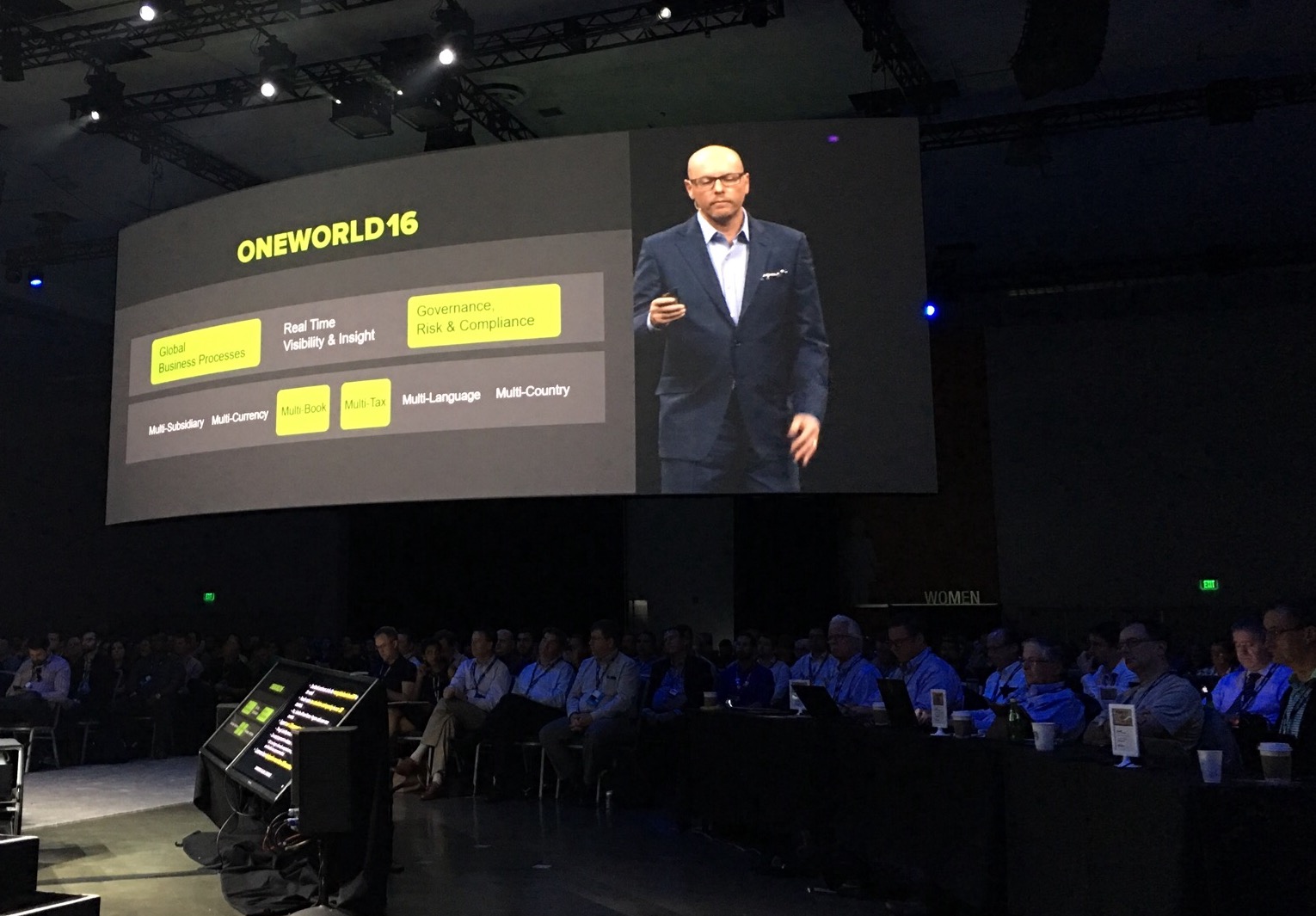

SAN JOSE, Calif.—At its annual Suiteworld Conference held recently, NetSuite Inc. announced OneWorld 16, dubbed by CEO Zach Nelson as “the last ERP system you’ll ever need.”

Building on the momentum of enhancements to NetSuite OneWorld announced in December 2015, this new release delivers deep global financial capabilities, global control, governance, risk and compliance (GRC) features and enhanced financial reporting. In conjunction with all the global enterprise-ready capabilities available in NetSuite OneWorld 16, this new release further helps global companies increase operational efficiency, streamline financial reporting, deepen local and global compliance, localize business processes and deliver peace of mind for CFOs, controllers and finance users.

“The robust functionality and flexibility of NetSuite OneWorld makes it the last ERP system you’ll ever need,” said Nelson. “Whether they’re a fast-growing start-up or a multinational enterprise, NetSuite continues to meet customer demands with features that enable them to confidently expand into new markets, launch new products or services and adapt to customer and market demands with a unified and agile cloud-based platform.”

