Global life insurer Manulife, in its 2020 study titled “Understanding Filipino Sentiments Toward Health and Critical Illness,” revealed that 75% of Filipinos intended to increase their usage of online platforms during the pandemic to manage their finances and conduct various financial transactions safely at home. A 2021 Manulife survey also reported that while 53% have spoken to agents about their insurance needs, 70% of Filipinos prefer to manage their policies through digital means.

In response to Filipinos’ evolving financial management habits, Manulife Philippines has further beefed up its digital suite, which includes Manulife Online, Electronic Point of Sale (ePOS), and eReceipts, as well as its website and social channels, for the ease and convenience of customers to transact and engage with the insurer, even while at home.

“Our work towards becoming a digital, customer leader in the insurance space is grounded on our desire to make insurance more accessible to Filipinos. We are leveraging digitalization because we believe these technologies can serve as both disruptor and accelerator to our industry, and we want to constantly find new ways to better serve our customers’ evolving needs, making their every day better,” Richard Bates, Manulife Philippines President and CEO, said.

“Even before the pandemic, we had begun a digital transformation and invested in new platforms and technologies, all focused on enhancing the customer experience. These innovations have allowed us to adapt to the constraints of the new normal, continue to provide uninterrupted service while keeping our workforce safe, and secure the future of our customers, especially when they need it most,” Bates added.

Secure present and future through ePOS, Manulife Online and other digital tools

Manulife’s insurance advisors are readily equipped with knowledge and resources to leverage the company’s array of digital platforms and tools to attend to customers’ needs. Through the Electronic Point of Sale (ePOS) system, insurance advisors can provide faster, more efficient, and hassle-free customer support throughout the policy purchase process. Insurance advisors are able to deliver proposals and guide customers through the application process without the need for face to face interaction.

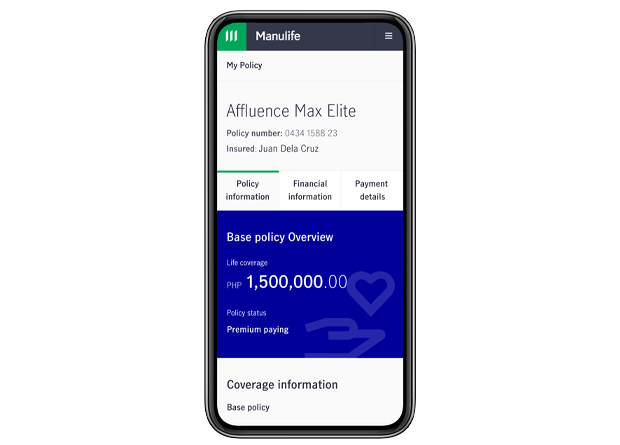

Meanwhile, Manulife Online has helped customers manage their insurance plans with ease and convenience, especially during the pandemic. This customer portal enables customers to view all their policies at a glance, make premium payments, and manage policy details. The portal was recently enhanced to allow customers to download electronic receipts as records of their premium payments. These eReceipts are also sent to customers via email and SMS, secured by a one-time password.

Manulife has also enhanced their website to allow customers to book virtual consultations with a financial advisor who can help them identify an insurance solution that best suits their needs and goals. Likewise, should customers need to file a claim, either as an insured or a beneficiary, they can do so via Manulife’s website 24/7.

Invest in global funds and manage them through iFunds

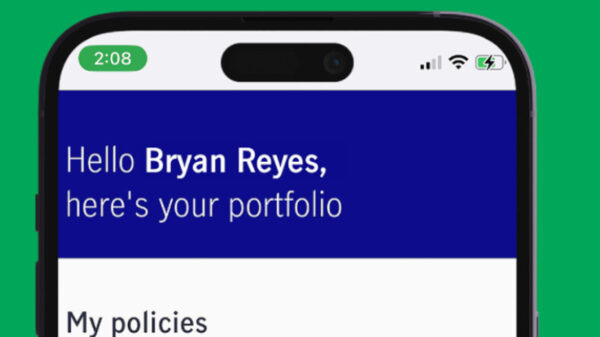

With Manulife iFunds, customers can open and manage an investment account that will allow them access to a variety of investment options starting at Php 5,000.* They can choose from various Unit Investment Trust Funds (UITFs) managed by Manulife Asset Management’s global team of investment experts. Depending on their risk appetite, customers can build a diversified portfolio with both local and global exposure, and track the performance via iFunds in real time.

Like Manulife Online, iFunds allows customers to digitally manage their UITFs, add top-ups, buy or switch funds, pay via their desired channels, and redeem returns.

To know more, visit Manulife’s website at https://www.manulife.com.ph/.