Millennials emerged as the fastest-growing generation to contribute to the growth of the home loan landscape in the country, according to Philippines’ first online mortgage brokering platform, Nook. As the platform disrupts the home loan process in the Philippines, millennials are seen to lead the industry as they express keen interest to invest in real estate properties.

The millennials or Generation Y are often lumped into somewhat narrow categories of traits and characteristics and are stigmatized for being self-absorbed and narcissistic according to a research article by Grubbs et al in 2019.

While millennials are seen to prioritize other leisure activities, data shows that millennials, in fact, are generally good financial planners. Based on an article by Forbes in 2019, millennials are taking advantage of finding new alternative investments and securing stability to settle down for their future. The millennial generation is both captive to and captivated by growing their money over time, investing in various social and environmental causes.

In the US, millennials have also shown an increase in their home buying purchase power, assuming the largest chunk of shares for new home loans, according to Realtor.com.

In the Philippines, as disposable incomes grow, more Filipinos aged 40 and below are purchasing property – a trend that industry observers correlate with the country’s strong economic fundamentals, and mirrors global trends.

According to the data gathered by Nook, almost 44% of loans from its platform are being acquired by millennials. Interestingly, 69% of those applicants are female and 65% are single.

“There is a strong interest in property among financially savvy millennials in the Philippines, a dynamic market that has shown a desire to save money on things like home loans to enjoy more of what life offers. Females, in particular, are keen on real estate, mirroring their investment aptitude and financial strength,” said Nook CEO Chris Elder.

“The average loan amount being reviewed by millennials using Nook is in fact, above P3 million, ” Elder added. Almost half of the applicants prefer house and lots while a third acquire condominiums, reflecting the diversity of preferences among buyers.

The preponderance of property options now available in the market has spurred strong interest among millennials. Over the past few years, the country’s largest developers have been offering a wide range of homes and condominiums across the country to fit various budgets and style preferences. The quick appreciation of property values has also been seen as a reason behind the strong uptake of real estate among millennials, who see themselves gaining not just a home, but an investment vehicle as well.

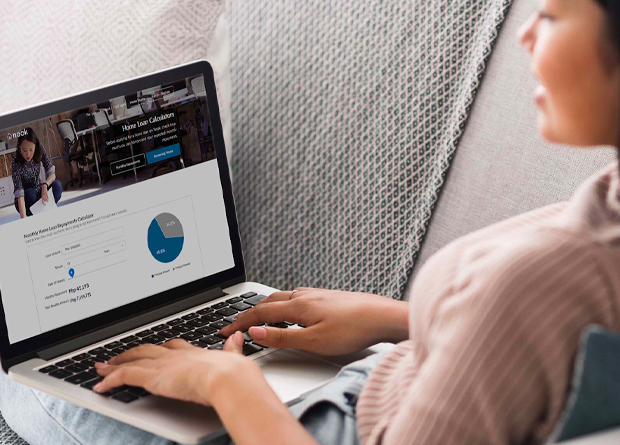

Recognizing that home buyers need assistance as they go through the loan application process in the Philippines, mortgage broker Nook launched its online platform that tech-savvy millennials have no trouble navigating. Nook enables users to do a loan comparison from many banks and experience a seamless loan application process online with the support of their loan consultants.

Elder notes that many prospective applicants, especially millennials taking out their first loans, are intimidated by the complicated loan application process. Moreover, they do not know what housing loan terms work best for their purposes and circumstances. Nook simplifies the entire process, by helping users to evaluate the most optimal loan terms to acquire their target properties.