Enhancements to NetSuite OneWorld include secondary books consolidation and financial reporting; electronic invoicing framework; and NetSuite SuiteBilling & Unified Revenue Recognition.

Nelson stresses that the NetSuite SuiteBilling & Unified Revenue Recognition is the industry’s first and only cloud order-to-billing-to-revenue solution. It unifies both the billing and revenue recognition processes for global businesses regardless of business model with complete controls and auditability, helping businesses with global compliance requirements to reduce risks.

New OneWorld features also support global operations. For example, the global vendor management feature enables multi-company users to centralize and manage their global vendor relationships, including credit limits, across multiple companies and to clean up duplicate vendor data from legacy systems by merging vendor records across subsidiaries.

Meanwhile, country-specific localizations, expands support for tax calculation and reporting requirements in more than 100 countries, including support for Czech Republic VAT Control Statement and Slovak Republic VAT Ledger Statement, which will allow global companies to meet the tax requirements of the countries they operate in.

Through NetSuite’s support for local tax calculation and reporting, changes in VAT transaction details in Belgium and Portugal, and similar upcoming changes in Spain and Hungary can be managed seamlessly, as NetSuite cloud ERP can allow global companies to cope with such changes with minimized business disruption.

Efficient Compliance Reducing Risks

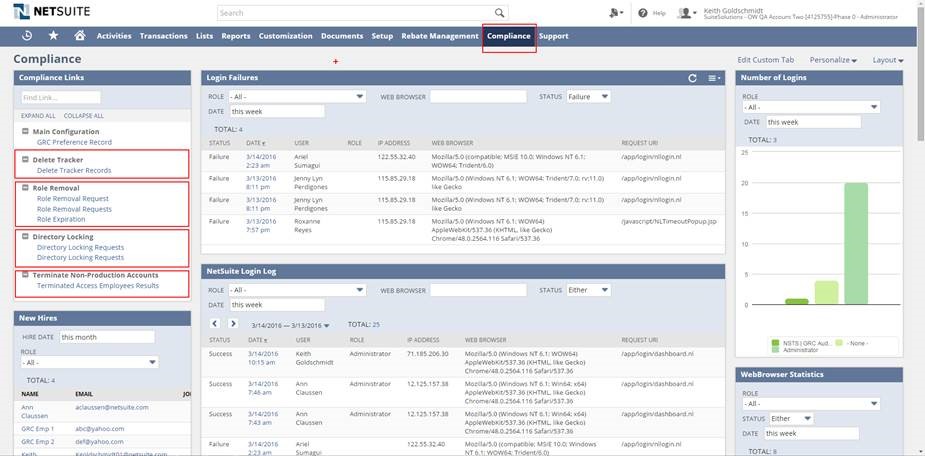

The new functionalities in the new release expands NetSuite’s existing GRC capabilities with a focus on ensuring companies of all sizes have the ability to define role-specific access controls across their global organizations, track activity and configuration changes at a granular level and report on that activity, including proactive alerting related to business-specific exception criteria.

Key improvements to NetSuite OneWorld which are part of this release include additional audit trails and searchability across all financially-relevant account setup pages; revenue recognition plan changes (within the Advanced Revenue Management module); custom financial layouts; and more comprehensive information about changes made to workflow definitions. Improvements also include significantly enhanced security around the password reset process.

Also available with this latest release of NetSuite OneWorld is the Administration and Controls Toolkit (ACT) SuiteSolution, which provides a powerful set of new tools for managing access, security, and audit controls. The ACT SuiteSolution contains extensible modules for tracking (and preventing) record deletion, managing employee terminations (pre-dating terminations as well as automated access removal from non-production environments), enhanced security around SuiteScript file management, and a robust audit and change management dashboard for at-your-fingertips, real-time, visibility into key configuration and controls changes.

SuitePayments and SuiteTax

Leveraging the powerful and flexible SuiteCloud development platform, SuitePayments and SuiteTax are two components of NetSuite OneWorld 16. SuitePayments allows payment partners to build extensible payment solutions that will be consumed by all current and future modules in NetSuite’s omnichannel commerce product portfolio.

For the first time merchants can enable credit card payments, manage complex alternative payments, offer fraud solutions and conduct EMV card-present solutions globally over a single interface delivered entirely in the cloud, which can drive down costs, consolidate providers and create an unbeatable customer experience. SuiteTax centralizes all tax functions within the NetSuite modules eliminating the need for tax partners to create page by page extensions within NetSuite to calculate taxes. This architecture creates greater stability, compatibility and compliance for NetSuite customers as they calculate, remit and manage compliance in an ever-changing tax regulation environment while massively simplifying the integration requirements for partners.

