PayMaya has waived cash in fees at over 55,000 online and physical touchpoints nationwide, making it easier for consumers to put funds and use their e-wallet anytime, anywhere. This is in line with making financial services more accessible and convenient to all Filipinos, especially during heightened community quarantine measures across the country.

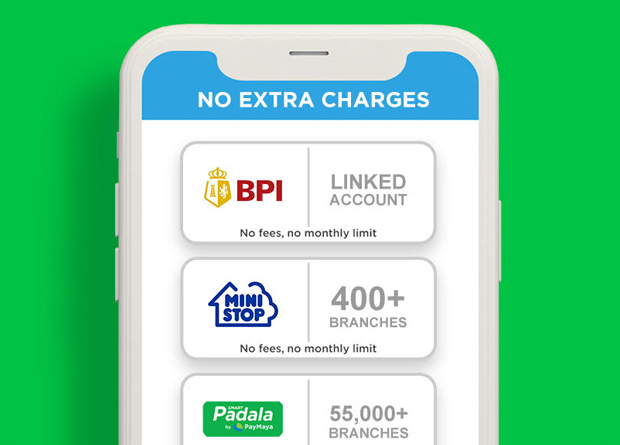

PayMaya users can now cash in for FREE via BPI online, Ministop, and PayMaya’s agent network arm, Smart Padala. Those with BPI accounts can quickly add funds for free by simply linking their BPI account to their PayMaya e-wallet. Meanwhile, PayMaya users can enjoy free cash in at over 400 Ministop branches across the country, allowing them to save as much as P200 on fees.

To make its services more accessible at the grassroots community level, PayMaya has tapped its widest network of over 55,000 Smart Padala agent touchpoints nationwide to provide free cash in services to PayMaya app users. As an additional incentive, PayMaya is also giving a 100% cashback on the Smart Padala service fee until August 31, 2021, whenever app users cash in to their accounts. This cashback promo is valid for cash amounts of P10,000 and below.

“Millions of Filipinos are using the PayMaya app for their everyday transactions such as sending money to loved ones, paying for utilities, buying airtime load, shopping online, and for purchasing for groceries and other essentials. That’s why providing our customers with more accessible ways to add funds to their accounts is important. Through our extensive cash in network across the country and free cash in channels, PayMaya is the easiest and most convenient way for Filipinos to embrace digital payments,” said Shailesh Baidwan, President at PayMaya.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines, with platforms and services that cut across consumers, enterprises, communities, and government. Through its enterprise business, it is the leading payments processor for “everyday” merchants in key industries such as retail, food, transportation, utilities, and eCommerce.

PayMaya provides more than 38 million registered users access to financial services through its consumer platforms. Customers can conveniently cash in, pay, cash out, and remit through its over 300,000 digital touchpoints nationwide. Its Smart Padala by PayMaya network of 55,000 partner agent touchpoints nationwide serves as last-mile financial hubs in communities, providing the unbanked and underserved access to digital services.