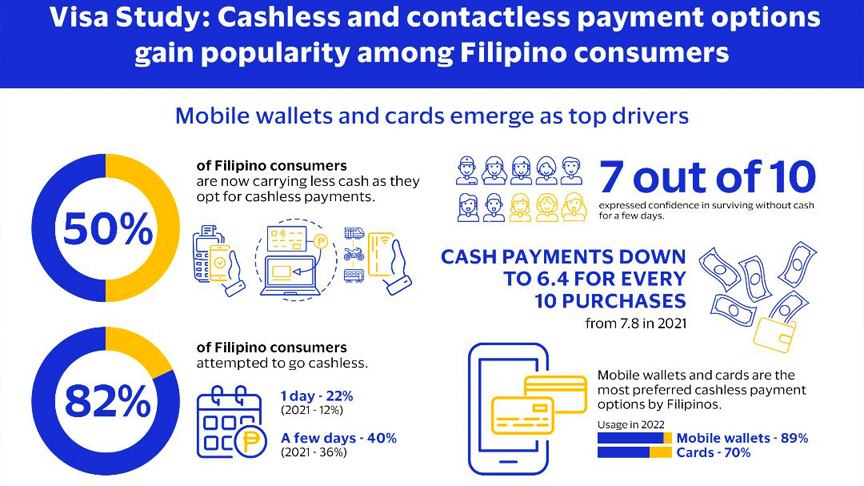

Cashless payment usage in the Philippines continues to increase as consumers adopt cashless and contactless payment methods in transactions where cash payment remains dominant. This has resulted in a significant decline in willingness to use cash among Filipino consumers. The Visa’s latest Consumer Payment Attitudes Study in the Philippines showed 50% of Filipino consumers are carrying less cash as they increasingly rely on cashless payments, which are more convenient, safe, and easy to use.

While cash remains a prevalent payment method, the study indicates that 82% of Filipinos have attempted to go cashless in 2022, with almost half (40%) succeeding for a few days. Notably, about 9% were able to go cashless for over a month.

The study also disclosed a decline in frequency of cash payments, dropping from 7.8 for every 10 purchases in 2021 to 6.4 in 2022. The decrease in the reliance on cash payments can be attributed to two factors: 62% of consumers increasingly relying on cashless payments and 61% expressing concerns regarding the safety of carrying cash.

The annual Visa Consumer Payment Attitudes Study provides insights into consumer payment behaviors in key markets, including the Philippines. The latest survey, conducted from September to October 2022, interviewed 1,000 Filipino consumers aged 18 to 65 years old.

“The increasing adoption of cashless and contactless payment methods is a testament to the growing preference among Filipinos for safe and convenient transactions. As consumers realize the benefits of cashless options such as mobile wallets and card, we are witnessing a progressive shift towards a cash-lite society in the Philippines. The Visa Consumer Payment Attitudes Study provides encouraging data that highlights the readiness of Filipinos to embrace secure and seamless digital payment solutions,” says Jeff Navarro, Visa country manager for the Philippines and Guam.

Driving the shift to cashless payments are payments innovations that offer more ways to pay. The most commonly used among digital payment methods include mobile wallets at 89% in 2022, while card payments are at 70%.

Among mobile wallet users, online and in-app payments are the most frequent, constituting 68% of total usage while QR code payments follow closely at 53%. For card payments, online transactions hold the most usage at 50%, followed closely by in-store payments through card swiping or insertion at 43%. Additionally, contactless payments via card tapping have gained popularity, accounting for 37% of usage.

Driven by technological advancements and the accelerated use from the COVID-19 pandemic, Filipinos are becoming more open to alternative payment methods, including contactless cards and QR codes.

Contactless card payments have seen a significant surge in popularity, increasing from 27% in 2021 to 37% in 2022. Almost two in five Filipinos now utilize contactless cards, and respondents estimate that if presented with the option to pay with contactless cards, they would do so around seven times out of 10 transactions, and feel that they would use even more in the future.

QR code usage has also seen remarkable growth, rising from 36% in 2021 to 53% the following year, led by the Affluent (65%) and Gen Z (59%) segments. Interest in QR codes among Filipinos has skyrocketed from 67% in 2021 to 93% in 2022.

The modernization of transportation has also influenced payment habits, as more Filipinos opt for contactless transit cards to pay for their commute. The adoption of such cards has increased to 73% due to perceived benefits such as faster transactions and reduced reliance on cash.

“The data from our Consumer Payment Attitudes Study is encouraging, as it brings us closer to a cashless Philippines. We anticipate that cashless and contactless payment methods will continue to gain prevalence in terms of awareness, interest, and usage. Visa is committed to continue educating and ensuring with all stakeholders that Filipinos have secure, seamless, and convenient digital payment solutions readily on hand,” said Navarro.