Just three months after its public launch, Maya Bank is off to a record-breaking start as it posted over 650,000 customers and P5 billion (USD89 million) in deposit balance as of end-July 2022 – making it the fastest-growing digital bank in the Philippines.

The pioneering digital bank provides wider financial access to unbanked and underserved consumers and MSMEs via the all-in-one money app Maya. Through the app, Maya Bank also introduced an instant credit of up to P15,000 for eligible customers and working capital loans for micro, small, and medium enterprises (MSMEs), starting with Maya Center agents. This makes Maya the only digital bank to offer credit to both consumers and MSMEs within the quarter of its public launch.

“Our strong growth validates the market preference for an all-in-one money experience. Through disruptive offerings, bold marketing, and our extensive ecosystem, we are bringing progressive financial services closer to consumers, enterprises, and communities,” said Orlando B. Vea, PayMaya Group CEO and Founder and Maya Bank Co-Founder.

“Filipinos deserve reliable and seamless digital banking experiences, and we are delivering this with urgency and speed with Maya. We are very excited to introduce more game-changing digital banking innovations through our all-in-one money platform,” said Shailesh Baidwan, PayMaya Group President and Maya Bank Co-Founder.

Maya’s integrated ecosystem approach uniquely positions it among e-wallets, banks, and fintech players in the Philippines. It is the only fintech brand serving all segments of consumers and enterprises with a widely used consumer e-wallet app, the leading enterprise payment processing business, and the most extensive on-ground agent network, Maya Centers (formerly Smart Padala). Meanwhile, Maya’s crypto feature is backed by a Virtual Asset Services Provider (VASP) license from the Bangko Sentral ng Pilipinas (BSP).

Executing and growing at the speed of digital

Maya Bank is also the fastest digital bank in the Philippines to go to market, receiving its Certificate of Authority (COA) to operate just six months after securing the BSP Monetary Board’s approval to establish a digital bank in September 2021. It launched its services to the public on April 29, 2022.

“We are executing and growing at the speed of digital, and we are grateful for the overwhelmingly positive response from the market. This feat reflects our strong commitment towards our country’s financial inclusion goals,” said Angelo Madrid, Maya Bank President.

Last year, the BSP granted licenses to six digital banks before a three-year moratorium for new digital bank applications took effect in August 2021. To date, only three digital banks have publicly launched, and this includes Maya Bank.

All-in-one experience is key to solid growth

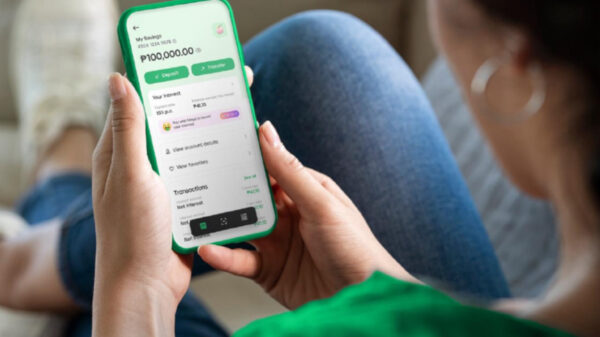

Maya has primarily attracted young consumers to open a deposit account via the app with its fresh marketing and exciting offers combined with a high-yield interest rate, lower barrier to entry, and seamless experience.

Consumers can save instantly without maintaining a minimum balance by registering a Maya wallet account and providing one valid government ID. They also enjoy a simple-to-use interface and 99.94% app uptime rate, providing a convenient and reliable experience that makes Maya the top-rated local finance app in the market.

Maya’s all-in-one money app innovation enables customers to manage their transaction needs more conveniently. Customers can move their money from their savings account to their e-wallet whenever they need to pay for goods. They can also quickly transfer funds from their e-wallet to their savings to build up their funds. On top of the savings account, customers can create up to five personal goals with set target amounts and timelines, helping them to manage their finances better.

To encourage more Filipinos to enjoy the best digital banking experience, Maya has extended some of its high-value promos, including the following: a 6% interest rate on Maya Savings up to Php5 million, free PESOnet transfers, and a free Maya Card, subject to eligibility, until September 30, 2022. Moreover, it offers a 6% interest rate on Personal Goals (up to Php1 million per goal) until December 31, 2022.

The BSP expects digital banks such as Maya to help fast-track the country’s goals of transforming 50% of the total volume of retail payments to digital and expanding the financially included to 70% of Filipino adults by 2023.

Maya Bank, Inc. powers the digital banking experience of consumers and enterprises across the Maya family of products, including the Maya all-in-one app, Maya Business, and Maya Center. It is licensed to operate as a digital bank supervised by the BSP. Deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) for up to PHP500,000 per depositor. For more information, visit www.mayabank.ph.