The digitization of money, widespread access to the Internet, and mass-adoption of smartphones are positive headwinds in the Philippines’ journey towards a digital economy. While the potential is undeniable, there is also concern that cyberattackers are shifting their focus to Asia-Pacific.[1]

Cybercriminals are growing in sophistication, and they are constantly finding new ways to victimize consumers and breach enterprises. This calls for a re-evaluation of safeguards against cyber threats.

“For consumers, there is really no subsitute to awareness,” said Nagesh Devata, General Manager of Southeast Asia Cross Border Markets for PayPal. “For enterprises, we need to move from reactive to predictive models in risk management.”

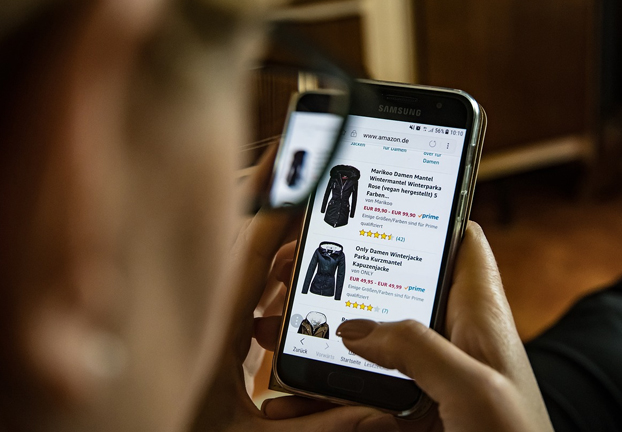

PayPal, the global leader in digital payments, outlined five consumer tips to secure online payments: (1) protect your personal information; (2) choose a strong password that combines alphanumeric characters; (3) share personal information only through authentic online banking features (4); opt for a 2-factor authentication, where a user is granted access only after successfully presenting two or more pieces of evidence to an authentication mechanism; and (5) ensure that authentic apps are downloaded for payment.

According to PayPal consumer research, 43 percent of consumers in Asia-Pacific identify security as the primary motivation when choosing a payment method while 38 percent choose convenience.[2]

With over 286 million active accounts made up of consumers and merchants. PayPal has a foothold on both equations of the purchasing process. “This puts us in a unique position to find insights [for consumers and merchants] in the entire process. Cybersecurity is a team sport, and everyone has a part to play.” described Devata.

Using data to mitigate risk

PayPal anchors its risk management on data science as it bridges technology and business. Through its two sidednetwork, it is able to study both sides of the transaction while providing buyer protection, data encryption, and a seamless experience for its customers.

For PayPal, data not only enables better customer experiences, but also enables it to take on more risk. “At the heart of everything we do with data, we do for our customers and to help our customers connect better,” said Devata.

“There is a strong network effect in the digital payments business. And we want to enable the good guys while keeping the bad guys out. This allows us to provide security and value to both merchants and consumers,” added Devata.

Story-based analytics for risk assessment

Matching users poses a series of analytical and technical challenges, PayPal uses advanced machine learning combined with proprietary story-based analytics to drive better risk decisions. “We run multiple models and rules before making decisions on transactions—all within milliseconds,” Devata added.

PayPal leverages the network effect for risk management by evaluating all the accountsit recognizes for its customers when making real-time assessments. According to Devata, the task is to identify accounts with suspicious fraudulent behaviors, and that requires a lot of science and analytics.

“There is a human story behind every transaction, and we combine data

analytics and human oversight to find this story and try to protect our customers,”

said Devata.

[1]Banks step up battle vs cybercrime

[2]On behalf of PayPal, Ipsos interviewed approximately 34,000 consumers from 31 markets to examine how people shop online and across borders. Research in the Philippines was carried out with 1,006 respondents between 16 to 27 April 2018. Data was weighted to adjust for panel bias based on external trend data on incidence of online shoppers in the country