CIMB Bank Philippines and Visa, a global leader in payments technology, have signed a strategic partnership to work together towards their common goal of making financial solutions easier to access and more innovative for all Filipinos.

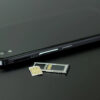

This collaboration is a convergence of CIMB Bank PH’s digital-first offerings and Visa’s global network of merchants and world-class technology. The mutually beneficial alliance reinforces CIMB Bank Philippines’ debit products growth through its virtual and physical cards while giving Visa exposure to a new set of customers via CIMB’s following, as well as those of its other partners. Visa will also be providing CIMB customers with exclusive discounts and other privileges when the Bank’s customers use their Virtual Debit Card with select Visa merchants.

“At CIMB Bank PH, we have always been committed to pioneering digital banking solutions and driving financial inclusion. Working together with Visa enables us to take this commitment to the next level by offering our customers enhanced payment solutions that are secure and convenient, to help allay the Filipinos’ hesitancy over digital banking, while also contributing to the Bangko Sentral ng Pilipinas’ Digital Payments Transformation Roadmap, which targets to make 50% of total retail transaction volumes digital,” said Vijay Manoharan, CEO of CIMB Bank Philippines. CIMB Bank currently has close to 500,000 virtual and physical card customers.

Jeff Navarro, Visa Country Manager for the Philippines and Guam, likewise expressed enthusiasm for the partnership, stating, “This milestone marks an important step towards our shared vision of providing accessible and innovative financial solutions to consumers, thereby boosting financial inclusion for Filipinos everywhere. By leveraging Visa’s global network and expertise and CIMB Bank PH’s digital leadership, we are set to create an unparalleled customer experience that caters to the evolving needs of the modern customer.”

CIMB Bank PH brings its extensive customer base of over 7 million users and its leadership in embedded banking to the partnership. Its commitment to empowering partner products on its platform also aligns perfectly with Visa’s vision of uplifting everyone, everywhere, by being the best way to pay and be paid.

CIMB Bank PH and Visa are poised to boost the payment landscape in the Philippines and contribute to the financial inclusion goals of the country. Customers can expect an even more seamless and secure payment experience with their CIMB Visa Debit Card while also leveraging on the many other features of the CIMB Bank PH app.