In a country frequently battered by typhoons, floods, and earthquakes, having a robust calamity fund is not just advisable—it’s essential. As the Philippines continues to face natural disasters, Mocasa, the Philippines’ pioneering virtual credit wallet, is dedicated to helping Filipinos prepare for the unexpected with practical advice on establishing and managing a calamity fund.

Natural disasters can strike with little warning, leaving devastating impacts on homes, livelihoods, and communities. A calamity fund is designed to provide financial relief in these challenging times, ensuring that you have the resources needed to recover quickly and effectively.

Here are some pointers when building your calamity fund:

Assess Your Risks and Needs

Start by evaluating the potential risks and expenses associated with common disasters in your area. In the Philippines, this may include damage from typhoons, flooding, or earthquakes. Understanding the specific needs and costs you might face will help you determine how much to set aside in your calamity fund.

Set Clear Savings Goals

Determine how much money you need for your calamity fund. A good rule of thumb is to save at least three to six months’ worth of living expenses. This amount will provide a financial cushion during emergencies and help cover essential expenses like repairs, medical costs, and temporary living arrangements.

Automate Your Savings

Consistency is key to building a reliable calamity fund. Set up automatic transfers from your paycheck to a separate savings account designated for emergencies. By automating your savings, you ensure that you are consistently contributing to your fund without the temptation to spend.

Leverage Financial Tools

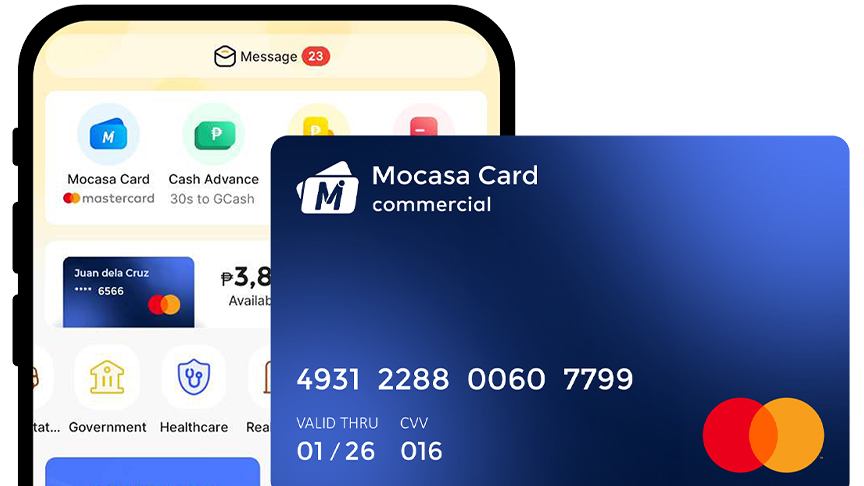

Mocasa offers practical financial solutions to support your calamity fund. With the introduction of Mocasa Quick Loan, you can borrow up to PHP 25,000, payable in three monthly installments, providing an additional layer of financial support in case of emergencies. This feature allows you to quickly access funds if your calamity fund falls short or if you need immediate assistance.

In addition, and as response to the recent stormy weather, Mocasa has decided to waive the penalty fee on overdue loans until August 4. This initiative aims to provide relief to clients who may be facing financial difficulties due to the adverse weather conditions. By alleviating this burden, Mocasa hopes to support Filipinos in times of need.

Review and Adjust Regularly

Regularly review your calamity fund to ensure it remains adequate for your needs. As your financial situation or the risk environment changes, adjust your savings goals and strategies accordingly. Stay informed about local weather patterns and disaster preparedness resources to remain proactive.

Mocasa is committed to empowering Filipinos with the tools and knowledge needed to navigate financial challenges, especially during natural disasters. By integrating practical saving strategies with innovative financial solutions, Mocasa aims to help individuals and families build resilience and financial security.

Download the Mocasa app in Google Play and App Store and be prepared for any unexpected expenses.