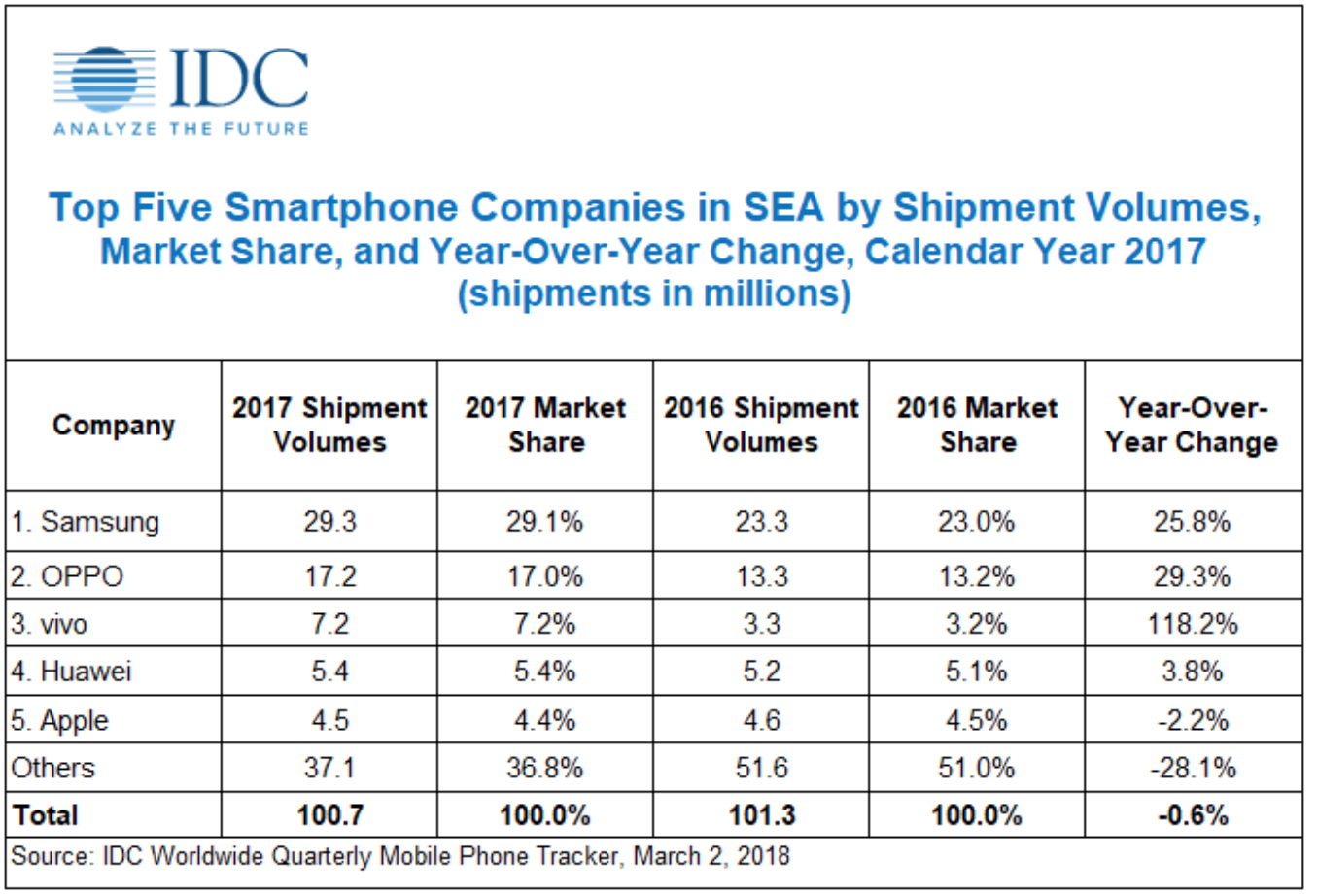

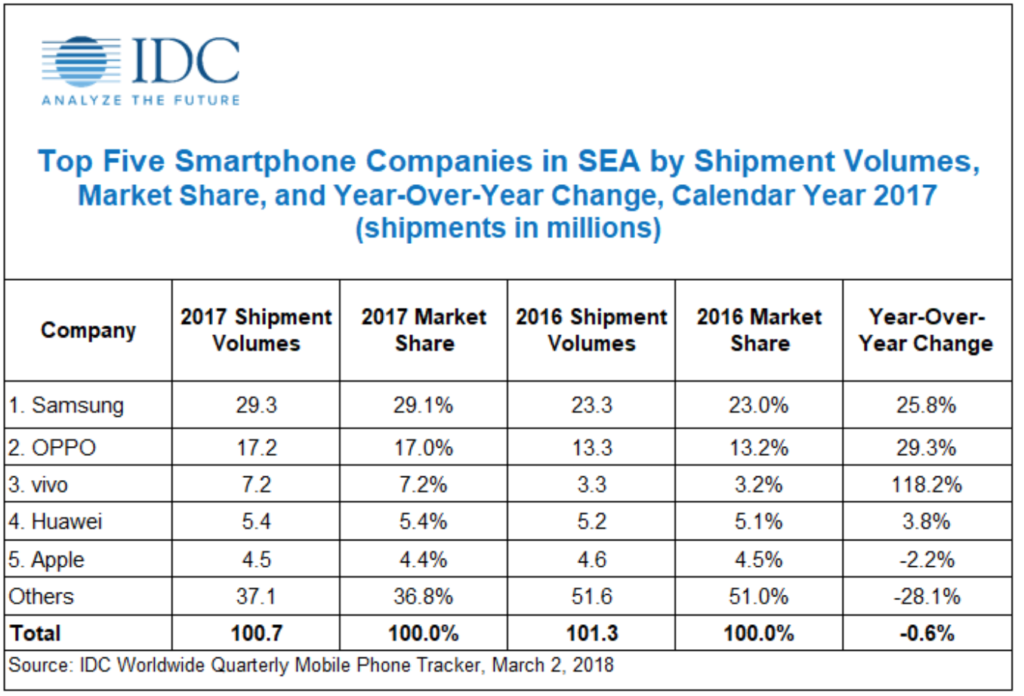

Total smartphone shipments in the emerging Southeast Asia (SEA) region recorded approximately 100 million units in 2017, declining by less than 1% Year-over-Year (YoY), according to the latest International Data Corporation (IDC) Quarterly Mobile Phone Tracker.

IDC categorizes Indonesia, Malaysia, Myanmar, Philippines, Thailand, and Vietnam as the emerging markets in SEA.

Myanmar and the Philippines were the only countries to record a decline, where some of the vendors’ shipments have reduced significantly — pulling down the total shipments in SEA. Several local and smaller players were losing out competitively as the top-4 players continued to fortify their positions with their mix of low-end (US$100<US$200) and midrange (US$200<US$400) handsets.

“Apart from the growing popularity of the top-4 players that have been able to hold up shipment volumes, majority of end-users are in no rush to acquire a new handset if they have been using midrange ones as the handsets are of decent quality and priced considerably high for this budget conscious region, resulting in longer lifecycles and replacement rates,” says Jensen Ooi, Senior Market Analyst, Client Devices, IDC ASEAN.

Midrange smartphone shipments grew 53% YoY

While low-end devices still make up most of the market with 37% share, midrange handsets now make up 27% (27.1million units) of the total market versus 2016 when it was 17% (17.6 million units). Samsung takes the top spot in the midrange segment with its affordable Galaxy J series. OPPO and vivo continued to expand their brand presence with the usual celebrity endorsements and loud marketing activities, pushing their F and V series respectively. Huawei joined the competition with its Nova series and employed almost similar tactics as OPPO and vivo. Meanwhile, Apple’s presence in the midrange segment was represented by its older models, mainly the iPhone 5, iPhone SE and iPhone 6.

