UnionBank has selected IBM Cloud to quickly and easily build, deploy, run and manage new customer-facing apps for its growing digital customer base.

Through IBM Bluemix, IBM’s cloud platform, and IBM API Connect, the company’s complete lifecycle management solution for application programming interface (API) development, the bank plans to create new compelling customer experiences, innovative new business models, and speed operational processes.

UnionBank has pioneered products and projects that have cemented its reputation as a technology leader in the banking industry. It was the first to introduce an internet-based deposit account with no minimum balance called EON, bringing online banking to a whole new generation of cyber customers. It was one of the first players in e-banking, with its financial portal unionbankph.com generating new business and winning numerous accolades. It also developed the first and only integrated web platform called OneHub.Gov for its e-government initiatives.

The bank now wants to take innovation to the next level. To do this, UnionBank is embracing APIs, which will enable it to extend services and open up new markets by allowing other businesses and application developers to more easily exchange data and build innovative new apps. Through IBM API Connect, UnionBank plans to quickly create, manage, secure and run APIs that the bank has made available internally and run them externally for consumption.

The bank hopes to create entirely new businesses, provide their customers with an even richer menu of services through this collaboration with the startup ecosystem. All this aligns with the two driving tenets of UnionBank’s digital transformation: enterprise scalability and startup agility.

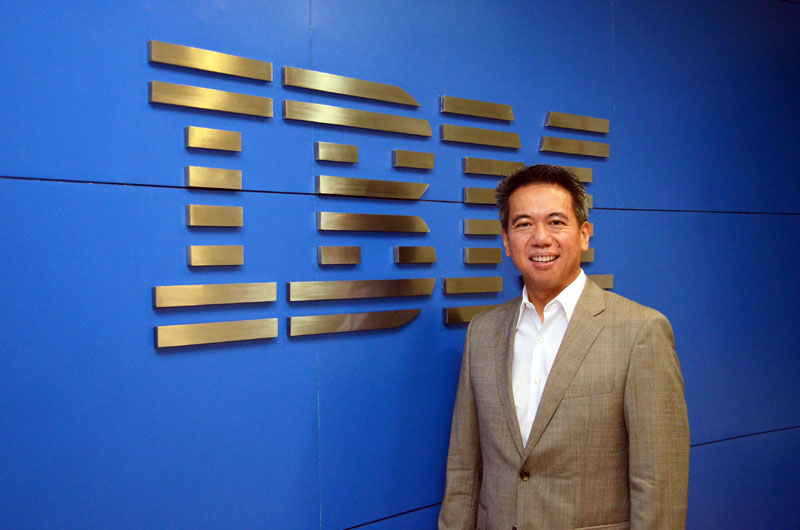

IBM Philippines President and Country General Manager Luis Pineda said IBM is committed to supporting UnionBank’s drive to advance Philippine banking.

“Our collaboration with the bank helped both of us with successful hackathons where over 150 developers participated to create new APIs for the bank using Bluemix,” Pineda said. “This is just the beginning of a long term relationship that has the potential to not only change, but improve banking in our country.”