying their online purchases and should only trust merchants whose payment standards adhere to the Payment Card Industry Data Security Standard (PCI DSS), a governing body that ensures payment gateways used to accept online transactions are secure. This gives the customer the peace of mind that their credit card information is secure.

On the merchant’s side, Dapul claimed fraud is also a big factor. “Shopify, an internationally-renowned e-commerce platform and a Globe myBusiness partner, in allowing SMEs to expand their presence in the digital space, has a built-in risk assessment functionality. It runs an assessment on every transaction and flags the merchant if a certain transaction is high-risk. This gives the merchant a chance to verify the transaction first before they proceed with the fulfillment.”

Store-owned online shop or online marketplace?

For many business owners who plan to sell online, the question would be whether to set up your own online store or join a marketplace like Lazada or YiLinker.

For Globe’s Dapul and Voyager’s Padua, owning an online retail shop has an advantage over joining an online market. It gives owners more control in the business from product development, customization, promotion and selling to creating customer base.

“Having your online store gives you the opportunity to keep the attention of customers because of the niche online offerings unlike the variety of product lines of big online sellers like Lazada and Zalora,” Dapul said. She includes other opportunities derived such as customization of products, targeted online merchandising, feedback mechanism for product development and service improvement, and the prospect of creating own followers and ecosystem to develop brand presence and recall.

Dapul added that running your shop allows you to promote your own product or brand without having to compete with other brands selling the same product in a marketplace.

For Padua, having your own online store means you control your brand and your online identity apart from getting insights on consumption behavior. “It allows retailers to own the customer and continually re-market to that consumer. Merchants can dive deeper into the consumer’s behavior and learn more about how they interact with their products,” he said.

Padua further adds that the affiliation with your product and brand becomes stronger and there will not be a situation where a competing brand is able to distract and take away sales from your brand. Besides, margins can be higher on that channel as there will not be a need to share with the marketplace.

But for Lazada’s Balci, having your own online shop gives you more control in building your business. It provides the owner a freehand in merchandising, marketing, and other operational procedures he deems fit.

However, Balci said, this freedom would also require significant investment, time, effort and responsibility to understand the category, the infrastructure required and how to maximize your profit in the online space, given the presence of other established online shopping sites.

One example of a company that has decided to join an online marketplace instead of building its own online store is PERRI Agridevelopment Corp. The company sells Citronella oil that has been extracted from Citronella grass grown in the company’s plantation in Misamis Occidental. It signed up as a seller on Lazada in April last year.

“We wanted to test the online marketplace first before building our own online shop,” says Jess Bernad, president of PERRI. “So far the experience has been great. The advantage of being an online merchant is that you can sell to buyers that are based anywhere in the Philippines. Our sales have definitely increased because of the exposure. We will eventually put up an online store but before that there are a lot of issues that we need to address, such as online security, payment options, and logistics.”

Bernad observed that logistics is one of the main problems of e-commerce today. “We had a repeat customer from Dasmarinas village in Makati who ordered candles but ended up getting the product more than a week later. This is despite us processing the order within one hour of receiving it. And our office is only in Mandaluyong. I think the customer wasn’t happy that her order came late and so refused to pay when the item arrived at her doorstep. It was returned to us unopened. That was lost revenue for us. So e-commerce marketplaces must fix their logistics and warehousing system otherwise they’ll lose merchants and buyers. In this age of connectivity, the competition is just a few clicks away.”

Collaborate for growth

To help the e-commerce industry hurdle challenges that are hampering its performance, there is a need for collaboration between the private stakeholders and the government to improve and promote the growth of the industry.

“The government can support e-commerce growth in the Philippines by taking the lead in promoting e-commerce awareness through industry-wide educational forums and empowering SMEs to venture into e-commerce,” said Balci.

As Internet speed and wider access to the public is critical to change market behavior, Balci said the government can invest in the country’s digital infrastructure. He also asked the government to create venues for e-commerce players and related side industries to collaborate and improve e-commerce services as these are sustainable steps in growing e-commerce in the country.

Being a key element of the e-commerce industry to protect customers from online fraud, theft, phishing, among others, Dapul said the government should provide online security regulations, as well as ensure access to consumer rights to guarantee that the online marketplace is secure and conducive to conducting business.

Dapul also said the government can act as liaison between public and private stakeholders to ensure that the application process for those who want to run their own online business is easy and hassle-free to ensure that more players will venture into e-commerce.

Padua relayed that the government must invest in long-term programs that will help MSMEs realize new digital opportunities, compete globally, and ride the wave happening in e-commerce. Government agencies that directly impact the e-commerce ecosystem should provide incentives with the goal of mass adoption of e-commerce among local enterprises.

Another aspect that can help, Padua said, is if the public sector can look into setting up funding, subsidies, grants and assistance that will create a launchpad for enterprises making the digital shift. Foreign investors and venture capitalists must be encouraged to invest in the country and fuel the startup ecosystem.

Government efforts to promote e-commerce

With e-commerce playing an important role in enhancing economic growth, the Department of Trade and Industry (DTI), together with major e-commerce players and digital industry leaders came together in a forum entitled “Gearing Up for Pinoy E-Commerce” in November last year to promote online shopping in the country.

“We need all hands together to increase the e-commerce penetration in the Philippines and this includes the government, private sectors and consumers,” said Balci.

In her presentation, Maria Lourdes Yaptinchay, Director of Sector Planning Bureau at DTI, announced that the government is preparing a five-year (2015-2020) roadmap for the local e-commerce industry with a vision of making the industry an economic growth contributor and Philippines’ competitive advantage.

The roadmap has the following business objectives and success criteria: (a) 100,000 MSMEs do e-commerce; (b) 30% of Filipinos do e-commerce; (c) implementation of e-payment by the government; (d) effective merchant and consumer protection; (e) to have a fast and cost-competitive Internet access; (f) cyber crime enforcement and prosecution; and (g) e-commerce to be 25% of the country’s Gross Domestic Product (GDP).

Set to see greater heights

Online shopping is set to see greater heights in the future, aided by increasing online customer base as a result of declining smartphone prices and encouraging growth of mobile Internet penetration and usage, the emergence of new payment methods as well as support from the government. The growing economy also contributed to the growth of e-commerce. These components complement each other to support the growth of e-commerce in the country.

“The local e-commerce industry is growing very fast,” claimed Balci. “In three years, we expect e-commerce penetration to increase to three percent to four percent of non-food, non-travel retail market which is $100-billion.”

As e-commerce became very successful last year, Balci expects the same direction to happen this year.

“2015 has been very successful for e-commerce. The market has grown several times and for this year, we are waiting for same thing to happen – to have a record market growth.”