Maya, the No. 1 Digital Bank and Omni-Channel Payment Processor in the Philippines, is making business easier for micro, small, and medium-sized enterprises (MSMEs) like sari-sari store owners by allowing them to buy inventory while accessing financing through a single app.

Maya has integrated the Sari Mall service into Maya Business app, which now allows small businesses such as Maya Center owners to order products—from daily necessities to business equipment—directly via the platform.

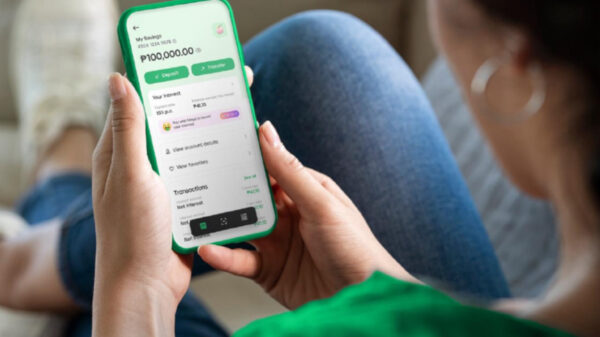

To help with capital needs, Maya also offers financing of up to ₱350,000 through Maya Advance, all within the app. This product is initially available to eligible MSME merchants who operate Maya Center businesses nationwide.

Entrepreneurs like Ana Mae Bandoquillo, a sari-sari store owner in Legazpi City, are already benefiting. “With Sari Mall, I can sell items without needing upfront capital—it’s been a huge help,” she said.

Maya Advance has also enabled her to boost inventory and cover expenses. “It added to my capital. It really helped. Before, I only had a small capital, but now I have more cash on hand, and I still have reserves left,” she said.

Addressing a Market Gap

Micro-entrepreneurs in the Philippines face hurdles ranging from inventory management to accessing credit. According to Bangko Sentral ng Pilipinas, only 4% of total bank loans go to MSMEs, despite them making up 99% of all businesses. Maya’s Sari-Mall and lending options aim to fill this gap.

“Sari-sari store owners often struggle with limited product range and financial capabilities,” said Maite Tarrayo, Executive Director of Sari Mall. “With Sari Mall, they can now conveniently offer a wide selection of products without needing upfront capital, streamlining their business operations and enhancing profitability.”

Renan Santiago, Head of Retail and MSME at Maya, added, “By providing quick access to inventory and capital, we’re giving small businesses the flexibility to adapt and grow—something many have lacked.”

Building a Digital Business Hub

Adding an inventory service to the app’s suite of offerings is part of Maya’s strategy to create a one-stop digital ecosystem for micro, small, and medium-sized enterprises (MSMEs), a sector often neglected by traditional banks.

Beyond inventory and financing, the app offers tools to diversify income—business owners can sell digital goods, process bill payments, and provide remittance services. The app’s payment processing feature allows entrepreneurs to accept payments via Maya QR, e-wallets, and InstaPay transfers, tapping into the growing trend for cashless payments.

By integrating inventory purchasing and financing, Maya is changing how micro-entrepreneurs operate, paving the way for digital banking to support small business growth in the Philippines.