Getting out of debt is the first step to financial freedom. To further advocate financial responsibility among Filipinos, global information solutions provider TransUnion recently partnered with Singapore-based credit collection agency Collectius so the latter can create practical payment arrangements that will help Filipinos eventually pay off their debts.

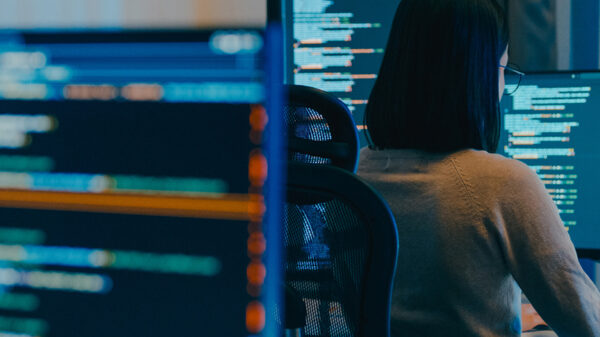

From left: Kian Foh Then, Collectius Group Country Managing Director – Philippines; Gustav A. Eriksson, Collectius Group CEO; Pia L. Arellano, TransUnion Philippines President & CEO; and Ryan Ricardo, TransUnion Philippines Director of New Member Solutions formalize Asia’s pioneering collections agency-credit bureau partnership that aims to help Filipinos get out of debt.

A pioneer in Asia, the partnership involves sharing data and using it to find solutions to credit-related situations. For Collectius, this starts with having access to the network of financial institutions in the Philippines that are part of the TransUnion ecosystem. In particular, TransUnion will provide information that will allow Collectius to create strategies on collection approaches and programs. Collectius will also have access to a host of services including credit reporting, analytics, investigations and portfolio reviews.

“TransUnion is more than just a credit bureau. Our data and analytics help our members like Collectius make informed decisions, which minimize risk, maximize profitability and ensure they are reaching out to the right borrower to help them improve their future credit standing,” said Pia L. Arellano, president and CEO of TransUnion Philippines.

A credit collection and debt acquisition company, Collectius employs fintech and innovation, as well as professional mediation in its processes. In 2017, Collectius acquired a non-performing loan (NPL) portfolio from a major bank in the Philippines, consisting of about 360,000 credit contracts with a total principal value of 350 million USD and this year in June, Collectius acquired its second portfolio consisting of 170,000 credit contracts with a principal of 103 million USD.

Apart from helping debtors settle their obligations, Collectius eventually reintegrates them into society with a transformed financial mindset.

“Our collaboration with TransUnion completes the credit picture. Collectius will update data with TransUnion to show Filipinos who are performing responsibly. This can motivate them a lot to improve their credit information and creditworthiness so they can come back to society more financially knowledgeable than they were before,” said Gustav A. Eriksson, CEO of Collectius Group.

Backed by a reputable Swedish conglomerate, Collectius Group was founded by Eriksson and his good friend Ivar Björklund. With operations in Singapore, Malaysia, and Thailand, it has experience in credit management service and purchase of NPL portfolios of distressed consumer debt. In late 2017, Collectius acquired CJM Strategic Management Solutions, Inc. to utilize local knowledge on the Philippine market. Kian Foh Then also went onboard as the country managing director.

The partnership is a significant one since Collectius is the first collections agency member within TransUnion Philippines. The data it contributes may be accessed by other TransUnion members, providing them a comprehensive view of consumers’ credit profiles. This more holistic assessment will thereby give them more confidence in extending credit to their customers again.

It essentially results in a virtuous cycle wherein financial responsibility opens doors and gives more access to credit to more Filipinos. As it is, more credit leads to more consumption, which results in more jobs that generate more money flowing into the economy. By using information for good, TransUnion fulfills its goal of helping fuel the economy.

“You see, debt holds us back from realizing our full potential. Every unpaid debt hurts our credit score. TransUnion is one with Collectius in helping Filipinos steadily make the necessary changes to get out of a bad financial situation. In the end, what matters is that every Filipino contributes to and benefits in a healthy economy,” Arellano said.

TransUnion Philippines is an information solutions company that prides itself on the quality of data and value-added services it provides. It helps clients with acquisition, portfolio management, and collections so they can make informed decisions that create opportunities.