Saving for college has just become easier. Manulife Philippines has launched GradMaker, the first mobile application in the industry that is specially designed to help young parents start saving for their children’s college education. With this new app, saving for college is now at your fingertips.

Saving for college has just become easier. Manulife Philippines has launched GradMaker, the first mobile application in the industry that is specially designed to help young parents start saving for their children’s college education. With this new app, saving for college is now at your fingertips.

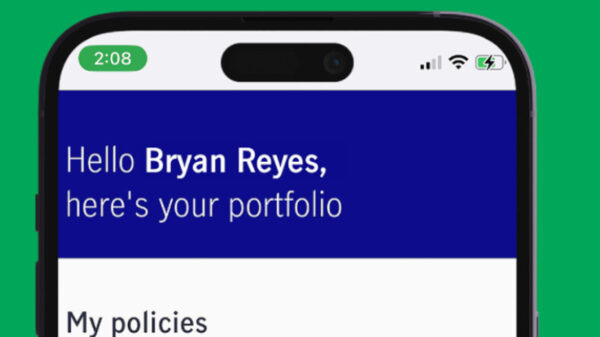

GradMaker enables customers to invest with a few easy clicks on their mobile devices. It was designed to meet the needs of parents who want to start planning for their child’s college education, but may be too busy to meet with investment counselors or financial advisors or think that investing is expensive. Parents can get started with GradMaker for only P10,000 and there is no lock-in period. This gives customers the flexibility to decide when they want to invest. With GradMaker, parents can learn about projected education costs at their preferred local university by the time their child goes to college; then the app helps calculate how long and how much they need to save to get there. When they are ready to invest, they can purchase the GradMaker plan in app.

In 2016, Manulife commissioned a regional study to look into key trends in connectivity, digital, and social media to get a deeper understanding of its customers across 56 markets. In the Philippines, most Filipinos have at least two digital devices, one is usually a smartphone, and spend an average of 3.2 hours a day online, 74% of the time using mobile internet. The study also shows that 89% of the respondents own at least one digital device and still intend to get another.

“Being relevant comes from a deep understanding of our customers and allowing them to decide when and on which platform to engage with us,” said Ryan Charland, President & Chief Executive Officer of Manulife Philippines. “GradMaker is intuitive, simple, and designed from the customer’s perspective.”

GradMaker invests in professionally-managed funds comprised of stocks and bonds to help customers achieve long-term growth. It also gives life insurance coverage of at least 125% of the customer’s single premium.

“Education is one of the most significant investments many families will make, and, on average, tuition fees increase by 10% annually according to the Bangko Sentral ng Pilipinas,” said Charland. “Through GradMaker, we aim to help parents be prepared by providing visibility on how much and how long they need to invest for their child’s college education.”

As you save for your child’s education, GradMaker will also allow you to help children in need. For every investment made through GradMaker, Manulife will donate 1% to Cartwheel Foundation, a non-stock and non-profit organization that seeks to nurture Filipino indigenous heritage through education.

“As we start the New Year, Manulife is proud to mark this milestone with something that will help secure the future of young Filipinos,” concluded Charland.

GradMaker is available for download on Google Playstore and the Apple App Store for select Android and iOS devices.