Several government agencies led by the Department of Education (DepEd), in partnership with private sector companies, launched the first and biggest public-private partnership initiative eyed to help public-school K-12 students through a tech-enabled early-stage micro-savings and personal accident insurance program.

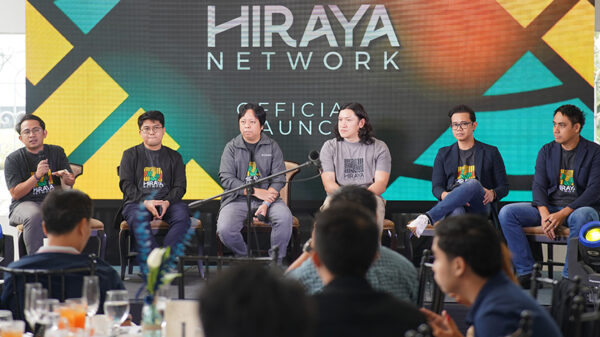

Present during the partnership ceremony held at the Bangko Sentral ng Pilipinas were (seated, from left) FINTQ CEO Lito M. Villanueva, Sun Life of Canada (Philippines), Inc. President and CEO Riza Mantaring, LANDBANK President and CEO Gilda E. Pico, PLDT, Smart, and Voyager Chairman Manuel V. Pangilinan, Department of Education Sec. Bro. Armin Luistro FSC, Bangko Sentral ng Pilipinas Deputy Governor Nestor A. Espenilla, Insurance Commission Commissioner Emmanuel Dooc, and Voyager Innovations President and CEO Orlando B. Vea. They are joined by (standing, from left) BSP Head of the Inclusive Advocacy Staff Pia Roman Tayag, LANDBANK Branch Banking Sector Head EVP Jocelyn DG Cabreza, Sun Life Financial Asia President Kevin Strain, and DepEd External Partnership Service Head Dir. Margarita Ballesteros.

The coalition, dubbed “PISO (Personal Insurance and Savings Option) sa Kinabukasan” is spearheaded by PLDT and Voyager Innovations’ financial technology unit FINTQ and supported by DepEd, the Bangko Sentral ng Pilipinas (BSP), the Insurance Commission, the Land Bank of the Philippines (LANDBANK), as well as PLDT Alpha Enterprise, Smart Communications (Smart), Philippine Business for Social Progress, PLDT-Smart Foundation, United States Agency for International Development (USAID) and Sun Life of Canada (Philippines).

At least 24 million K-12 public school students nationwide are expected to benefit from the program that will give them a way to save money with as little as one peso per day, while also having a personal accident insurance coverage.

“We are proud to be part of this initiative that seeks to empower and embolden young Filipino students to take charge of their future early on,” said outgoing DepEd Secretary Br. Armin A. Luistro FSC. “We have integrated financial literacy in the K to 12 curriculum in partnership with the BSP in the past, but I believe these lessons will make more sense when put into practice and eventually turned into a habit, something which the PISO initiative will help them achieve.”

“The importance of starting young when it comes to saving money cannot be overstated, as savings act as an important backbone of the Philippine economy. PLDT, Smart and Voyager, through FINTQ, are excited to be part of this groundbreaking initiative as digital enablers of the PISO project, which hopes to inculcate the values of savings and insurance among the young generation,” said PLDT, Smart and Voyager chairman Manuel V. Pangilinan.

The initiative is also in support of the National Strategy for Financial Inclusion (NSFI), which aims to provide access to a range of financial services and products to all citizens nationwide to promote inclusive growth. This comes a month ahead of the first year anniversary of the government’s launch of the NSFI in July last year .

“This revolutionary multi-stakeholder initiative will open doors for public school K to12 students to broaden their horizons by underscoring the importance of savings and insurance with the help of digital technology. Its ripple effect encompasses the schoolchildren’s parents, guardians, teachers and even the community leaders within their localities. It’s just like making the concept and value of savings and insurance among our children simple and easy to understand, and fun to have. Our aim is to make these social protection tools viral as a unique initiative towards financial inclusion,” said Lito Villanueva, CEO of FINTQ, the financial technology unit of Voyager under the PLDT Group.

“Building the habit of savings among young children is critical in developing their financial well-being, because when they start young, saving money will eventually come naturally for them when they grow up and generate their own income,” said BSP Deputy Governor Nestor A. Espenilla. “At the same time, this initiative will help address the unbanked and underserved population of the country and eventually enable the youth to participate in the growing economy.”

This program also supports the BSP’s coin recirculation program which was launched in March 2005. The perceived shortage of coins is brought about by non recirculation of these coins. Coins are kept inside bank vaults, in piggy banks, inside drawers, used as washers, or thrown away as inconvenience. As of March 2016, the BSP has 24.5 billion pieces of coins in circulation valued at P27.6 billion. The number of coins in circulation is equivalent to 238 pieces per Filipino

The low regard towards lower-denominated coins is one of the main reasons coins are not circulating efficiently. Schoolchildren as agents of change in their homes and communities, however, can generate better appreciation of the use of coins.

“Financial inclusion is almost second-nature to LANDBANK, because countryside banking is at the center of our operations. This program is very timely because it will give us an opportunity to provide the youth an avenue to save money and give them the skills needed so that later on, they will know how to manage their own money in the future,” said LANDBANK president and CEO Gilda E. Pico.

With only 4 in 10 Filipinos saving money and a low insurance penetration of just 1.84% in the country, leveraging digital technology becomes key to building a digitally and financially inclusive society.

“Voyager is a proud partner of the PISO initiative that is wholly in line with our mission of developing breakthrough digital initiatives for emerging markets like the Philippines,” said Orlando B. Vea, president and CEO of Voyager Innovations, the digital innovations arm of PLDT and Smart.