SuiteBilling

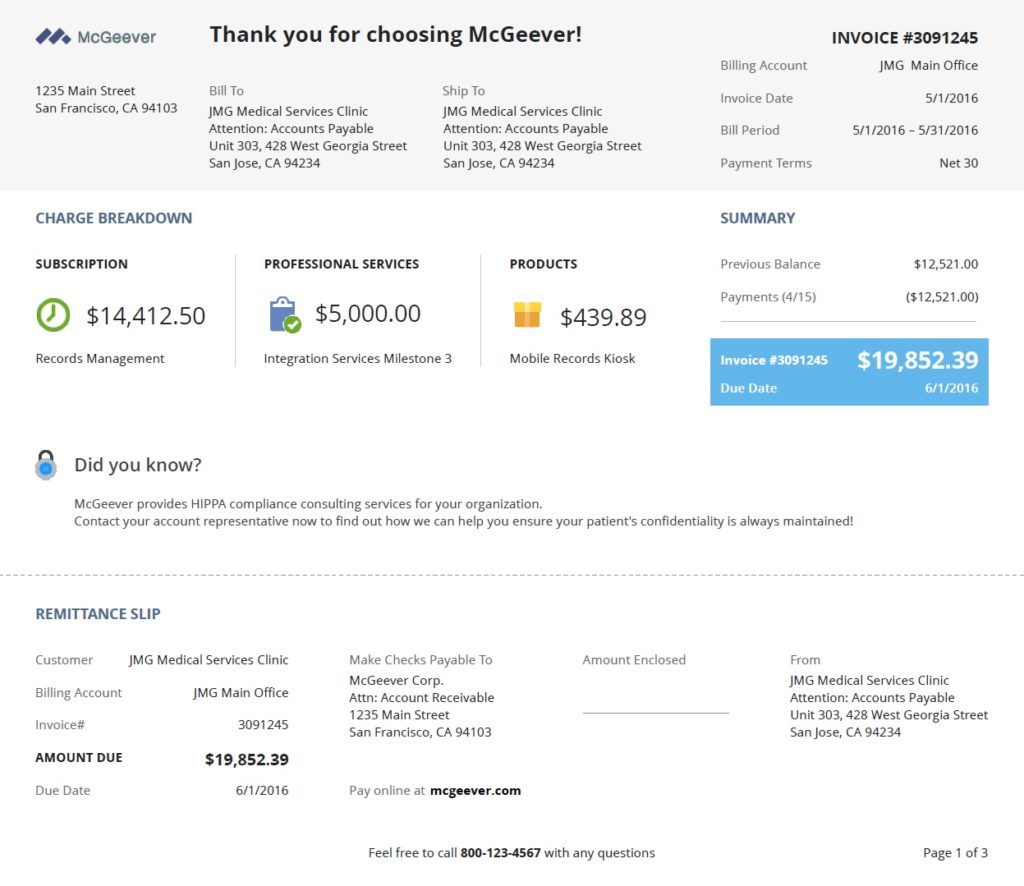

SuiteBilling is a new product release designed to enable businesses to adopt any business model from product-based, to time- and services-based, to usage- and subscription-based, or any combination of these without limit.

Traditionally, businesses have had to use multiple, disparate systems – one or more for billing, one for order and one for revenue recognition — leaving customers to cobble together manual processes and complex integrations to manage business processes and accurately recognize revenue.

In recent years, dramatic shifts in the marketplace like the Internet of Things (IoT), the emergence of services attached to products and trends towards subscription-based pricing, have transformed the importance of the billing process.

Meanwhile, different billing scenarios, whether it’s delivering a product for product-based companies or milestones for project-based companies impact revenue differently, making the amount billed and the amount recognized different over time. At the same time, as these new billing models introduce additional complexities around how and when to recognize this revenue, the revenue recognition standards are changing quickly, introducing risks of noncompliance and added costs or lost revenue.

SuiteBilling unifies both the billing and revenue recognition processes regardless of business model with complete controls and auditability, helping businesses comply and reduce risks. Built natively into NetSuite’s core ERP system, it is the industry’s first and only comprehensive cloud solution that synchronizes complex processes from order to billing to revenue recognition, all within one system, said Nelson.

NetSuite SuiteBilling gives businesses unprecedented control and flexibility over products and pricing, while enhancing the customer experience by improving transparency and focusing on value delivered vs. the cost, all while supporting the new accounting standards. NetSuite provides a single system to manage orders from multiple sales channels, and to manage billing and revenue recognition that supports compliance with revenue recognition rules such as revenue arrangements with multiple elements (ASC 605-25) and percentage-of-completion accounting (ASC 605-35), while providing a foundation to prepare for adopting ASC 606 in the future.