A deal that is being worked out between GCash, Globe Telecom’s mobile money service, and PLDT Group’s PayMaya Philippines will enable the customers of both service providers to send money to each other electronically.

A press released issued by Globe said that both companies are discussing mobile money interoperability to help accelerate financial inclusion particularly among those without access to banking services.

“This move underpins our commitment to help drive mobile money adoption by removing barriers between different providers. We advocate for mobile money interconnection to lower cost, increase convenience and formalize cross-border remittance flows,” said John Rubio, President and CEO of Mynt, a fully-owned financial services subsidiary of Globe. Mynt is also the mother company of G-Xchange, Inc. which operates GCash.

Once interconnected, a GCash customer can already send money electronically to a PayMaya customer and vice versa. Aside from domestic remittances, GCash and PayMaya are also expected to collaborate on merchant payments, bulk payments, government-to-person payments (G2P), and person-to-government payments (P2G), among others.

“We are confident that more consumers would be more open to adopt mobile money services if they can send cash to anybody regardless of what mobile provider they are using especially if this means more efficient services and lower prices,” Rubio added.

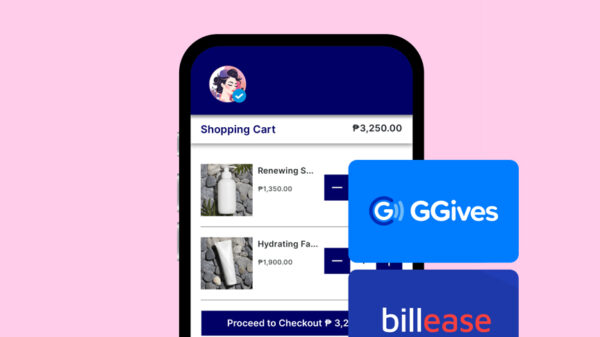

GCash has been a preferred micro payment service of millions of Globe subscribers since it was launched in 2004. It transforms a mobile phone into a virtual wallet for safe, secure, and hassle-free mobile money transactions such as the purchase of prepaid load, bills payment, money remittance, donations, online shopping, among others.

Through GCash, customers no longer need to own a credit card or even have a bank account to make financial and ecommerce transactions. The GCash wallet may be funded by cashing-in at over 11,500 GCash outlets nationwide or by enrolling in mobile and online banking.

Mobile money interoperability is a joint initiative of the Bangko Sentral ng Pilipinas and GSM Association. GSMA is an organization of mobile operators and related companies devoted to supporting the standardizing, deployment and promotion of the GSM mobile telephone system.

The GSMA Mobile Money Programme supports the mobile money industry to develop mobile financial ecosystem, enable a broad range of digital transactions and make mobile wallets central to the lives of the financially excluded and underserved, providing them with better solutions to manage their financial resources and face economic shocks.

Through interoperability, GSMA expects to increase the number of mobile money transactions, grow deployments, improve customer experience, and increase addressable user base in an affordable, reliable and suitable way.

There are at present 10 GSMA active operators with strong money deployments, three of which – Sri Lanka, Pakistan, and Tanzania, are already practicing interoperability since 2014. Committed markets, on the other hand, include the Philippines, Paraguay, and Myanmar while Rwanda, Madagascar, Thailand, and Jordan already made a pilot launch last year.