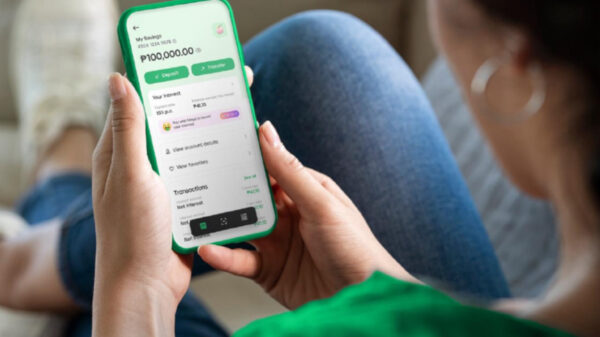

Been dreaming of opening your own coffee shop or launching an online store but stuck without the funds? Fret not! With the Personal Loan product of Maya, a digital bank in the Philippines, turning your side venture into reality is effortless with just a few taps.

Boost Your Funds for your Side Hustle

Currently in early access and available to select users, Maya Personal Loan offers up to ₱250,000 with flexible repayment terms of up to 24 months and an incredibly low add-on rate of just 0.77% per month. Whether you’re planning to launch a new business, invest in essential equipment, or enhance your skills through a course, this loan gives you the capital you need to thrive.

Borrow Without the Hassle

Applying for your Maya Personal Loan is simple and stress-free! All you need is your upgraded Maya account to get started—no additional paperwork, collateral, or guarantor required. Once approved, the funds are transferred directly to your Maya Wallet, giving you instant access to the money you need.

Say goodbye to long approval processes and hello to a streamlined, hassle-free experience. Here’s how to get started:

- Open your Maya app, go to the Loans tab, and start the application process by tapping ‘Apply now.’

- Enter your desired loan amount, complete the application process, and wait for feedback on your eligibility.

- Choose your loan offer and tap ‘Accept’ if you’re happy with the terms.

- Enter a One-Time Pin (OTP) to authorize the loan disbursement.

Manage Your Loan with Ease

Managing your loan is a breeze with the Maya app. You can settle your dues directly from your Maya Wallet, which helps you maintain a good credit score. Plus, Maya’s top-notch security ensures your funds are safe, so you can focus on growing your side hustle with peace of mind.

Ready to make your next big life move? Apply for a Maya Personal Loan today and give your side hustle the boost it needs to succeed. Keep using Maya for your transactions to stay on track and become eligible for more loan opportunities. For more information, visit maya.ph and mayabank.ph, and stay connected by following @mayaiseverything on Facebook, Instagram, YouTube, and TikTok.