Businesses must prepare for a new generation of cyber risks which are fast evolving, moving beyond the established threats of data breaches, privacy issues and reputational damage to operational damage, business interruption and even potentially catastrophic losses, according to a new report by specialist insurer Allianz Global Corporate & Specialty (AGCS).

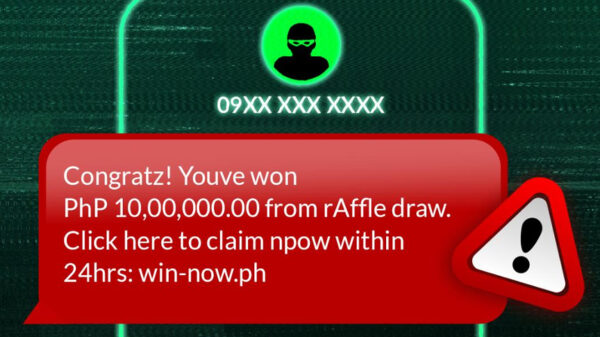

Cyber risk is a major and fast-increasing threat to businesses with cyber-crime alone costing the global economy approximately $445 billion a year, with the world’s largest 10 economies accounting for half this total.

“As recently as 15 years ago, cyber-attacks were fairly rudimentary and typically the work of hacktivists, but with increasing interconnectivity, globalization and the commercialization of cyber-crime there has been an explosion in both frequency and severity of cyber-attacks,” says AGCS CEO Chris Fischer Hirs.

“Cyber insurance is no replacement for robust IT security but it creates a second line of defense to mitigate cyber incidents. AGCS is seeing increasing demand for these services, and we are committed to working with our clients to better understand and respond to growing cyber risk exposures.”

Tougher regulatory regimes and new cyber perils

Increasing awareness of cyber exposures as well as regulatory change will propel the future rapid growth of cyber insurance. With fewer than 10% of companies currently purchasing cyber-specific policies, AGCS forecasts that cyber insurance premiums will grow globally from $2 billion per annum today to over $20 billion over the next decade, a compound annual growth rate of over 20%.

Previously, attention has largely been focused on the threat of corporate data breaches and privacy concerns, but the new generation of cyber risk is more complex: future threats will come from intellectual property theft, cyber extortion and the impact of business interruption (BI) following a cyber-attack or from operational or technical failure; a risk which is often underestimated.

“Awareness of BI risks and insurance related to cyber and technology is increasing. Within the next five to 10 years BI will be seen as a key risk and a major element of the cyber insurance landscape,” says Georgi Pachov, cyber expert in AGCS’s global property underwriting team. In the context of cyber and IT risks, BI cover can be very broad including business IT computer systems, but also extending to industrial control systems (ICS) used by energy companies or robots used in manufacturing.

Connectivity creates risk

Increasing interconnectivity of everyday devices and growing reliance on technology and real-time data at personal and corporate levels, known as the ‘Internet of Things’, creates further vulnerabilities.

Some estimates suggest that a trillion devices could be connected by 2020, while it is also forecast that as many as 50 billion machines could be exchanging data daily. ICS are another area of concern as a number of these still in use today were designed before cyber security became a priority issue. An attack against an ICS could result in physical damage such as fire or explosion, as well as BI.

Catastrophic event

While there have been some very large data breaches, the prospect of a catastrophic loss is becoming more likely, but exactly what it will look like is difficult to predict. Scenarios include a successful attack on the core infrastructure of the internet, a major data breach or a network outage for a cloud service provider, while a major cyber-attack involving an energy or utility company could result in significant outage of services, physical damage or even loss of life in future.

Stand-alone cover

Allianz also predicts that the scope of cyber insurance must evolve to provide broader and deeper coverage, addressing business interruption and closing gaps between traditional coverage and cyber policies.

While cyber exclusions in property and casualty policies are likely to become commonplace, standalone cyber insurance will continue to evolve as the main source of comprehensive cover. There is growing interest among the telecommunications, retail, energy, utilities and transport sectors, as well as from financial institutions.

Education – both in terms of businesses’ understanding of exposures and underwriting knowledge – must improve if insurers are to meet growing demand. In addition, as with any other emerging risk, insurers also face challenges around pricing, untested policy wordings, modeling and risk accumulation.

Responding to cyber risk

The AGCS report highlights steps companies can take to address cyber risk. Insurance can only be part of the solution, with a comprehensive risk management approach being the foundation for cyber defense.

“Once you have purchased cyber insurance, it does not mean that you can ignore IT security. The technological, operational and insurance aspects of risk management go hand in hand,” explains Jens Krickhahn, expert for cyber & fidelity at AGCS Central & Eastern Europe.

Cyber risk management is too complex to be the preserve of a single individual or department, so AGCS recommends a ‘think-tank’ approach to tackling risk whereby different stakeholders from across the business collaborate to share knowledge.

In this way, different perspectives can be challenged and alternative scenarios considered: for example, these might include the risks posed by corporate developments such as mergers and acquisitions or by the use of cloud-based or outsourced services. In addition, cross-company involvement is essential to identify key assets at risk and, most importantly, to develop and test robust crisis response plans.