Following its local launch in December last year, digital payments solutions startup Xendit announced it has secured US$150-million in Series C funding making it in the growing list of Southeast Asia’s unicorns. The round was led by Tiger Global Management, with participation from existing investors Accel, Amasia and Justin Kan’s Goat Capital.

In line with the firm’s commitment to accelerate digital transformation, this new investment will fuel Xendit’s plans of innovating its product suite and make its digital payments infrastructure available to more entrepreneurs in the Philippines and other key markets. By specializing in building hyper-localized products and catering to a broad spectrum of customer needs, Xendit has been able to build first-in-market products, provide unparalleled customer service, and quickly adapt to a dynamic region.

Committed to strengthen its local operations by building digital infrastructure in the country and promote financial inclusivity, Xendit strives to make payments in the country more affordable and accessible. Last year saw more than 200% year-over-year increase in total payments volume across the Philippines and Indonesia, maintaining a 25% month-over-month growth rate in the Philippines and continuing a track record of more than 10% month-over-month growth since inception.

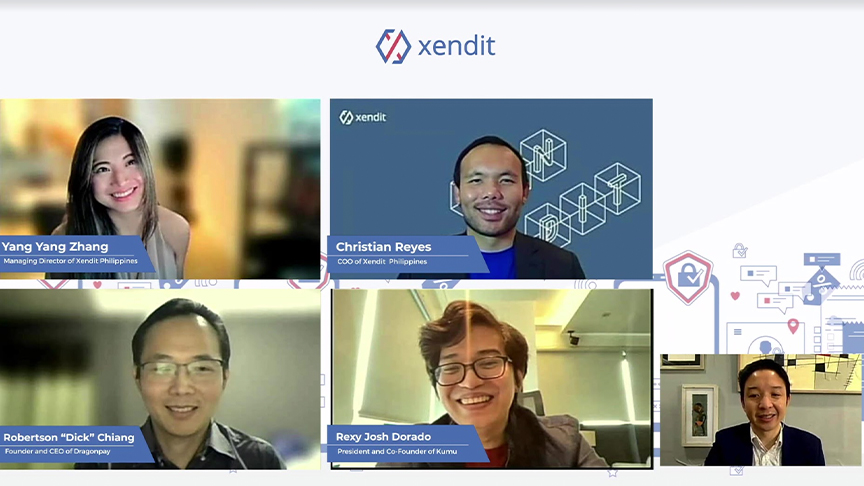

“Xendit’s new round of fundraising and status as a unicorn will strengthen our mission to provide reliable and secure financial infrastructure to hundreds of thousands of growing businesses across the Philippines. Our dream is to accelerate the growth of the Philippine digital economy by continuing to build first-to-market solutions for enterprises and SMEs alike, while introducing the global VC community to the growing local startup ecosystem,” said Yang Yang Zhang, chief executive officer and managing director at Xendit Philippines

According to Zhang, Xendit Philippines is a company of firsts. The company has paved the way in building first-to-market solutions that differentiates it from other companies in the scene. It was the first payment gateway to launch a direct debt and Buy Now Pay Later (BNPL) solution as well as integrate to the top three e-wallets GCash, GrabPay and PayMaya. Xendit is providing a solution to the Philippines’ specific reliability and infrastructure hurdles by expanding access to technologies that create an equal playing field, enabling businesses and people in the region to scale and thrive.

The growth of e-commerce in the country, where more customers shift their purchases online for safety and convenience amid the pandemic, contributed to the rise in Internet usage and the use of financial services app. About 67% of the country’s population are internet users, of whom 42% utilize banking and financial services app for their online transaction needs. Overall, for 2021, 38.88-million Filipinos are currently making digitally-enabled payment transactions.

To further boost the growing trend toward digital payments and those who have embraced it, Xendit will be introducing three key initiatives that will support its commitment to empowering more Filipino businesses and customers, bridging digital solutions where needed, and delivering growth opportunities. Xendit designed and created the following innovative programs to ensure better service for every Filipino: the Auto Debit and Recurring Payments that supports subscriptions and account linking for future payments through Xendit’s Direct Debit and eWallet products; Level Up Grant program for SMEs and individual business owners where they can get two months fee waiver across all payment channels, access to exclusive workshops, and be connected to Xendit’s list of partners that could support their businesses; and Accelerator Program, a comprehensive initiative aimed at Filipino startups in achieving regionalization through hyper-localization, providing opportunities for fee waivers, and bridging the gap between Filipino SMEs and international investors.

These three initiatives we believe can help small and medium businesses (SMEs) in the Philippines, according to Christian Reyes, chief operating officer at Xendit Philippines. “In the Philippines, we really want to focus on SMEs so we listen to them and identify business challenges and impediments when it comes to doing business in the Philippines and going digital with their operations. We also think about solutions and programs that specifically cater to SMEs,” said Reyes.

Reyes emhasizes customers do not have to be a multinational corporation or fully-funded company to handle digital payments. “We created tools and dashboards, payment links where any small business can start using within hours after signing up with Xendit. For individual sellers to SMEs, you can basically go fully digital without having to be fully techie.”