By Paul Skipski, Chief Financial Officer, IBM Philippines

In the business world, CFO means “Chief Financial Officer.” But increasingly, I think it has evolved into an even bigger meaning. At some top performing finance organizations, the “F” from CFO is taking on the meaning of “Future.”

In most organizations, the CFO is the person who is in the best position to harness the expanding flood of data that can be used to inform and drive corporate strategy. We can’t just be scorekeepers. We need to help the company score – meaning discovering new revenue growth opportunities.

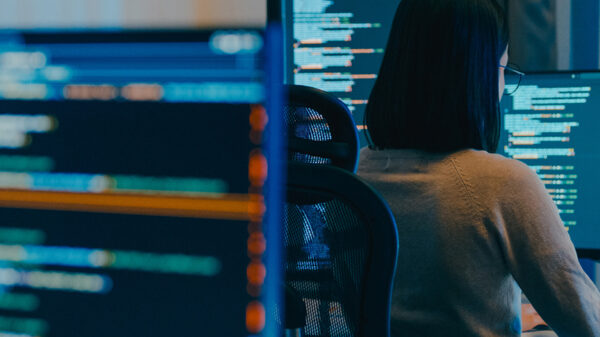

We need to understand how unstructured data, from call center records to warranty reports can predict the future. We need to see how publicly available data such as credit card records and telephone-traffic logs can uncover new opportunities. Instead of shining a spotlight on the past to show how we arrived, we need to shine headlights on the future that tell us where to go.

CFOs have to collect and report the company’s sales and profits, of course. But that’s no longer our main job. We need to establish systems to acquire and use data on a wide range of items to guide the company’s strategic plan. The goal is to make sure the company is making decisions based on real data rather than the gut instinct of the HIPPO — “highest-paid-position” — in the room.

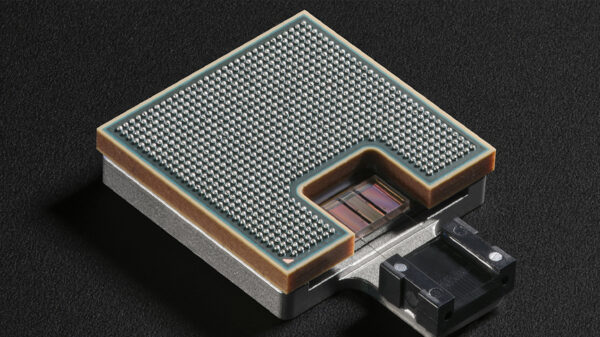

At IBM, we try to use real data to make the right decisions. One of the most important things the company does to grow its business is make acquisitions. We make lots of them, most of which are pretty small relative to our revenue and market cap. In aggregate they have been a key part of our growth strategy and maintaining our technological leadership.

A few years ago, we asked our research department to look at up to 500 variables related to making acquisitions. They were able to pick out three-to-five variables for each acquired company that needs to go right for the acquisition to be successful. Today, knowing those variables is helping shape the way we pick our acquisition targets and the way we integrate their operations. About 90% of our acquisitions are successful whereas broad studies of merger and acquisition activity show that less than half of all acquisitions increase corporate value.

CFO’s at other companies are using data to help plot their companies’ futures. When Kimberly-Clark Corporation, a US-based personal care company, wanted to expand in the China market for disposable diapers, it was the CFO who brought together procurement, manufacturing and product development people to come up with a plan to sell premium-priced diapers.

One of the most important jobs for the CFO is to make sure that there is one version of the truth that is used across the company. That’s harder than it sounds. Over the years, many companies have developed silos of information built around particular marketing efforts or product lines. Acquisitions that have their own computer systems present an added challenge. Standardizing accounting world wide is something every CFO has worked hard on. Standardizing the treatment of unstructured data is a new challenge, and it’s one that the CFOs needs to embrace.

Having common, integrated data isn’t just nice. It’s the key to making the company agile. If every new initiative requires converting and reconciling existing data for new purposes, it slows the company down dramatically – thereby missing potential new opportunities in the marketplace.

CFO’s need to work with the CIOs to make that happen. According to a recent survey IBM study, 39% of CIOs — the people in charge of information technology at a company — report to the CFO. Computer infrastructure has long been required for running supply chains and monitoring finances. The CFO has to make sure that the infrastructure is in place to assess future risks and look for future rewards.

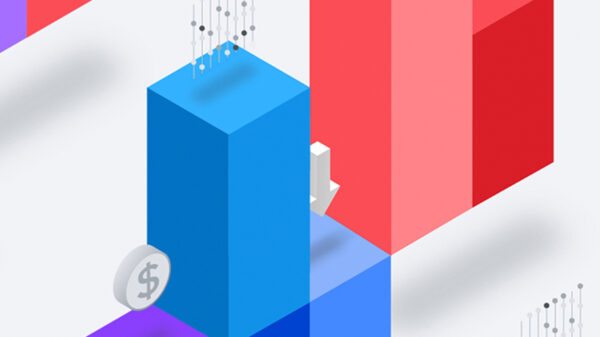

A data analytics infrastructure isn’t just a ‘nice-to-have.’ It has to be a priority. IBM’s recent studies show that companies that apply advanced analytics have 33% more revenue growth and 12 times more profit growth than companies that don’t.

The CFO can’t just sit back and report what happened to the company. We need to lean forward and use hard data to help predict the future for the company.