Although the widespread adoption of smartphones has created very strong growth in the global mobile phone market over the past five years, this trend is set to slow markedly in the run up to 2020, as competition in the budget smartphone segment increases, and growth in mature markets slows, according to research company Marketline.

The company’s latest report states that three consecutive years of double-digit value growth between 2012 and 2014 pushed the global mobile phone market’s compound annual growth rate (CAGR) to an impressive 12.2% from 2011 to 2015, a trend that does not look sustainable between 2016 and 2020. The performance of Asia-Pacific (APAC) markets such as India and China have driven this growth, with 2011–2015 CAGRs of 20.5% and 17.1%, respectively.

While double-digit growth is forecast over the next five years in the Indian market, China, the dominant APAC market, is set to slow to the levels of many Western markets as it matures. As China accounts for around 44% of APAC sales volume, its deceleration will have a notable impact on the market as a whole.

Duncan Hannavy, analyst for MarketLine, explains: “Slowing growth is in part due to the rise of budget smartphones, produced by local manufacturers such as Xiaomi and Huawei. This has pushed the market towards saturation point, and increased the pressure on traditional global market leaders such as Apple and Samsung.”

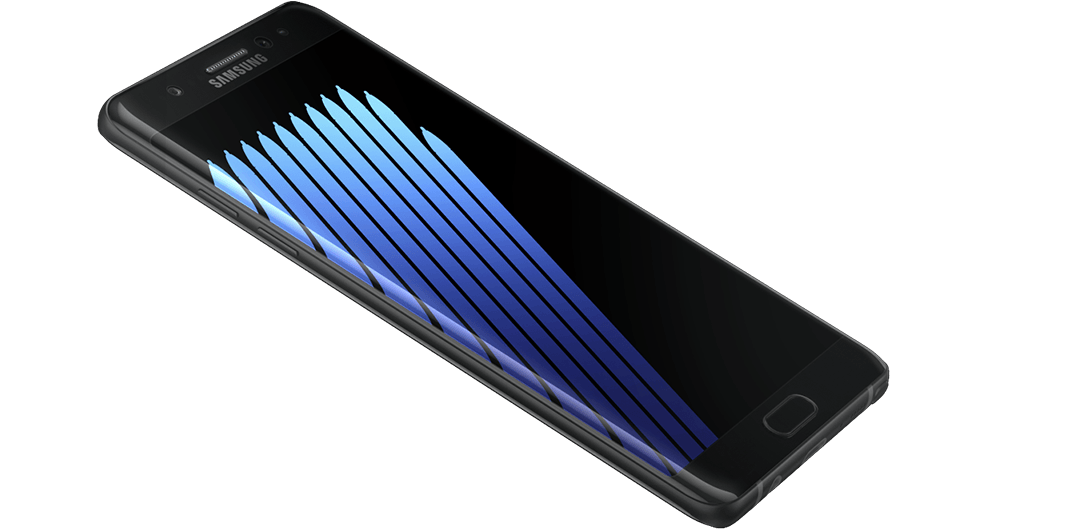

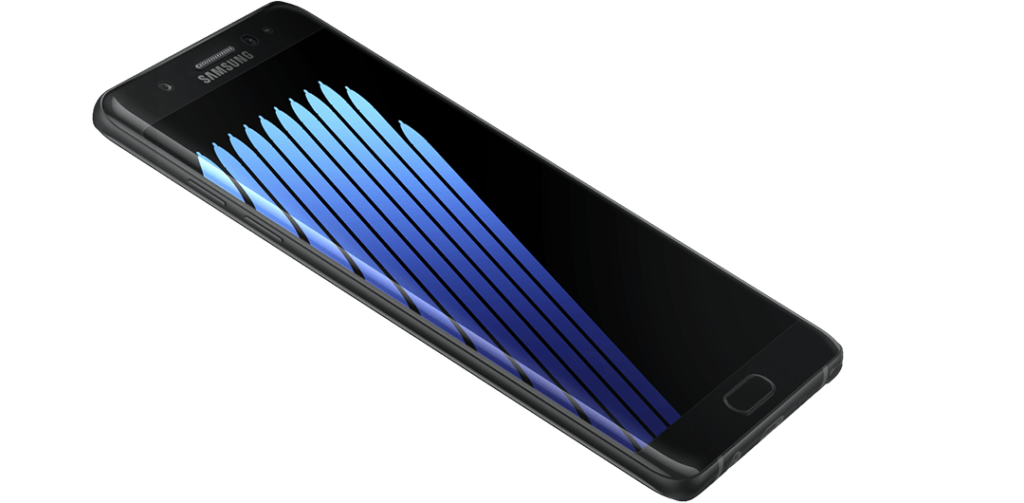

As well as the two Chinese brands now dominating their domestic market, Huawei are hot on Apple’s heels, boasting the third highest global sales volume of any mobile manufacturer. It remains to be seen how these brands will benefit from safety concerns over market leader Samsung’s latest offering, the Note 7, sales of which were recently discontinued.

Samsung’s global dominance saw the company shift more than double the volume of handsets sold by its nearest rival, Apple, with Europe proving to be the most lucrative market. Having shifted nearly 75 million handsets across the continent, Samsung accounted for nearly a third of all mobiles sold in Europe during 2015.

Hannavy concludes: “As the mature and highly saturated markets of Europe and North America continue to slow, pressure is increased on manufacturers to either compete on price and features, or focus on the remaining emerging markets across APAC and Africa. MarketLine expects the global mobile phone market to reach $347.3 billion by 2020, growing at a CAGR of 2.9% to 2020.”