Asia’s boom in mobile-first consumers is creating a growing target for online fraud and cybersecurity attacks. Criminals who used to focus on ATM skimming are turning their attention online in an effort to compromise credit and debit card data. These attacks can be far more lucrative, with more details stolen and a lower chance of getting caught.

The demographics suggest that this this will soon become a very big data problem. In the next 15 years, Asia is expected to add another billion Internet users, which comes on top of the 700 million it has today, making it the world’s largest market for online consumers.

With fraud challenges growing, the issues and technologies needed to address them will be discussed this week in Bali, Indonesia, where FICO will hold its regional Fraud Forum with bank executives from across Asia Pacific.

The last year alone has seen an average 22 percent increase in shopping on mobile phones across 13 APAC markets, according to a 2015 study from Visa. Indonesia, China and Taiwan reported the highest rates of growth for 2015 at 36 percent, 34 percent and 28 percent respectively.

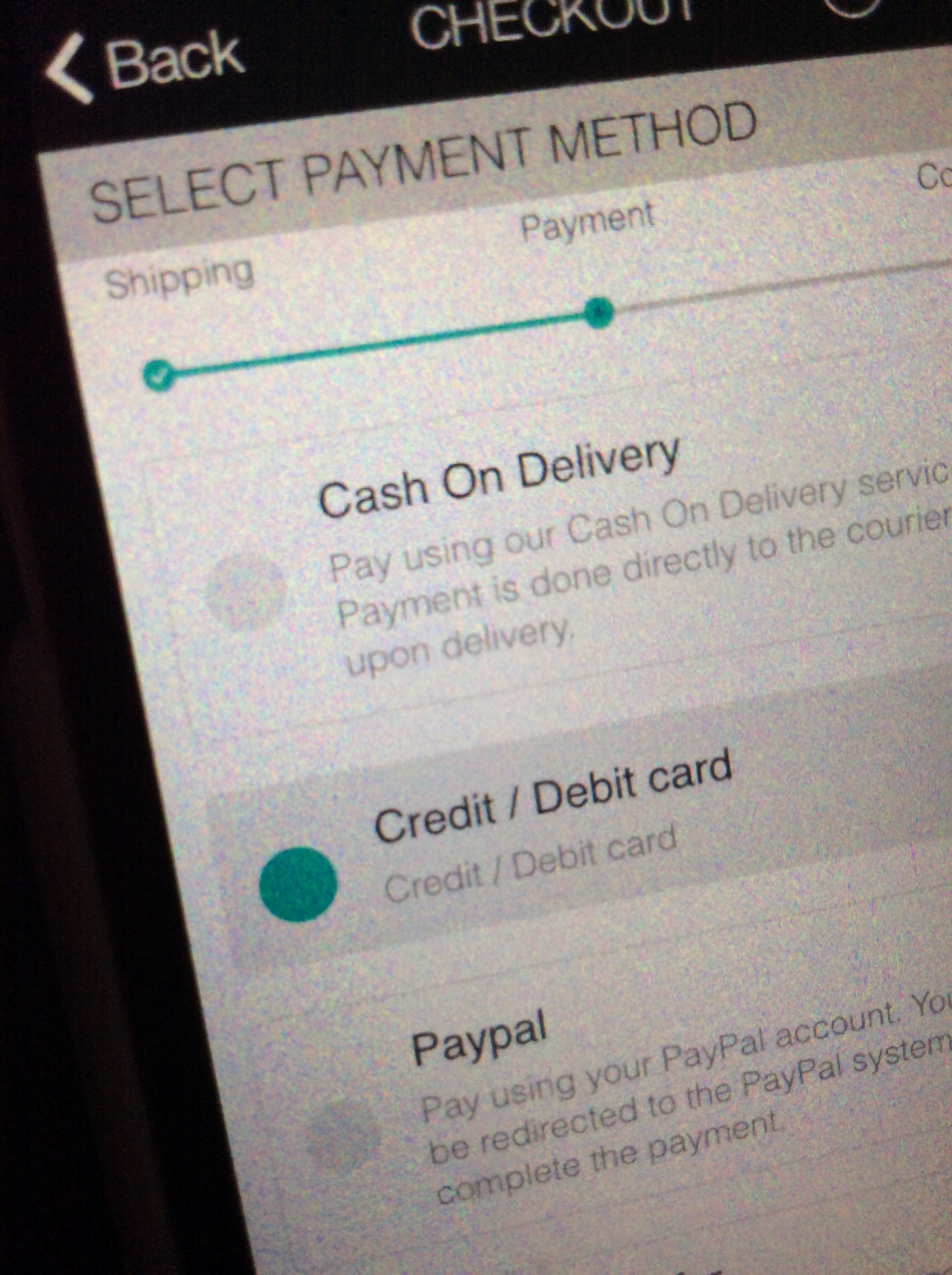

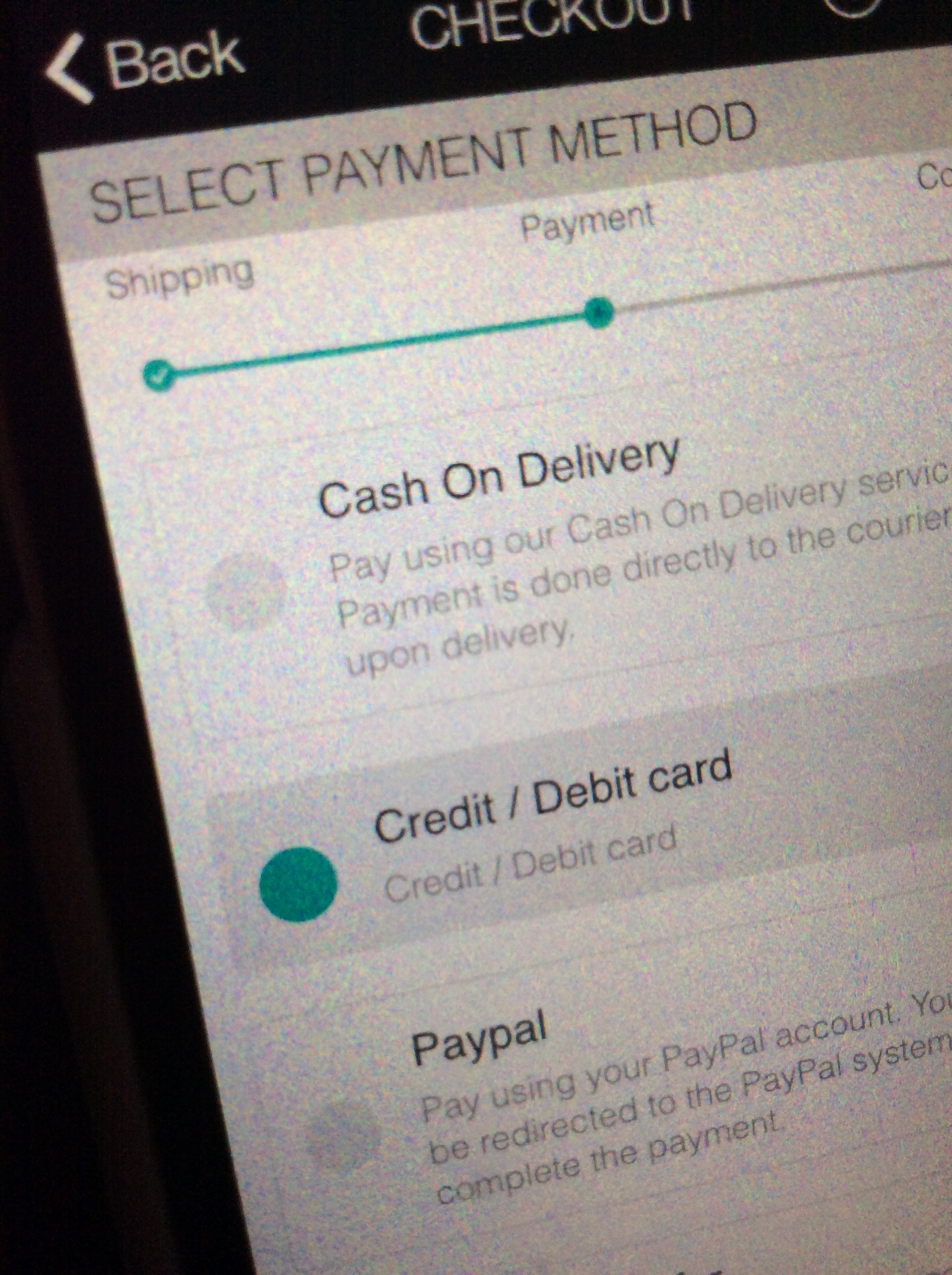

With these card-not-present (CNP) transactions, the retailer never sees the customer or their physical card, and the cardholder doesn’t enter their PIN. At last year’s FICO Asia Pacific Fraud Forum in Singapore, 94 percent of attendees said that cases of online or CNP fraud had increased at their organization.

Spotting and finding anomalies in this pool of data requires sophisticated self-learning and adaptive technologies so banks can catch fraud vectors as quickly as criminals exploit them.

FICO is currently testing the geolocation abilities of mobile devices and integrating them with the FICO Falcon Platform, which protects 2.5 billion payment cards worldwide.

By validating whether a consumer’s phone is in the same place where their card is being used, the system can reduce false positives while focusing on the most likely incidents of fraud. Banks can also send SMS messages to the consumer’s mobile to validate a transaction in real time.Maintaining trust in shopping from mobile devices will also require a new approach to cybersecurity. Data breaches at poorly protected retailers can threaten ecommerce sales. Predictive analytics is needed, rather than signature-based solutions, so that so-called “zero day” attacks can be identified and controlled.