A new update to the Worldwide Semiannual 3D Printing Spending Guide from International Data Corporation (IDC) shows global spending on 3D printing (including hardware, materials, software, and services) growing to $23.0 billion in 2022 with a five-year compound annual growth rate (CAGR) of 18.4%. IDC forecasts worldwide spending to exceed $14.0 billion in 2019, an increase of 23.2% over 2018.

Together, 3D printers and materials will account for roughly two thirds of the worldwide spending total throughout the forecast, reaching $7.8 billion and $8.0 billion respectively in 2022. Services spending will reach $4.8 billion in 2022, led by on-demand parts services and systems integration services. Purchases of 3DP software will grow more slowly than the overall market with a five-year CAGR of 16.7%.

“3D printing solutions are gaining traction outside of the traditional industries of aerospace and automotive manufacturing and healthcare,” said Marianne Daquila, research manager, Customer Insights and Analysis at IDC. “Professional services and retail will each see more than $1 billion dollars in annual spending before the end of the forecast period, driven by the benefits of fully customized solutions.”

The United States will be the region with the largest spending total in 2019 ($5.4 billion) followed by Western Europe ($4.0 billion). Together, these two regions will provide nearly two thirds of all 3D printing spending throughout the forecast. China will be the third largest region with more than $1.9 billion in spending, followed by Asia/Pacific (excluding Japan) Central and Eastern Europe (CEE), the Middle East and Africa (MEA).

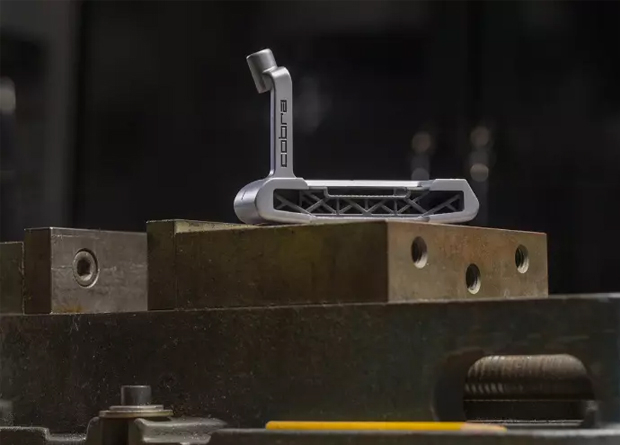

The leading use cases for 3D printing are prototypes, aftermarket parts, and parts for new products. These three use cases will account for 45% of worldwide spending in 2019. Dental objects and medical support objects and tissue/organ/bone printing will see five-year CAGRs exceeding 21%.

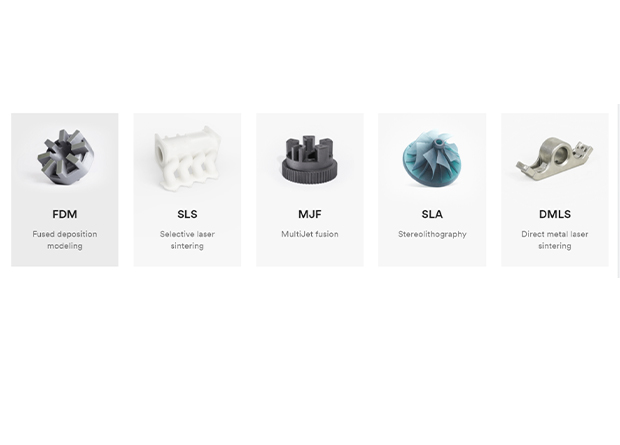

“The emergence of higher speed 3D printers, production configurations, and the expanded range of materials available for 3D printing systems continue to enable wider adoption of 3D printing across numerous industries,” said Tim Greene, research director, Hardcopy Peripherals and 3D Printing. “The development of some of these new materials is critical, because it increases both adoption and utilization. Over the forecast period IDC expects revenue from 3D printed materials to surpass revenue from 3D printer hardware.”

The Worldwide Semiannual 3D Printing Spending Guide quantifies the opportunity for 3D printing, which enable the creation of objects and shapes made through material that is laid down successively upon itself from a digital model or file. Spending data is available for 15 use cases across 20 industries in nine geographic regions. Data is also available for 3D printing hardware, materials, software, and services. Unlike any other research in the industry, the comprehensive spending guide was designed to help IT decision makers to clearly understand the industry-specific scope and direction of 3D printing expenditures today and over the next five years.