Manulife Philippines, the local arm of global financial services provider Manulife, recently launched its Manulife Online Mobile App, expanding its digitalization efforts to ensure more convenient and hassle-free options for customers to access and manage their insurance policies.

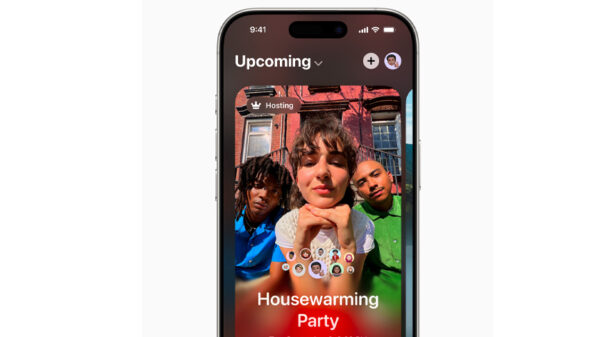

Manulife’s web-based customer portal Manulife Online has been consistently ranked by Filipino insurance customers as the No. 1 online insurance self-service platform. Now available on the App Store and Google Play, the app enables customers to access Manulife Online on their mobile devices to perform self-service policy transactions, such as policy viewing and contact details update, checking of fund values of their investment-linked products, accessing premium payment information and history, and secure premium payment online. The app’s one-time PIN (OTP) feature is enabled to help ensure customer data privacy and security.

“The new Manulife Online Mobile App is launched at the nexus of two behavioral shifts happening in the Philippines — Filipinos’ rising awareness of the value of life insurance and their appreciation for digital platforms for financial management and transactions,” said Rahul Hora, President and CEO, Manulife Philippines. “Our mobile app is a testament to our dedication and focus on our ambition to become the most digital, customer-centric global company in our industry. We are doing this by continuously enhancing our products and services to adapt to our customers’ evolving behaviors and preferences, and enabling more Filipinos to manage their protection needs as they financially prepare for the future.”

Manulife’s recent Asia Care Survey has found that up to 80% of the respondents in the Philippines are interested in purchasing insurance products as they take charge of their health and finances amid economic uncertainties. Further, findings in Manulife’s The Modern Filipino Family: Exploring family dynamics and digitalization in the new normal study highlighted Filipinos’ increased preference for online platforms when conducting various financial transactions, with up to 82% of respondents saying they have been using digital applications due to convenience (45%), sense of security (22%), and protection (17%).