Strengthening its position as Filipinos’ partner in growth, the Bank of the Philippine Islands (BPI) introduced new loan products and programs designed to help small and medium enterprises (SMEs) navigate current business challenges and embrace emerging market opportunities.

“While Filipino SMEs are seen as important drivers of our country’s economic growth, they tend to be more vulnerable to market headwinds and volatility, as well as industry disruption and competition. They need support from various sectors in the ecosystem to survive and thrive,” Dominique “Ococ” Ocliasa, Head of BPI Business Banking, said.

“With our latest BPI Business Banking offerings, we are giving them a helping hand by providing convenient and simple financing solutions, as well as relevant advice and assistance throughout their journey to help execute their ideas, overcome their problems, and strive for bigger achievements,” he added.

SMEs may leverage on these Ka-Negosyo Loans to help execute their business plans:

- The Ka-Negosyo Credit Line (KCL) is ideal for recurring business expenses such as raw materials and finished goods inventory, employee wages, utilities, equipment repair and maintenance, and sales or distribution costs. It is like an extended wallet that allows the business to take advantage of any opportunity at any given time. SMEs can rest easy even when faced with unexpected expenses. KCL can be easily accessed through a stand-by checkbook which can be used to immediately pay any on-the-spot need or emergency of the business.

- The Ka-Negosyo Ready Loan (KRL) is available for SMEs with seasonal working capital requirements, such as stocking up on supplies and inventory for Christmas and holidays, harvest seasons, or peak business seasons. It gives the business owner flexibility to focus on growing the business and seizing sales opportunities, instead of constantly managing cash flow especially during off or slow seasons. With a shorter repayment period, it is ideal for SMEs with cyclical funding needs that will be repaid from a quicker conversion or business cycle.

- The Ka-Negosyo SME Loan (KSL) can help support SMEs who are aspiring to branch out, expand product lines, purchase new equipment, or meet other capital expenditures. This makes the expense affordable and light on the pocket, as paying the loan is monthly and can be over a long period of time. KSL also has an option for capital expenditures that need longer payment terms, such as major capital asset construction and acquisition. The Property Acquisition Loan (PAL) makes it more convenient and comfortable for the business owner to invest in such an expense. PAL spreads the payment term over a long period of time, and as the property asset earns more profits for the business.

SMEs interested in availing of KCL or PAL will enjoy waived processing fees at the upcoming BPI Ka-Negosyo Festival from September 15 to October 15, 2022.

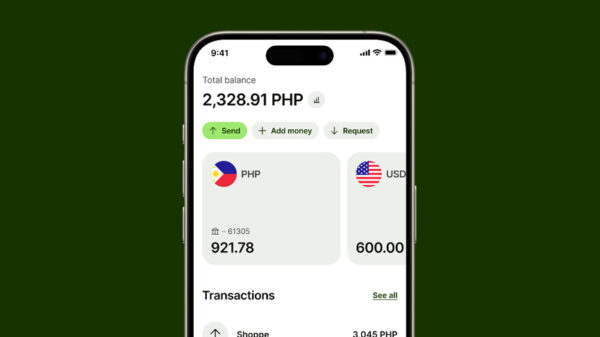

In addition, the BPI Ka-Negosyo Festival not only offers promos for businesses on loans, but also on BPI BizLink, the digital banking platform for SMEs, BPI AIA insurance plans, and Ayala Enterprise Circle membership where small business owners can access exclusive discounts from Ayala partners and subsidiaries. Each application for these bank solutions will earn a raffle ticket and a chance to win an Apple iPad for the business. SMEs can visit any BPI Branch to know more about the Ka-Negosyo Festival promos terms and conditions.

Beyond financing, BPI is sharing insights into staying resilient amid the ever-changing business landscape with SMEs through its recently-launched YouTube series, BizKits, which shares the experiences and best practices of successful Filipino entrepreneurs.

The first episode features Anna Meloto-Wilk, co-founder of Human Nature, a social enterprise brand of natural beauty and personal care products. She discusses how her company is adapting and growing despite business challenges and the steps it is taking to become future-ready.

“With BPI Business Banking’s business solutions and knowledge resources for SMEs, BPI continues to reinvent itself to offer client experiences designed to address their current realities, stay relevant, and provide real value to its key stakeholders,” Ocliasa said. “With resilience, agility, and foresight, BPI is carrying on its rich heritage of banking excellence and innovation by reinventing banking for a more inclusive and better Philippines.”