TransUnion released its analysis of digital fraud trends in the Philippines. Its assessment found that the percentage of suspected online fraud originating from the Philippines more than doubled when comparing the periods Jan. 1-March 10 and March 11-April 28, increasing 119%. This makes the Philippines the country with the 76th highest percentage of digital suspected fraud originating from it from March 11 to April 28, 2020. In comparison, TransUnion found the rate of suspected fraudulent online transactions rose 5% globally during the pandemic.

In its assessment, TransUnion analyzed fraud trends to reflect the changing economic environment with COVID-19. It used March 11, 2020 – the date the World Health Organization (WHO) declared the coronavirus (COVID-19) a global pandemic – as a base date for analysis. TransUnion analyzed the billions of online transactions its flagship fraud and identity solution, IDVision with iovation, assessed for fraud indicators on more than 40,000 websites and apps globally. It identified more than 100 million suspected fraudulent digital transactions worldwide from March 11-April 28.

“Given the billions of people globally that have been forced to stay at home, industries have been disrupted in a way not seen on this massive of a scale for generations,” said Pia Arellano, President and CEO at TransUnion Philippines. “Now that many transactions have shifted online, fraudsters have tried to take advantage and companies must adapt. Businesses that come out on top will be those leveraging fraud prevention tools that provide great detection rates and friction-right experiences for consumers.”

Examining Digital Fraud Impact on Industries

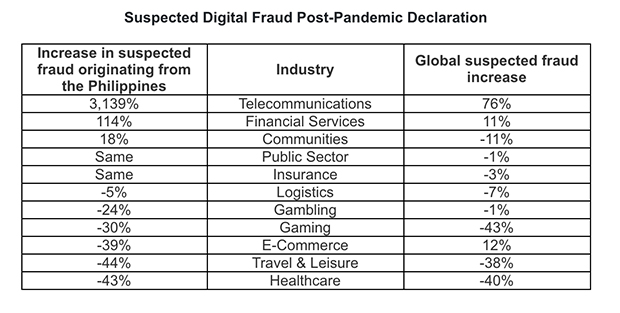

TransUnion analyzed the following industries for a change in the rate of suspected digital fraud against them, comparing the periods of Jan. 1-March 10 and March 11-April 28.

TransUnion’s data shows that as social distancing changes shopping patterns, fraudsters have taken notice and targeted the more digital forward industries while following the money globally. Telecommunications, e-commerce and financial services all have large digital adoption, financial information and payments at the center of their online experience, and thus digital fraudsters targeted them more compared to other industries during the pandemic worldwide.

Globally post-pandemic, the most common types of online fraud in telecommunications—the industry with the highest percentage of suspected digital fraud growth from the Philippines—are credit card fraud and account takeover/hijacking. The types of online fraud from the industry with the second highest rate of suspected digital fraud growth from the Philippines—financial services—are identity theft and account takeover/hijacking globally.

Philippines Top Globally for Suspected Logistics Fraud

TransUnion’s analysis also detected the Philippines as the country with the highest rate of suspected online fraud originating from it targeting the logistics industry during the pandemic. The overwhelming type of digital fraud in logistics TransUnion sees is shipping fraud wherein criminals typically take over a customer’s account but don’t change the shipping address in order to avoid detection. Once the package has shipped, they intercept it at the carrier website and change the shipping address.

Most of these statistics involve transactions that the TransUnion IDVision with iovation suite of solutions identified as suspected fraudulent to its customers before any fraud occurred. IDVision with iovation unites both consumer and device identities. It fuses traditional data science with machine learning to provide businesses with unique insights about consumer transactions, safeguarding tens of millions of transactions each day globally.