New research from PayPal reveals that the adoption of digital payments is having a big impact on the financial lives of consumers and businesses in the Philippines.

IMAGE FROM PIXABAY.COM

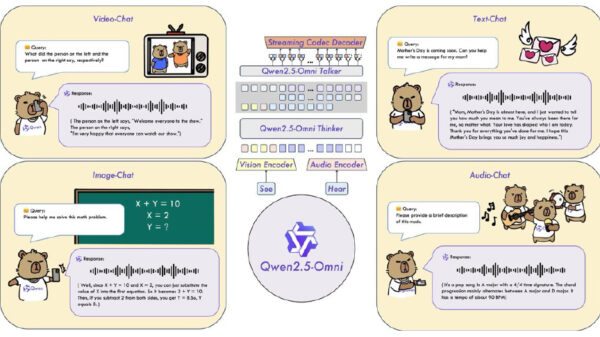

Findings from the PayPal study, “Digital Payments: Thinking beyond Transactions”, which surveyed 4,000 consumers and 1,400 merchants across seven markets in Asia, of which 500 consumers and 200 merchants were from the Philippines, highlights the positive impact digital payments can have on consumer and merchant welfare by reducing inefficiencies and unlocking economic opportunities.

“Transparent tracking of money flow, improved transaction efficiencies, unlocking new business models and the creation of more economic channels are just a few ways digital payments drive economic opportunity for both consumers and businesses,” said Rahul Shinghal, PayPal’s GM for Southeast Asia. “As a global leader in digital payments, we will continue to deliver innovative products and services to help our customers unlock the economic potential that digital payments can enable.”

The Philippines is well on its way to be a cashless nation, with 25% of consumers surveyed indicating that traditional (physical credit card, bank transfer/internet banking, cheque etc.) and new payment methods are now their primary options. In fact, one third of consumer respondents in the Philippines have already starting transacting without cash.

Digital payments offer not just convenience and a more secure way to pay, but also provides consumers with more options. Most respondents (74%) cited convenience as a reason to use digital payments. Another 57% said it was because of the lower processing and transaction fees they received when using digital payments. Interestingly, 27% of respondents prefer new payment options because of the increased amount of promotions they received as compared to 23% who use traditional methods and 12% who use cash.

The study also revealed that digital payments have provided consumers with the tools to better manage their finances, in particularly, one of the most challenging financial issues faced by consumers – bill payments. Among those surveyed, 54% of consumers who rely on cash have difficulties managing their bills/credit payments compared to a smaller proportion (29%) of digital payments users. The ability to track payments, pay instantly, and the choice of payment methods can be a boon to managing consumers’ cash flow and their financial health.

Digital payments offer a transformational solution for merchants because they increase convenience for consumers. Additionally, merchants are able to reap large efficiency gains transitioning from cash to digital payments and moving away from manual to electronic financial tracking. The benefits to business owners range from reduced operational costs, convenience of transactions to allowing new business models, such as social commerce (“s-commerce”), to solidify.

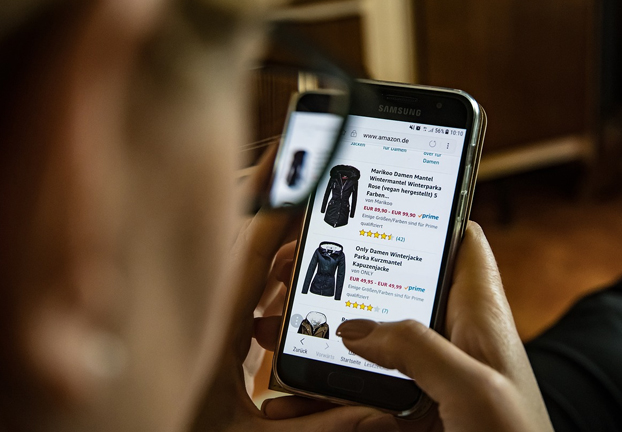

With social media moving beyond a networking platform to a digital marketplace, the adoption of digital payments is further boosted with its ability to offer seamless payments between merchants and consumers. Among merchant respondents in the Philippines, 88% have turned to selling on social media.

The growing trend of s-commerce, of which digital payments is a key transaction method, has been shown to have positive effects on merchants’ financial health. A substantial 96% of s-commerce respondents said it has improved their financial condition and 88% mentioned that it helped grow their business. For the Philippines, s-commerce is a viable opportunity for the significant rural population to tap into as a means to improve their economic well-being.

The positive impact that digital payments can have on the welfare of individuals and businesses is significant, but the ripple effect on the economy is even more promising. Such is the case with online freelancers or social entrepreneurs. Financially healthy individuals spend their money at local businesses and start companies of their own. Financially healthy businesses create jobs that pay good wages and support the economic development of communities.

The Philippines government is making strides in rallying Filipinos to adopt digital payments, including the launch of the National Retail Payments System (NRPS) Framework, which seeks to create a reliable electronic payment system between banks and e-money accounts. Yet, the country is only scratching the surface of what it could be. Industry players and government regulators within the payment ecosystem need to collaborate to further drive adoption of digital payments and unlock the full potential of this new payment method.

“The role of digital payments is rapidly evolving. More than just a mode of transaction between sellers and buyers, digital payments has become the platform for its users to achieve better financial wellbeing and greater economic opportunity,” Shinghal ended.