Technology, finance and nonprofit companies join forces to announce the launch of PayID, a universal payment ID to simplify the process of sending and receiving money globally – across any payment network and any currency.

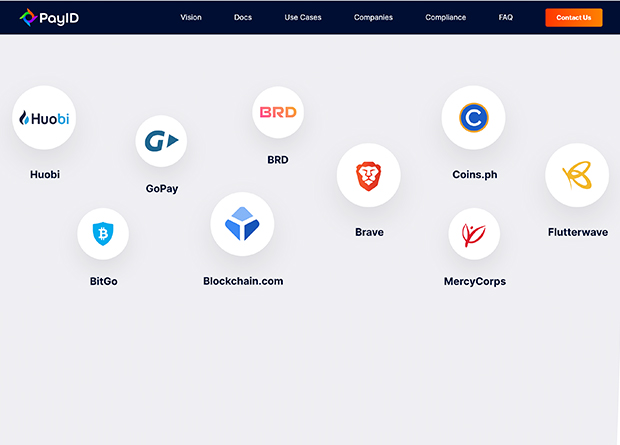

GoPay, Ripple, Coins.ph Blockchain.com, BitPay, Brave, Flutterwave, Mercy Corps and others collaborated on the development of PayID through the Open Payments Coalition, a multinational alliance of industry leaders.

PayID brings together companies across all industries with an open solution for payments, marrying traditional finance, and the new world of fintech under one standard. More than 40 global companies and nonprofits reaching more than 100 million consumers worldwide have joined the Open Payments Coalition to break down the proprietary silos and standards that exist in payments, accelerate the adoption of digital payments, and change the way money is sent around the world today.

“We are excited to support the launch of PayID, which is in line with our shared vision of making financial transactions simpler and more accessible for everyone. PayID is a significant step in driving interoperability in the financial ecosystem and simplifying the process of sending and receiving money through multiple online platforms worldwide,” said Coins.ph Head of International Growth Lisa Kienzle.

Though existing solutions have attempted to connect individuals across networks, no standard has yet achieved global reach and adoption. With support from companies across industries, PayID is the first global solution to address the biggest pain point in payments, uniting the many, closed payment networks that exist today.

PayID allows individuals to send and receive money across any payment network using an easy-to-read address versus one that’s awkward and unintuitive – such as a bank account, routing or credit card number. Most have experienced the frustration and inconvenience of sending money between different bank accounts or payment apps — with PayID, sending money is as simple as sending an email directly to friends and family, no matter which provider is used.

Whether a bank, payment provider or processor, digital wallet, or remittance provider, PayID is designed for any business that sends or receives money. Implementing PayID is simple, and makes it possible for companies to access more networks, consumers, and currencies to expand their businesses globally.

“The next payments network should be open, like the web, where any company can participate just by building your service on the network. PayID is the beginning of building an open payments network that is designed for people and simplifies the experience of sending or receiving money. Building the open payments network that simplifies payments processes will accelerate the growth and adoption of digital payments for everyone around the globe, said Ripple Senior Vice President for Xpring Ethan Beard.

This is the first step in creating a truly open payments network. PayID was built for all – it’s open-source, free, and simple to integrate with the security and privacy that everyone from large financial institutions and global nonprofits, to ride-hailing apps and neobanks require. In addition, it provides an end-to-end Travel Rule compliance solution for satisfying both FinCEN requirements and FATF recommendations.