By Paul Skipski, Chief Financial Officer, IBM Philippines

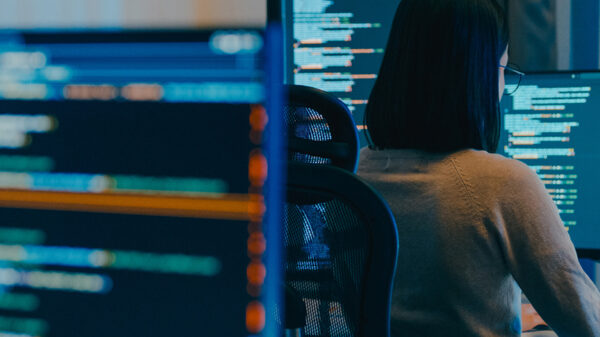

We are in a new era of finance and technology. Financial decision makers are now able to get answers to complex business questions that they didn’t even think possible, thanks to analytics.

Analytics enable CFOs to look beyond traditional structured data sitting in general ledgers and spreadsheets to indentify patterns and uncover deeper business insights from new unstructured data sources such as images, video, and social media.

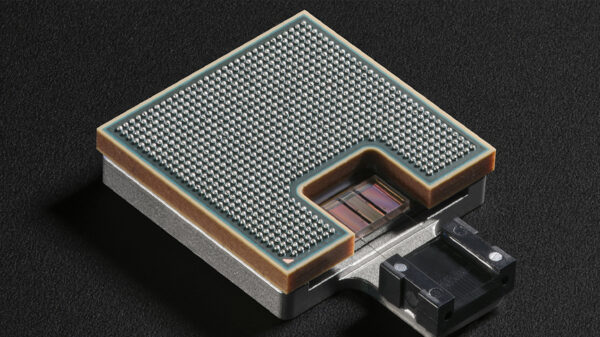

Over the next 5 years, the role of the CFO will transform under the influence of Big Data. Analysts at Gartner predict that the amount of data stored by enterprises will grow 650% by 2018. Instead of simply collecting, validating and reporting data, CFOs will be expected to apply the strategic use of Big Data to accelerate enterprise transformation. Advanced technologies, like predictive analytics, will help CFOs transcend from traditional bookkeeping to drawing on Big Data insights for smarter decision-making.

These technologies allow finance leaders to scrutinize dozens of dimensions of financial data with an unprecedented level of granularity. For example, financial decision makers at IBM can now precisely isolate and identify the components of risk enabling us to understand what’s occurring, and may likely occur, in different parts of our organization, the ecosystem and the wider marketplace.

CFOs and senior financial decision makers can now ask and get answers to an array of new business questions. Gathering the data is no longer the challenge. The more compelling opportunity now is to focus on the best ways to use the data to solve customer and business problems in a way that was never before possible.

Some CFOs already are breaking ground in this area – by applying Big Data to uncover hidden pockets of profitability.

A CFO of a leading energy company in oil and gas production worked with IBM to build a new analytics solution to uncover insights about minimizing the impact of their operations. By integrating environmental monitoring processes into their day-to-day operations, they made it easier for the company to respond to changing conditions – to precipitate a stop in drilling, shutting down production, or ceasing construction activity – while saving resources and boosting the bottom line.

A CFO at a leading retailer turned to IBM to implement a Big Data solution to understand consumer purchasing habits. By analyzing in-store shopping patterns, the company was able to rearrange aisle formatting and product inventory, to boost sales and capture more consumer spending.

Taking the wait-and-see approach to analytics will keep organizations trapped in the lagging position. As highlighted in the 2011 IBM/MIT Sloan Management Review – New Intelligent Enterprise study, the number of organizations using analytics to create a competitive advantage surged 57 percent in just one year, to the point where nearly 6 out of 10 organizations are now differentiating themselves through analytics. This gap has major implications for CFOs seeking to make the best possible and most strategic decisions in an uncertain global financial environment.

At some point in time, new insights from the use of analytics will become a commodity. Every competitive organization will effectively harness Big Data or they will fall behind. The question will move beyond what do CFOs and the C-Suite know about the information they have, but what they do with it, and how fast do they act upon it.