Demand for 4G feature phones remains low

A long time coming, 4G smartphones finally became a norm in 2017. 4G smartphones now make up 81% (81.1million units) of the total market versus 2016 when it was 56% (56.2million units). 3G smartphones were shipped by local vendors and some global players still, targeting the price conscious segments. Meanwhile, the adoption of 4G feature phones has been slow and recorded only close to a quarter of a million units. They are mainly available in Tier-1 cities where the 4G network is more reliable while lower tier cities continue to opt for 2G feature phones. These 4G feature phones have been available in Thailand since 2016 while Indonesia and Philippines introduced it only towards late 2017.

Preference for larger screen sizes

Phablet shipments made up 35% (35.0 million units) of total shipments in 2017 versus 2016 when it was only 20% (20.5 million units). However, smartphones with screen sizes of 5”<5.5” still hold the larger share of 50% (50.5 million units). The growth of phablet shipments was spurred by the ongoing change in media consumption habits and vendors introducing thin bezel smartphones to the market. Samsung recorded the largest shipments while vivo recorded the highest growth in this category.

“In 2018, local vendors will continue to feel the impact as end-users gradually shift their preference to more popular brands and are more willing to invest in their upgrade to larger screen midrange smartphones. Most would soon be equipped with enticing features such as dual cameras, thin bezels, on-device Artificial Intelligence (AI) and so on. To stay competitive, we expect the local vendors to ship smartphones with some of these features as well and introduce devices that come with Android Oreo ‘Go edition’ while keeping the price affordable at <USD$200 to suit the budget requirements of their local target segments,” ends Ooi.