The country’s rapidly evolving financial industry, open-minded and collaborative leaders, and young population combined offer a lot of opportunities for digital transformation in the financial sector. Jackal Ma, co-founder and partner of leading global risk control services provider Tongdun Technology, expresses his optimism about the adoption of digital solutions among the country’s financial institutions on the side lines of the recent Finance Philippines 2019 conference.

According to Ma, while digital payment in the country is not yet very inclusive and the infrastructure is lagging behind other countries in the ASEAN region, there has been a lot of improvements, especially in the information infrastructure. “The Philippines is one of the most important countries in our operations in Asia. We are positive that once the challenges in infrastructure have been addressed, the country is going to make its leap to digital transformation,” Ma shares.

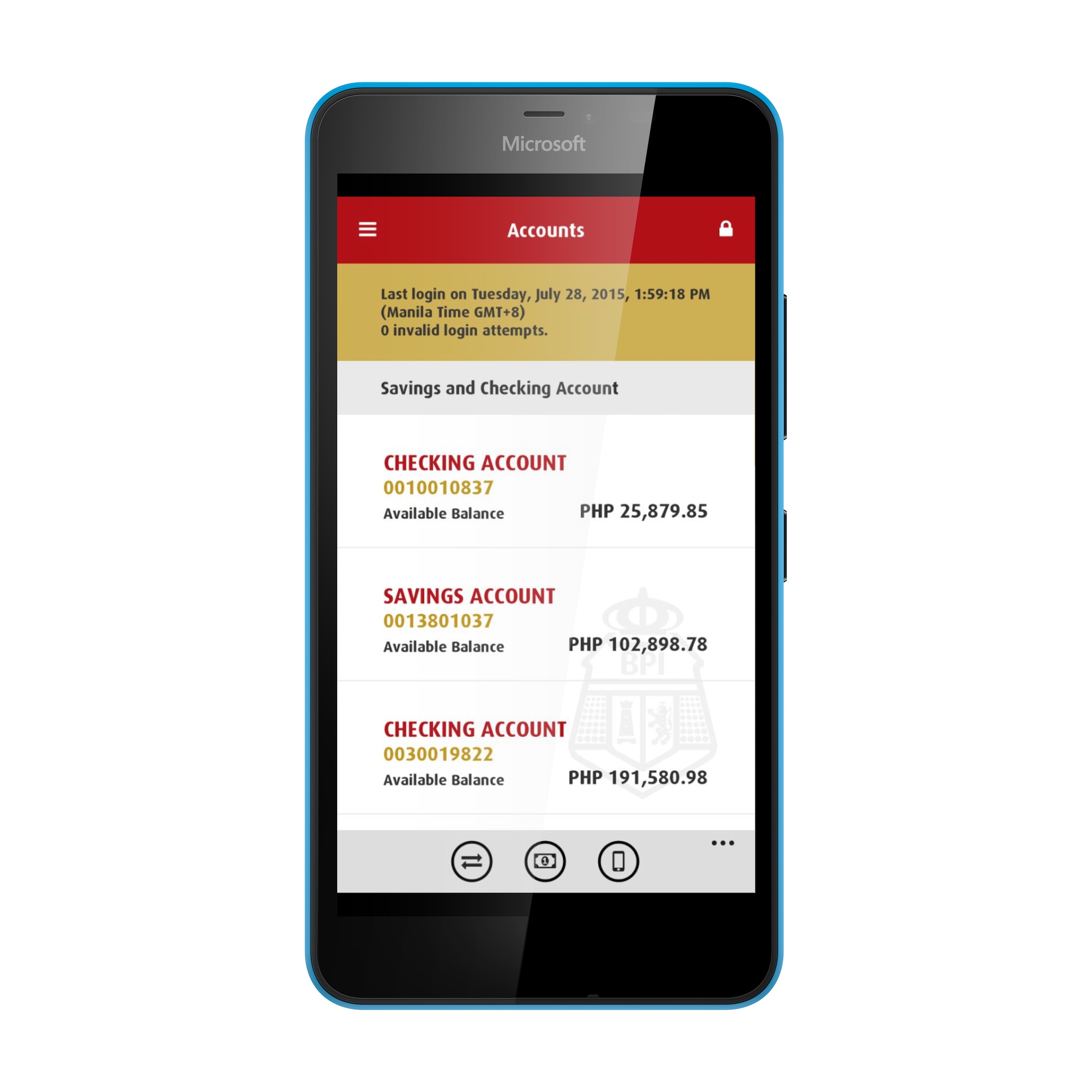

Asserting its position as one of the leading global providers of risk control services to financial institutions and insurance companies, Tongdun further strengthened its footprint in the Philippines with the recent extension of its partnership with the Bank of the Philippine Islands (BPI). Through the partnership, Tongdun will aid BPI in offering more accessible and sustainable digital banking solutions to its customers, especially those from unbanked communities in the country.

To help BPI reach out to more Filipinos and further improve its efficiency, Tongdun will provide customized and omnichannel solutions to help BPI’s customers access a wide range of financial products and services, including savings, payments, credit, and insurance.

“Now that technology has made it possible to reach clients and markets previously untapped by digital services, we integrated artificial intelligence into risk management to provide our customers such as BPI with comprehensive intelligent risk control solutions. We are confident that our technology can help BPI be a catalyst in digitizing the Philippine banking ecosystem with an AI-led, omnichannel customer experience,” Ma adds.

Since BPI tapped Tongdun last year, customized credit scoring models have been created to build customized solutions for SMEs.

“Tongdun’s sophisticated technology will help streamline our processes, allowing us to move faster to serve our clients better. At the same time, we will be able to optimize our risk management so we can reach more of the underbanked SME segment. With this, we can contribute to a more sustainable and broad-based economic growth for the country,” Business Banking head Eric Luchangco said.

With the vision of a digitally inclusive mainstream financial ecosystem that is convenient, affordable and accessible to more Filipinos, both Tongdun and BPI aim to continue leveraging and integrating new technology to offer relevant and innovative solutions to more businesses, especially SMEs, in the country.

According to the Q1 2019 Financial Inclusion Dashboard published by the Bangko Sentral ng Pilipinas, 533 cities and municipalities in the Philippines or 32.6 percent of the total remain unbanked. Tongdun and BPI seek to improve the numbers by developing and offering banking solutions that can serve as many Filipinos across the nation as possible.