The City of Manila has disbursed more than P13 million in financial assistance to eligible senior citizen beneficiaries through PayMaya.

This financial aid is part of the monthly stipend allocated to senior citizens and the release has been expedited to further help the beneficiaries cope with the effects of the current Enhanced Community Quarantine due to the COVID-19 pandemic. Receiving three months’ worth of stipend covering January to March directly to their PayMaya accounts are some 9,000 senior citizens who are among the initial batch of beneficiaries equipped with citizen ID cards powered by PayMaya. Another 8,000 senior citizens have already received their stipend for the same period earlier this year.

“Our partnership with PayMaya has enabled us to deliver fast and transparent financial assistance to our senior citizens at this time of great need, allowing them to receive their benefits from the safety of their own homes. Digital financial services helps us to continue serving our constituency despite our current public health challenges,” said Manila City Mayor Francisco “Isko Moreno” Domagoso.

“Disbursing cash assistance via e-wallets is a safer and more transparent means in providing financial aid to citizens, since it minimizes cash handling and provides a record of money transfer. We are happy to see our services being utilized during this Enhanced Community Quarantine for the benefit of one of the the most vulnerable segments of Manila’s population,” said Orlando Vea, founder and CEO of PayMaya.

The PayMaya-enabled citizen ID card initiative was launched in late 2019 as part of the City of Manila’s citizen benefit program for senior citizens, persons with disabilities (PWDs), and solo parents. To date, the City of Manila and PayMaya has distributed more than 17,000 citizen ID cards. Distribution of citizen ID cards to eligible citizens will continue immediately once the enhanced community quarantine has been lifted. Senior citizens yet to be equipped with ID cards powered by PayMaya will be receiving their cash assistance through their barangay captains.

Safer, more transparent financial aid

In light of the current public health situation, the use of cashless technologies such as the citizen ID cards powered by PayMaya are providing a means for local governments to directly disburse aid to their constituents.

Aside from Manila, PayMaya has also partnered with the Social Security System (SSS) for disbursement of the national government’s Small Business Wage Subsidy (SBWS) to affected employees, and previously with the local governments of Mandaluyong, Caloocan, and Quezon City, among others.

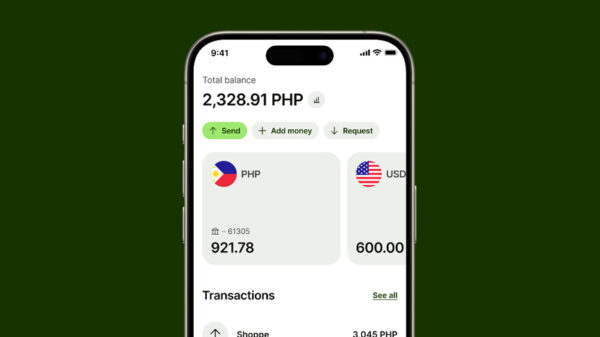

Once they receive financial aid directly in their PayMaya account, citizen beneficiaries can then easily use the funds to pay bills, buy load, buy groceries online, or send money to other users as they see fit.

Should they wish to do so, they can transfer and encash the funds from PayMaya to the nearest Smart Padala agent in their neighborhood. They can also withdraw the money through any of the Bancnet ATMs using their citizen ID cards.

“Mobile wallets and other digital financial services are proving to be essential tools in helping the national and local governments deliver better public service to the people,” Vea said.

Through a digitally empowered system, the government can not only efficiently and quickly distribute financial aid to intended beneficiaries but can also ensure that the entire process is transparent and on record, which can help reduce incidents of red-tape and corruption.

At the same time, digital payments is a preferred mode of transaction particularly during this time because it promotes lesser cash handling and consequently helps in containing the spread of COVID-19 infection. With mobile wallets, people can easily transact at home or with limited contact at local neighborhood merchants through QR or card payments.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines with platforms and services that cuts across consumers, merchants, and government. Aside from providing the payments acceptance for the largest e-Commerce, food, retail and gas merchants in the Philippines, PayMaya is enabling national and social services agencies as well as local government units with digital payments and disbursement services.

Through its PayMaya app and wallet, it is providing millions of Filipinos with the fastest way to own a financial account with over 40,000 Add Money touchpoints nationwide, more than double the total number of traditional bank branches in the Philippines combined. Its Smart Padala by PayMaya network of over 30,000 partner agents nationwide serves as last mile digital financial hubs in communities, providing the unbanked and underserved with access to services.