Eligible employees under the Small Business Wage Subsidy (SBWS) program will be able to conveniently receive the cash assistance straight to their PayMaya accounts once disbursements commence in May.

State pension fund Social Security System (SSS) has tapped digital financial services leader PayMaya for an easier and more convenient way to disburse proceeds from the national government’s SBWS program and its other loan offers to more than 3 million member-employees affected by the current COVID-19 public health situation.

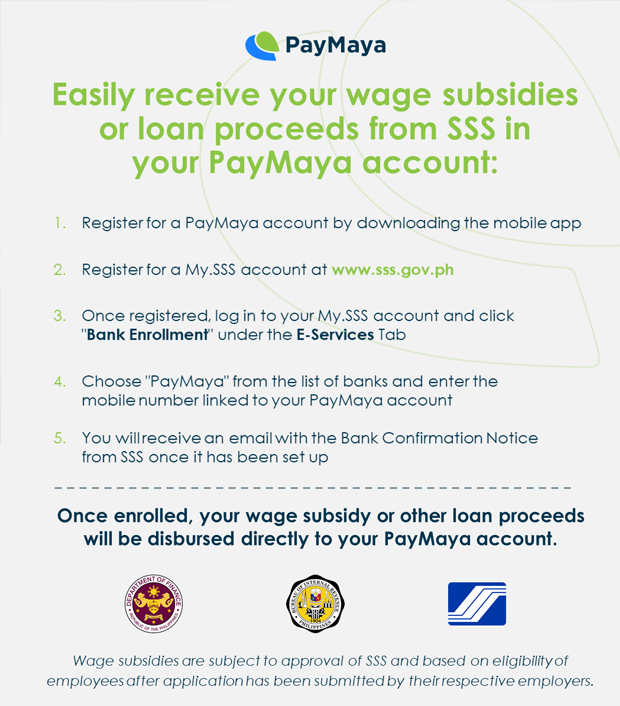

Eligible employers and their respective employees can now link their PayMaya accounts in the My.SSS online portal, so that they can conveniently receive their wage subsidies when the disbursements start next month. Depending on their location, eligible employees stand to receive P5,000 to P8,000 in subsidies from the government through the SSS. Employers have until April 30, 2020 to submit their applications at the SSS website (www.sss.gov.ph).

To successfully receive their wage subsidies via PayMaya, employees must make sure that their PayMaya accounts are upgraded.

The government has set aside a P51 billion fund in wage subsidies for small businesses whose employees were affected by the enhanced community quarantine and unable to work due to suspension of business operations in some industries.

“This is especially convenient and beneficial for employees in small businesses who were unable to work during the enhanced community quarantine period. More than ever, fast and easy access to funds for their daily necessities becomes critical at this time. We are happy to be part of government’s thrust in using e-Money as a convenient tool for cash distribution,” said Orlando Vea, founder and CEO of PayMaya.

The disbursement of wage subsidies and other loan proceeds is an expansion of the partnership between SSS and PayMaya, which together launched a more convenient way to pay for member contributions using the SSS mobile app in late 2019.

Promoting safe and convenient payments

After receiving their wage subsidies or loan proceeds in their PayMaya accounts, employee beneficiaries may immediately use the funds to pay bills, buy airtime load, send money to family, or shop online for basic necessities using their PayMaya app.

They may also opt to withdraw the funds at any Bancnet ATMs currently available using their physical PayMaya card or through the more than 30,000 Smart Padala centers nationwide.

Aside from offering convenience, utilizing PayMaya for various digital transactions is also a safer way to pay as part of physical distancing and health measures.

To sign up for a PayMaya account, all they have to do is download the PayMaya app in the Google Play Store or the Apple App store and register using their mobile number.