Philippine Savings Bank (PSBank) made banking simpler and safer with its new digital offering — allowing Filipinos to open a PSBank peso savings account via its Mobile App. With just one (1) valid ID, a selfie, and with literally just a few taps, then it’s done.

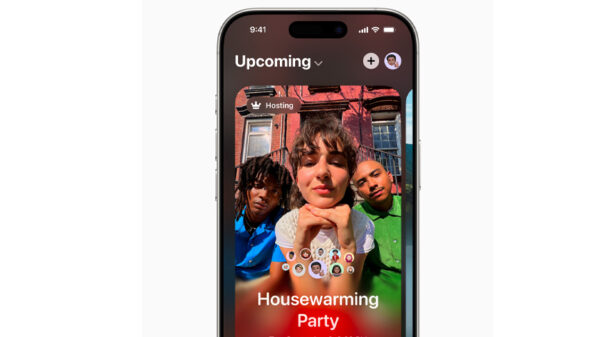

What used to require at least a visit to the bank is now replaced by an online account opening service through one’s smartphone and the PSBank Mobile App.

The app allows customers to enjoy hassle-free, safe banking and easily and conveniently do tasks such as bills payment, fund transfers, mobile check deposits, time deposit placements, toll RFID and telco reload, loan application, and now account opening in the comfort of their homes.

“Our customers’ safety is our number one priority. This is the reason why we continuously strengthen our digital infrastructure so that Filipinos can do their banking transactions whenever they want and wherever they are. Supplementing today’s consumer lifestyle, this new feature allows customers to do more despite staying indoors,” shares PSBank Senior Vice President for Marketing Noel Tuazon.

PSBank’s online account opening service completes the bank’s suite of digital services, designed to keep in step with its customers’ ever-evolving needs. The PSBank Mobile App offers a well-rounded and best-in-class user experience, from real-time account management to savings growth and security.

Meanwhile, customers may open a maximum of two (2) accounts online. New customers may also request a PSBank Debit or Prepaid Mastercard for their newly opened deposit account and have it ready for pick up at any PSBank branch or delivered to their registered mailing address.

Innovation for safety

Aside from convenience and security, innovation for consumer safety drives PSBank’s mission to upgrade and develop its products and services.

“Our clients can attest that we constantly innovate to make banking simpler and so much easier. We are the first lender to introduce Cardless Withdrawal, the ATM Lock feature, Mobile Check Deposit, among other things,” Tuazon notes. “This time, innovation becomes our tool in helping Filipinos safeguard their health. Trust that we will keep on harnessing digital technologies and continue to upgrade our industry-leading product and service offerings for our customers,” he adds.

For more information on PSBank and its products and services, visit www.psbank.com.ph or facebook.com/psbankofficial. You may download PSBank Mobile App from the Apple App Store or Google Play Store.