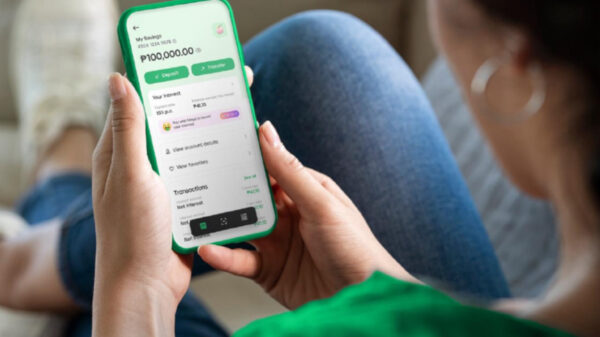

Visa cardholders are now able to cash-in their Maya wallets for free, as announced by Visa, a world leader in digital payments. As part of the “Cash-In for Free” program, which became effective from 1 May, this offer is available to all Maya users who have a mobile number from any local telco provider and are currently residing in the Philippines. The initiative aims to expand consumer choice by allowing Visa cardholders to use their cards to fund their Maya wallets fee-free, to be used in Maya-accepting wallets.

To qualify, eligible users must cash into their Maya Wallet using their Philippine-issued Visa credit, debit or prepaid cards via the Maya app. Free Visa transfers are available for transactions up to P5,000. The typical P200 surcharge for cashing into Maya using cards will be rebated back to users. For larger transactions above P5,000, a discounted fee of 50% off or P100 per transaction will be imposed.

The ”Cash-In for Free” program will benefit consumers and small businesses in the Philippines in driving acceptance of mobile wallets. Visa’s recent Consumer Payment Attitudes study found that Filipino consumers are increasingly embracing cashless transactions, with 87% of surveyed respondents using their mobile wallets in the last 12 months. There is growing acceptance of cashless payment methods in the Philippines, with more consumers observing that supermarkets (88%), food and dining (86%), and bill payment operators (82%) have opened acceptance of cashless payment methods.

Jeff Navarro, Country Manager for Visa Philippines, said: “We are delighted to collaborate with Maya to provide free cashing-in services to all Visa cardholders, in response to the increasing number of Filipinos shifting towards cashless payments. This initiative supports small businesses by enhancing their payment acceptance experience, given today’s growing reach of digital payment methods such as cards and mobile wallets. At Visa, we aim to promote growth and access to a broad spectrum of digital payment modes to drive digital and financial inclusion. This ensures Visa continues to be the preferred choice for Filipinos, by offering an enjoyable, seamless, and secure payment experience.”

“We are thrilled to partner with Visa on this initiative,” said Shailesh Baidwan, Group President at Maya and Co-Founder at Maya Bank. “Maya’s mission focuses on providing innovative and accessible digital financial services to both consumers and businesses in the Philippines. The Cash-In for Free initiative is part of Maya’s broader strategy to make digital financial services more accessible and convenient for everyone, promoting cashless transactions and financial inclusion in the Philippines.”