E-wallets have managed to change the landscape of the payment system and through this, Xendit has established its position as the Philippines’ payment gateway of choice. As the first and only platform that works with the three top e-wallets in the Philippines market: GCash, PayMaya, and GrabPay, Xendit allows merchants to accept payments and eliminate the need to perform separate integration and maintenance.

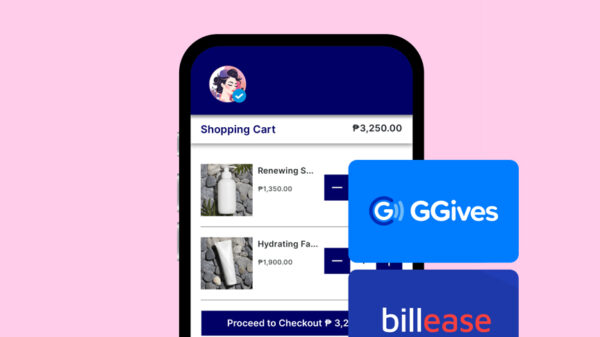

Xendit’s partnership with the top e-wallets and merchants make it more convenient for businesses to send and accept payments. In turn, optimizing the user experience by choosing the type of checkout that suits them best, customers have more payment choices when shopping online via a single endpoint or plug-in, through GCash, Paymaya and GrabPay.

Online transactions have seen a sharp rise, according to The State of Digital Payments in the Philippines 2019 report by the Better Than Cash Alliance. The share of digital payments was recorded at 10% by volume and 20% by value in 2018. This is a dramatic increase from 2013 when digital payments accounted for only 1% of the country’s total transaction volume.

Digital payments are also seeing an uptick amid the COVID-19 pandemic, where everyone is advised to socially distance and avoid physical contact. This led to an increase in users and transactions from e-wallets. GCash observed a 65% increase in their users in 2020 compared to the previous year. Meanwhile, PayMaya processed over P95 billion worth of online shopping transactions in 2020 alone.

In response to this greater demand for digital transactions, Southeast Asian payments start-up Xendit has been actively building the most advanced payment system for businesses. Since 2015, Xendit has powered small and medium enterprises (SMEs), some of Indonesia’s largest tech startups, and the world’s largest businesses. Its expansion in the Philippines is part of its commitment to build the country and the region’s digital payments infrastructure.

With Xendit, businesses can go live in less than a day and experience a simplified and integrated payment process. It is faster to accept payments, create and manage invoices, and disburse funds to customers, employees, and suppliers. Businesses also have access to a centralized dashboard with daily reconciliation for visibility and easy reporting.

“We are proud to be the first PG in PH to enable enterprises and SMEs with all 3 eWallets – Gcash, Paymaya and Grabpay,” says Ruihong Zhang, the product manager lead for digital payments. “These eWallets will immediately provide our customers with wide consumer coverage and better payment success rates. We look forward to making more of the latest payment trends accessible to our customers!”

Additionally, Xendit is equipped with a powerful in-house fraud detection system which intelligently assesses every payment transaction. It makes recommendations on the risk level and even preemptively blocks suspicious payments. The platform also comes with a world-class customer service experience that can cater to all of the client’s needs.

“Financial inclusion only extends as far as the last person who is able to participate in the rapidly growing Filipino digital economy,” says Yang Yang Zhang, Managing Director of Xendit Philippines, “As ewallets have risen as a mode of payment over the past year, we committed ourselves to ensuring that every Filipino can have access to online channels and any local business can process payments from their customers using fast and reliable technology.”